Dear Reader,

The 100-year parallel between 1920 and 2020 is unmistakable.

Spanish flu followed by a short, sharp depression.

A century later, COVID-19 delivered a particularly nasty recession…and, for some business owners, it was a depression.

Since both situations were clothed in identical attire, surely a Roaring Twenties decade is in our future?

Remember the movie Twins, starring Danny DeVito and Arnold Schwarzenegger?

Underneath the matching ‘attire’, there were two vastly different bodies:

|

|

| Source: Twins |

The idea of the ‘2020s being the twin of the 1920s’ was raised in late 2020. At that time, The Gowdie Advisory took a closer look into the ‘long and short’ of it all.

Are the twin scenarios identical OR just a freakish coincidence in ‘wardrobe’ choice?

While the data in the report is more than a year old, the essence of the research remains current.

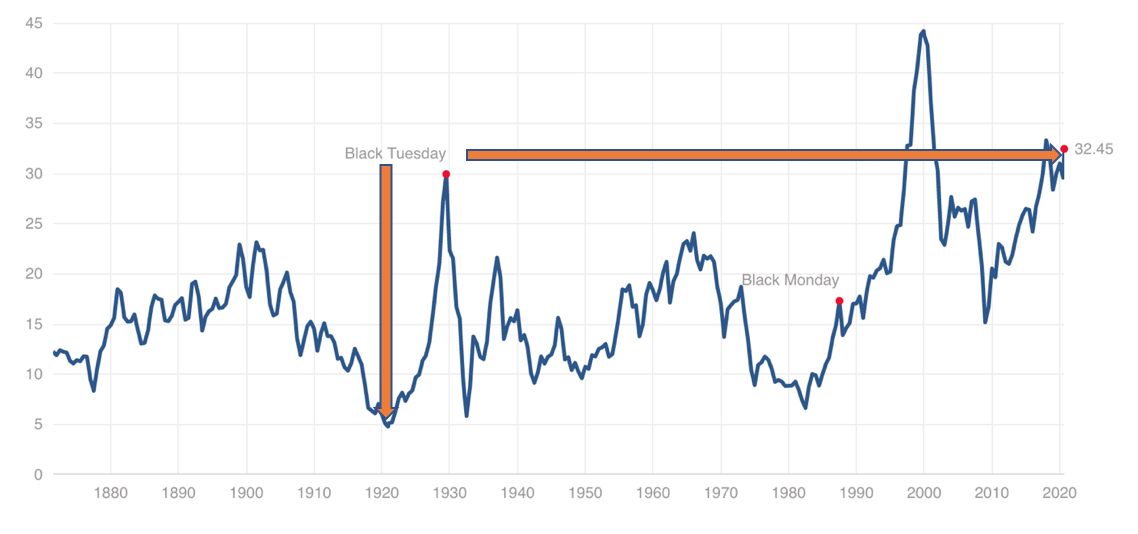

Firstly, we looked at the price/earnings ratios for the two periods.

The 1920 multiple was more like Danny DeVito…low to the ground.

The 2020 multiple is definitely more Arnie…beefed up on speculation steroids.

‘The starting positions

‘The time-honoured secular (long-term) market cycle has been…

‘Secular Bull markets START with a LOW P-E10 and FINISH with a HIGH P-E10.

‘Secular Bear markets START with a HIGH P-E10 and FINISH with a LOW P-E10.

‘If we look at the P-E10 valuation multiples for 1920 and 2020 they are poles apart.

|

|

| Source: Multpl |

‘The 1920 P-E10 multiple is less than five times.

‘The 2020 P-E10 multiple is over 32 times…the current multiple is at the same level as 1929 NOT 1920.

‘This chart from Crestmont Research shows that from 1901 to 1920 (red line), the US market was in a secular bear market.

‘A 20-year period when the P-E10 started at a HIGH of 20 times and finished at a LOW under five times…into the Range for Bull Starts and Bear Ends.

|

|

| Source: Crestmont Research |

‘The current market reading — blue line as at June 2020 — is a million miles away from that ‘bull market’ starting range.

‘We cannot completely discount the possibility — due to the Fed’s intervention — that 120 years of cyclical market patterns might be rendered obsolete.

‘Possible. But that’s a huge bet against human nature and mathematics.

‘The reasons why the 1901 to 1920 period was so punishing for shareholders were…

- 1907 Bankers Panic

- US Recession in 1910–11

- US Recession in 1913–14

- World War One 1914–18

- Spanish Flu 1918–20

- Economic Depression in 1920–21

‘The US share market was battered from pillar to post.

‘Little wonder the P-E10 fell to its lowest reading ever…under five times.

‘For some perspective, the P-E10 didn’t even fall that far during depths of the Great Depression.

‘In 1920, the heavily discounted US market was prime for a rebound.

‘I imagine the question back then was “Can this cheap market get any cheaper?”

‘Whereas today, the question is “Can this expensive market get more expensive?”

‘The starting valuation points for the two markets — 1920 and 2020 — are vastly different.’

Secondly, another comparison being made between the 1920s and 2020s is:

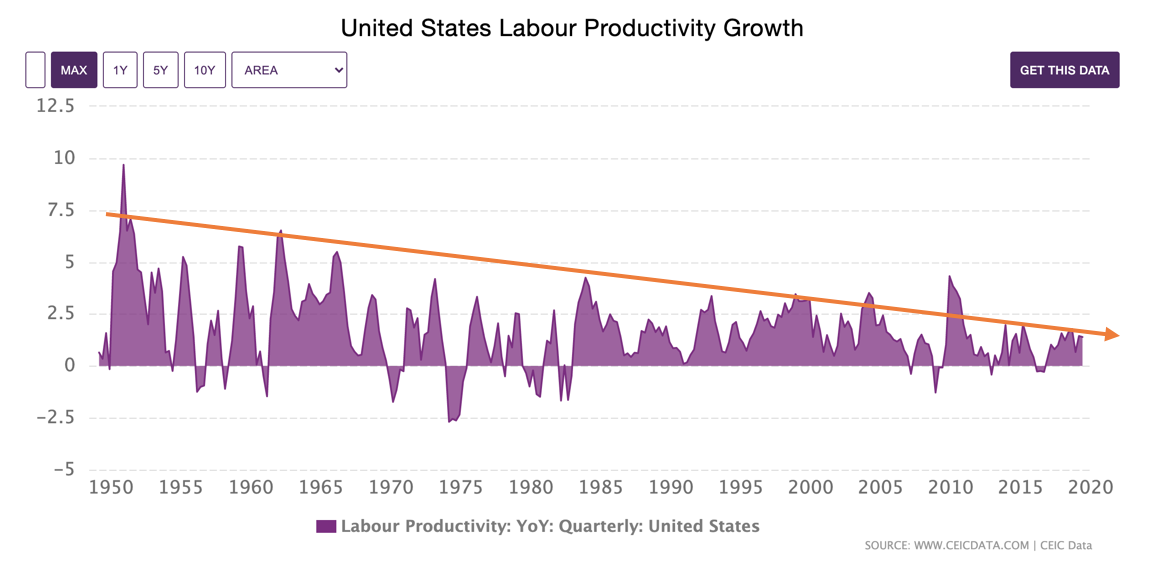

‘Technology-enhanced productivity

‘What about…the driver of the coming boom will be technology-enhanced productivity, as it was during the 1920s?

‘The Industrial Revolution did herald in a period of technology-enhanced productivity.

‘The US economy transitioned from being agriculturally based to manufacturing based.

‘Farm hands freed from laborious duties migrated towards factories and assembly lines.

‘But there was a little help along the way.

“In the past, the U.S. responded to technological change by investing in education. When automation fundamentally changed farm jobs in the late 1800s and the 1900s, states expanded access to public schools.”

‘Today, education in the US comes with a hefty price tag.

‘Learning new skills is going to cost you.

‘That extract came from this TIME magazine article that was published on 6 August 2020:

|

|

| Source: TIME |

‘As reluctant as I am to say it, “this time is different”.

‘The evidence tends to indicate, that on average, technology is shrinking the workforce.

‘To quote from the TIME article (emphasis added):

“…the drive to replace humans with machinery is accelerating as companies struggle to avoid workplace infections of COVID-19 and to keep operating costs low. The U.S. shed around 40 million jobs at the peak of the pandemic, and while some have come back, some will never return. One group of economists estimates that 42% of the jobs lost are gone forever.

“This replacement of humans with machines may pick up more speed in coming months as companies move from survival mode to figuring out how to operate while the pandemic drags on.

“Robots could replace as many as 2 million more workers in manufacturing alone by 2025, according to a recent paper by economists at MIT and Boston University. ‘This pandemic has created a very strong incentive to automate the work of human beings,’ says Daniel Susskind, a fellow in economics at Balliol College, University of Oxford, and the author of A World Without Work: Technology, Automation and How We Should Respond. ‘Machines don’t fall ill, they don’t need to isolate to protect peers, they don’t need to take time off work.’”

‘Since the productivity peaks in the US’ golden age of manufacturing, the trend in productivity — even with the increased uptake in technology — has been down.

|

|

| Source: CEIC data |

‘The reason for this is simple. It’s called “The Law of Diminishing Marginal Returns”.

‘When the farmer replaces the horse-drawn plough with a tractor, his productivity goes through the roof. But after that initial burst in productive output, the returns become marginal. He could buy a new tractor that’s a little faster and more efficient. However, these are gains made at the margin.

‘If you buy the latest computer and access lightning fast internet service, your productivity will jump immediately. But after that, any gains in your output will be marginal.

‘Handmade goods were replaced by manually operated production lines. Then those production lines became automated.

‘Each time these one-off changes were implemented, productivity spiked…then it fell back into a downward trend.

‘The first half of the 20th century was more “revolutionary”, whereas technology is (or at least to date has been) more evolutionary.

‘There has been no big bang change. Which is why we don’t see a 1950s and 1960s type spike in the US Labor Productivity.

‘And, even if there is a sustained spike in productivity, that’s only part of the growth equation.

‘According to the Australian Government Productivity Commission:

“Economic growth, as measured by GDP, is jointly determined by the three Ps — changes in population, its rate of participation of the working aged in economic activities (also referred to as ‘labour utilisation’), and labour productivity.”

‘You can have the fastest and most efficient system in the world, but for an economy to grow it needs an increased population of working age AND an active engagement (participation) of that available labour force in the workplace.

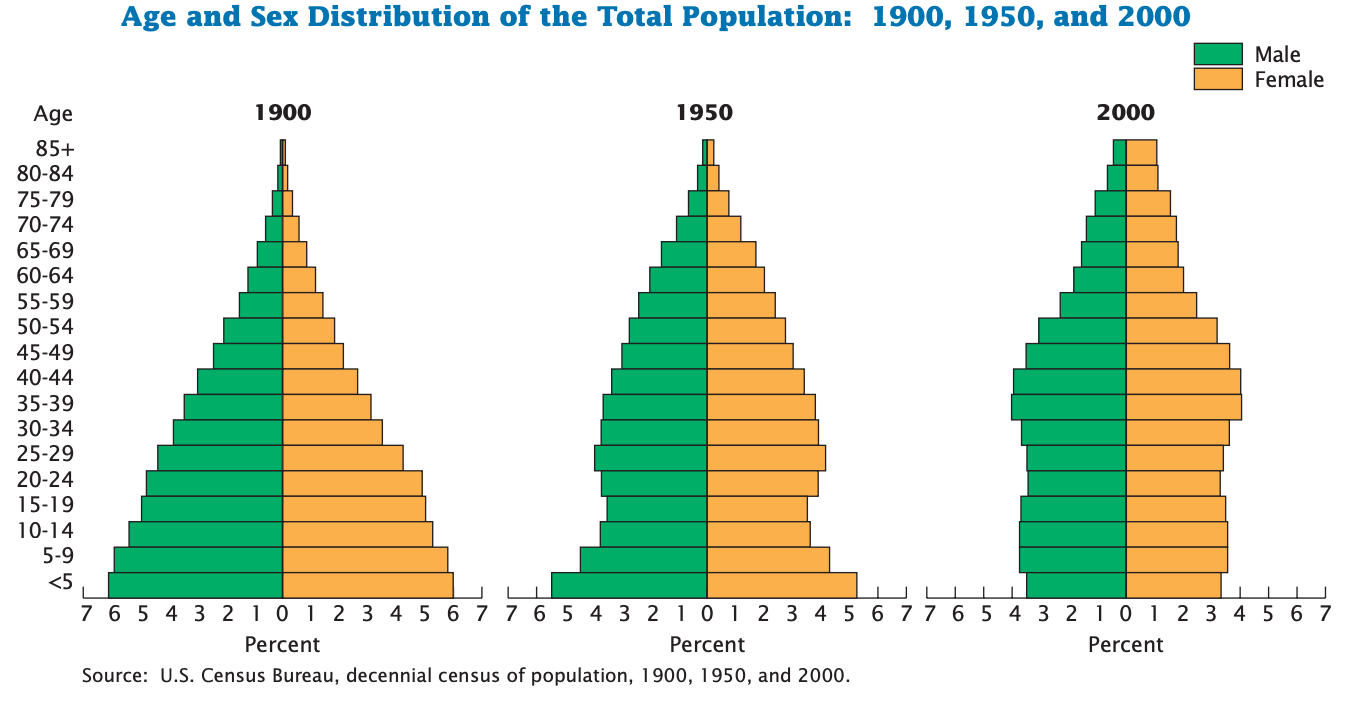

‘If we go back to the early 1900s, the age distribution formed the perfect society pyramid.

‘A large base of youth supporting a narrowing apex.

‘Over the course of the 20th century, some middle-age spread started to set in…

|

|

| Source: US Census Bureau |

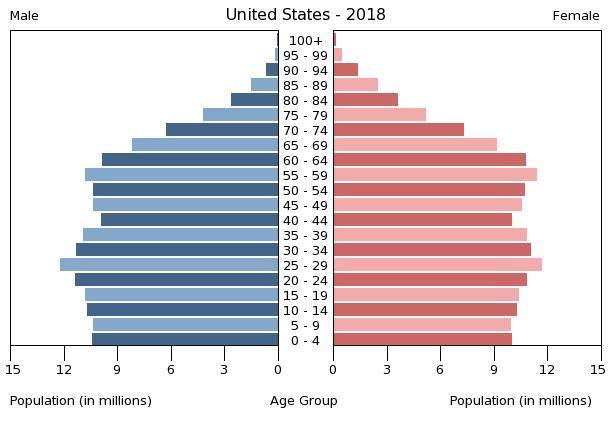

‘And now the shape has completely changed.

‘People living longer.

‘The bulkiness in the middle has moved up into the over 60 age group.

|

|

| Source: Indexmundi |

‘The composition of US society today is vastly different to that of 1920.

‘Demographics play a huge role in economic growth…just look at the impact Japan’s ageing society has had on its once glorious economic prowess.

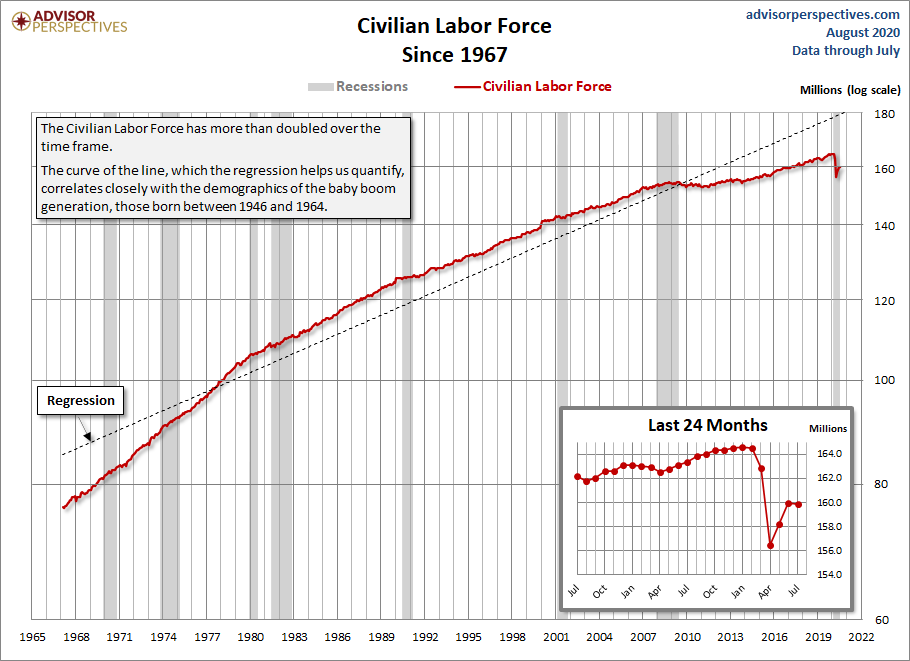

‘The following chart shows the US Civilian Labor Force is falling below the regression trend line.

‘The period above the trend line was a result of baby boomers and females entering the labour force.

|

|

| Source: Advisor Perspectives |

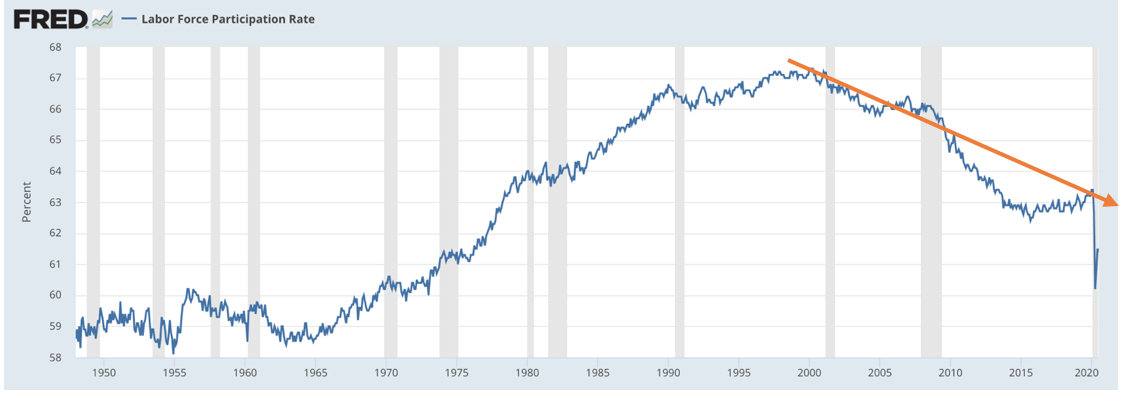

‘In addition to below trend labour force growth, the participation rate has been in a two-decade decline.

‘Is this because people have disconnected from the employment market due to lack of re-skilling and/or technology making jobs obsolete?

|

|

| Source: Federal Reserve Economic Data |

‘Even if there is a boom in technology-enhanced productivity, it’s likely to be offset by weak labour force growth and a lacklustre participation rate.

‘Without two of the three ingredients for economic growth, how can there be an economic boom?’

And finally, there is:

‘Household finances

‘In 1920, total US debt-to-GDP was around 170%.

‘Today, it’s nudging 400% (US$80 trillion debt to US$20 trillion GDP).

|

|

| Source: Hoisington |

‘Household balance sheets are in vastly different shape to that of a century ago.’

Can an already overleveraged private sector (household and corporate) take on even more debt…especially if rates are going to rise?

The only thing these twins have in common is the same outward attire. Beneath the exterior, there are two vastly different economic and financial bodies.

The only similarities I can see between the two periods are, they both have a ‘20’ and a pandemic.

Choose your investing decade carefully…the 2020s are shaping up to be the 1930s NOT the 1920s.

Regards,

|

Vern Gowdie,

Editor, The Daily Reckoning Australia