Whether it’s food, wine, entertainment, fashion, or home designs, we are well and truly spoilt for choice these days.

Options are good, but too many can trigger an acute attack of paralysis by analysis.

Information overload causes the thought processes to shut down. Inertia takes hold. People become fearful of making the wrong choice…so they do nothing.

Which, ironically, is a choice in itself.

When it comes to the world of investing, the choices are almost endless:

- Asset classes: Shares, property, fixed interest, cash, precious metals, currencies, cryptos, futures, etc.

- Each asset class then have their own sub-sectors: large-, mid-, or small-cap shares, and residential, industrial, or commercial property, and government or junk bonds, and gold or silver, and AUD or USD or GBP, and Bitcoin [BTC], Ethereum [ETH], or Ripple [XRP].

- Do you invest directly or via a managed product?

- How much should be allocated to each asset class and sub-sector?

- What’s the appropriate balance between income and growth?

- What’s the best structure for tax purposes: individual name, trust, or superannuation?

- If it’s superannuation, what’s better: public offer or SMSF?

- What’s best for age pension purposes?

- And then, the BIGGIE: Where are we at in the investment cycle?

The choices we make can sometimes change our life’s fortunes…good and bad. Going all-in on shares in mid-1929…not so good. However, three years later, buying shares with your ears pinned back would’ve been a stroke of genius.

With an almost endless list of investment choices on offer, it’s easy to understand why people outsource these decisions to financial planning professionals.

But then, you’re faced with another decision.

Is the adviser independent or a tied salesperson?

With so many decisions to make, I really can appreciate why people find the planning process so overwhelming.

In an effort to assist you with your decision-making process, here’s some things I’ve learnt along the way…

Regrets

One of the things I’ve learnt from my 35-plus years in the business is that investing ALWAYS comes with regrets.

Regret not buying at all.

Regret not buying more.

Regret buying too much.

Regret buying too early or too late.

Regret selling too early or too late.

We’ve all had those ‘shoulda, woulda, coulda’ moments. Comes with the territory.

Accepting regret as part and parcel of the investing process can help keep the emotions in check.

The FOMO (fear of missing out) phenomena of recent years is driven by regret. Decisions based on fear or greed tend to create the greatest amount of regret. As much as possible, try to take emotion out of the equation.

When making decisions, the best any of us can do is gather the best information available at the time, then weigh this up against your situation: age, risk profile, stage of life (far from, close to, or in retirement), experience, and capacity to handle volatility and loss.

Over the course of my career, I’ve had my fair share of regrets.

The positive side of these negatives is the experience and wisdom you gain. Each disappointment or setback is a learning opportunity.

Making the choice to manage your emotions, your reactions, and your downside, is crucial to long-term financial success.

Time in or timing?

Countless academic studies have determined most investment gains come from being in the right asset class/s at the right time.

To quote from the Ibbotson Associates research paper, ‘The True Impact of Asset Allocation on Returns’ (emphasis added):

‘…we looked at the impact of asset allocation policy on balanced mutual funds and pension funds. We can extrapolate from the study that for the long-term individual investor who maintains a consistent asset allocation and leans toward index funds, asset allocation determines about 100 percent of performance — regardless of whether one is measuring return variability across time, return variation between funds, or return amount.’

Going all-in on shares in 1929 was (with hindsight) a lousy time to adopt a ‘time in’ the market mindset.

The amount of time you’d have to have been in the market to breakeven was 25 years.

Go in at 60 and have your dollar made whole again at 85…there goes your retirement years.

|

|

| Source: Macrotrends |

From 1966–83, ‘time in’ the market proved to be another exercise in frustration:

|

|

| Source: Macrotrends |

‘Time in’ the market works exceptionally well when the market is moving through the under to overvalued phase of the cycle.

However, when the market is on the cusp of rotating from over to undervalued, what follows is the worst of times to be invested.

This time is spent regretting…

Buying too much.

Buying too late.

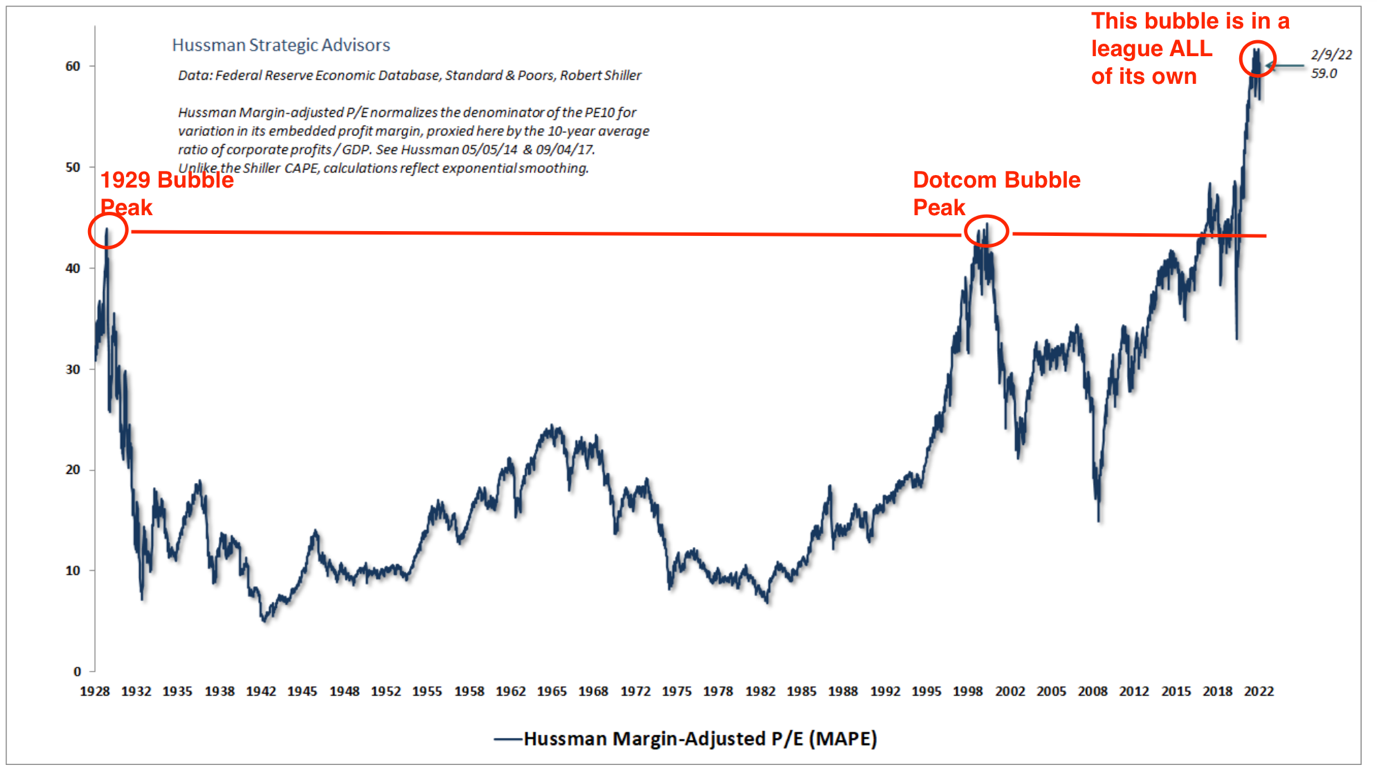

John Hussman’s Margin-Adjusted PE (MAPE) is one of the most accurate measurements of where the US market is in the valuation cycle.

The current reading puts the Fed’s sponsored ‘everything bubble’ in a league all of its own…dwarfing the valuation excesses of the 1929 and dotcom bubbles:

|

|

| Source: Hussman Strategic Advisors |

The choice investors are now faced with is simple…stay (time in) or go (timing)?

If you stay, you’re assuming the time-honoured mathematical principle of reversion to the mean is no longer relevant, and history won’t rhyme (or, at least, not just yet).

If you go, you’re assuming this will not end well…but if this market defies gravity for a while longer, be mentally prepared for the regret of selling too soon.

At this stage in the valuation cycle, the choice you make about time in or timing is going to be crucial to your longer fortune.

Keep the investing process simple

If you don’t have the time, inclination, desire, or temperament to trade shares or invest in individual stocks, then you may want to heed Warren Buffett’s advice…

‘A low-cost index fund is the most sensible equity investment for the great majority of investors.’

And:

‘By periodically investing in an index fund, the know-nothing investor can actually out-perform most investment professionals.’

In 2007, Buffett put his money where his mouth is when he made a US$1 million wager with a hedge fund manager. He bet that over the next decade, an S&P 500 Index fund would outperform the high-priced stock pickers.

As reported by CNN in February 2018:

‘One decade ago, Warren Buffett took a $1 million wager that stashing money in an index fund would make you richer than if you entrusted it with hedge fund managers.

‘He won — big time — and in his annual letter on Saturday, the billionaire Chairman and CEO of Berkshire Hathaway (BRKA) Inc. outlined the final tally. He also took a jab at the hedge fund folks at the losing end.

‘His pick, the S&P 500 (OEX), gained 125.8% over ten years. The five hedge funds, picked by a firm called Protégé Partners, added an average of about 36%.’

Index funds are a simple, uncomplicated, and inexpensive way to gain exposure to asset classes that are in the ascendency phase of the market cycle.

While markets portray an outward calm, underneath the surface there is significant tension…recent pricing in debt markets indicates trouble ahead.

The choices you make today on where to invest your capital and in what percentages, are going to have a profound effect on your financial situation.

Choose carefully.

Regards,

|

Vern Gowdie,

Editor, The Daily Reckoning Australia