China just accused the US government of orchestrating the theft of US$13 billion worth of Bitcoin.

That’s 127,272 Bitcoin tokens, stolen from the LuBian mining pool back in December 2020. China’s National Computer Virus Emergency Response Center claims it’s a “state-level hacker operation” led by the US.

The timing is fascinating.

Just last week I wrote about the US-China trade truce and how it probably won’t last as long as the markets hope. I thought maybe we’d get through to 2027 or 2028 before the next flare-up.

Maybe I was a touch optimistic saying it would last at least two months.

Two hypocrites walk into a bar…

Here’s what makes this accusation a touch rich.

China is crying foul over $13 billion in allegedly stolen Bitcoin while conveniently ignoring the trillions they’ve siphoned from the US through decades of systematic intellectual property theft.

The Commission on the Theft of American Intellectual Property estimates Chinese theft of trade secrets, counterfeit goods, and pirated software costs the US economy between US$225 billion and US$600 billion annually.

Not over a decade. Every single year.

According to CBS, Chinese state-actor APT 41 has conducted cyber operations stealing intellectual property worth trillions from about 30 multinational companies.

We’re talking blueprints for fighter jets, helicopters, missiles, pharmaceutical formulas, and advanced manufacturing technology.

FBI Director Christopher Wray called it “one of the largest transfers of wealth in human history.”

So China’s outrage over $13 billion is a bit like a bank robber complaining someone nicked his getaway car.

Don’t point that crypto at me

China’s hysteria about this Bitcoin seizure reveals something more important than their strategic doublespeak.

It exposes their nervousness about the US push into crypto under the current government.

Think about what’s happened this year. The US passed the GENIUS Act in July, creating the first major federal cryptocurrency law. The CLARITY Act passed the House 294-134, establishing clear regulatory frameworks for digital assets.

Together, these laws position crypto, particularly stablecoins, as instruments of dollar dominance.

By mandating that stablecoin issuers back their tokens with US Treasuries, America is creating a captive market for government debt while extending dollar hegemony through digital rails.

China sees this. And they’re worried.

It’s about the nature and future of global currencies and the US dollar’s status as a reserve asset.

Nordic bus not moving? Blame Xi

For decades, China has been positioning itself to challenge dollar dominance.

One of my most popular ever articles was called “China to fire first shot in war on cash”.

That was released in 2019, and it talked about the launch of the digital yuan.

That one hasn’t quite taken off yet.

So in the last few years they’ve shifted the play.

They’ve weaponised their control over critical minerals. In 2010-2011, they banned rare earth exports to Japan.

This year, they’ve imposed export restrictions on gallium, germanium, antimony, and rare earths targeting Western supply chains.

Then briefly back pedalled.

They’ve also weaponised renewable technology.

China controls 80% of the global solar manufacturing supply chain and produces half the equipment needed to make solar panels.

They’ve even been caught installing undocumented communication devices in solar inverters sold to the West. (Unsurprising)

Norwegian buses may have remote off switches in Beijing. (Not joking)

Control the inputs to economies, control the game.

But the US may have found a different weapon entirely.

Making things vs making money

While China plays the long game with physical commodities and manufacturing dominance, the US is doing something more audacious.

The CLARITY Act grants the CFTC jurisdiction over digital commodities while the SEC maintains authority over securities. It creates pathways for massive institutional capital to flow into crypto markets with regulatory certainty.

And stablecoins, backed by US debt, become digital dollars circulating globally, 24/7, with minimal friction.

Every USDC and USDT transaction reinforces dollar dominance in a way that doesn’t require aircraft carriers or trade agreements.

Gotta make money to spend money

China’s accusation about stolen Bitcoin isn’t really about the Bitcoin.

It’s a shot across the bow in a much bigger conflict about who controls the rails of 21st century finance.

China weaponised commodities and renewable tech, betting they could strangle Western supply chains when needed.

The US may just weaponise currency itself, turning the very medium of exchange into its ultimate strategic asset.

Maybe China can dodge sanctions, but can they dodge the US moneyball?

Regards,

Lachlann Tierney,

Australian Small-Cap Investigator and Fat Tail Micro-Caps

***

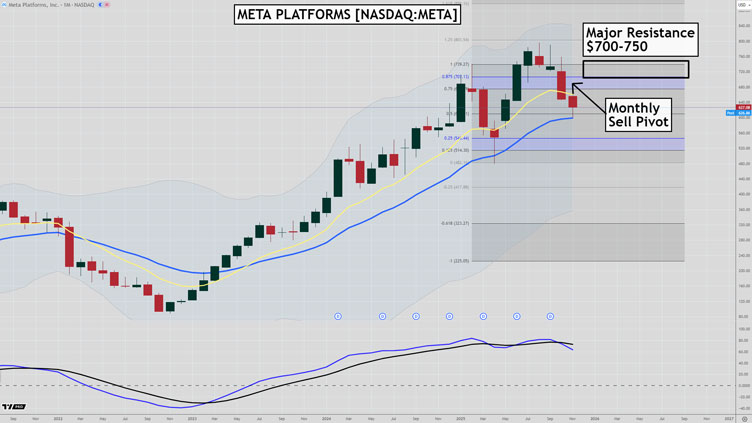

Murray’s Chart of the Day –

Meta Platforms

Source: Tradingview

As debate rages about the possibility of a correction in AI related stocks, we now have a canary in the coalmine to keep an eye on.

Meta Platforms [NASDAQ:META] is investing huge sums in their AI build out.

They recently released quarterly results which spooked the market due to the huge and growing investments into AI.

Meta lifted capex again for 2025 to US$70–72bn and management warned capex and total expenses will be ‘notably larger’ again in 2026.

The stock fell 11% on the day which is a huge move.

Despite the long-term uptrend which remains in place, the shorter term picture is starting to look a little ominous.

Last month saw confirmation of a monthly sell pivot, which also confirmed a false break of the February 2025 high.

That just means momentum has been waning all year.

Now that the price has fallen to major support near its 20-month moving average it is decision time.

I would expect buyers to be lined up there, ready to buy. If we see a failure below the 20-month MA at US$600 in the short-term the bearish picture will increase.

Even if we see a rally from this level there is now major resistance between US$700-750. I have a confluence of indicators pointing to that area as a spot where the sellers will be lined up.

A bounce to that area and failure could set up a brilliant shorting opportunity for the bears.

So the big picture for Meta remains bullish but there are definite signs of weakness showing up.

If AI stocks are going to crack, Meta will probably be the first, so keeping an eye on them from now on is imperative.

Regards,

Murray Dawes,

Retirement Trader and International Stock Trader

Comments