It seems so obvious.

Healthcare systems around the world need to change rapidly.

The immediate threat is clear, the long-term threats, also clear.

For now, it is a virus.

But later?

Aging populations, outdated tech, and a myriad of inefficiencies.

Point is, we need cheaper, better, and faster medicine.

How do we get there?

I think technology is the only way.

Four Innovative Aussie Stocks That Could Shoot Up after Lockdown

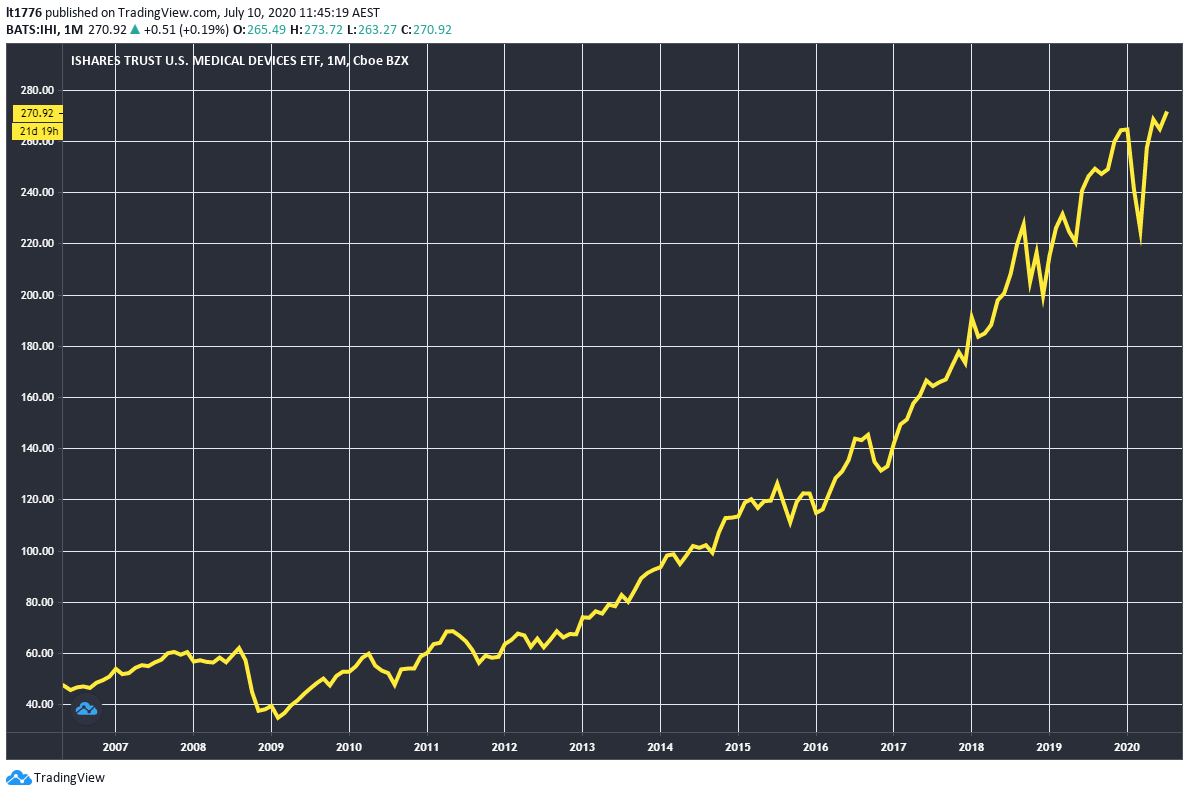

These charts show you what’s happening in medtech in the US

Just have a look at the iShares US Medical Devices ETF [IHI]:

|

|

| Source: tradingview.com |

Looks like an almost inexorable trend…

And it gives you a sense of how much money is pouring into medtech, particularly in the US.

Medtech is incredibly broad and includes:

‘Any technology that can be used in a care setting, which covers disposables, capital equipment and surgical procedure innovations, through to implant technology, biomaterials and connected health IT.’

In contrast to biotech or pharmaceutical companies though, its focus on devices, software, and materials means it is more tangible.

Its results can be more binary too — either the thing works, or it doesn’t.

Sometimes with a potentially breakthrough treatment or drug, results are inconclusive and follow-up research is needed to figure out its effectiveness.

With medtech, the trends driving money into the sector are easy to spot.

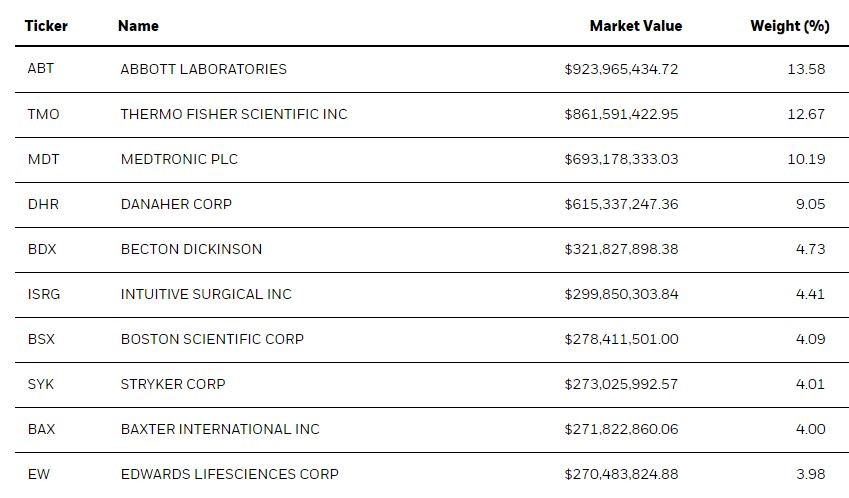

To understand how this works, let’s take a look at the top 10 holdings of [IHI]:

|

|

| Source: iShares |

Diving into its top holding, which is Abbott Laboratories [NYSE:ABT], a picture emerges of what they do that is so valuable.

Abbott Laboratories has a portfolio of medical device products with a focus on the heart and diabetes.

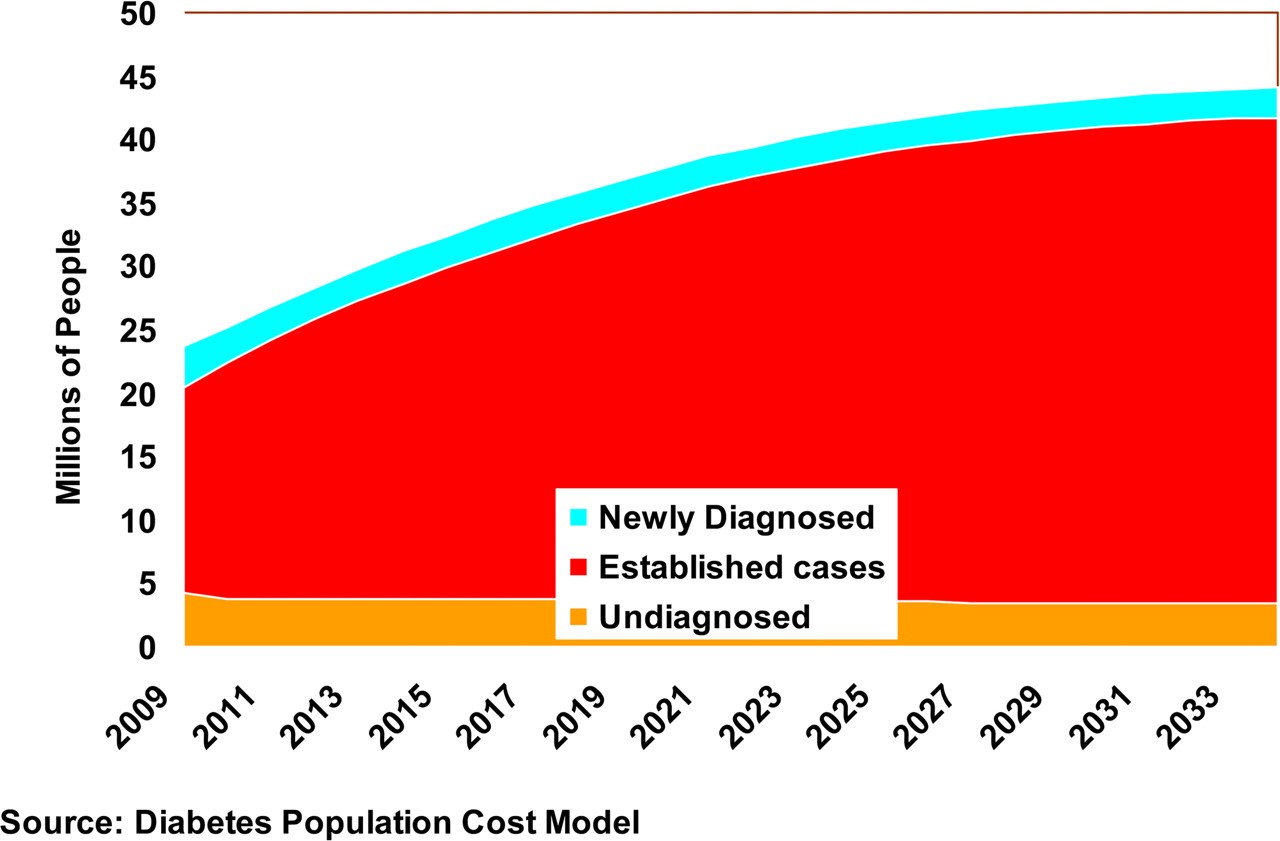

You can see a projection of the growth in diabetes patients:

|

|

| Source: American Diabetes Association |

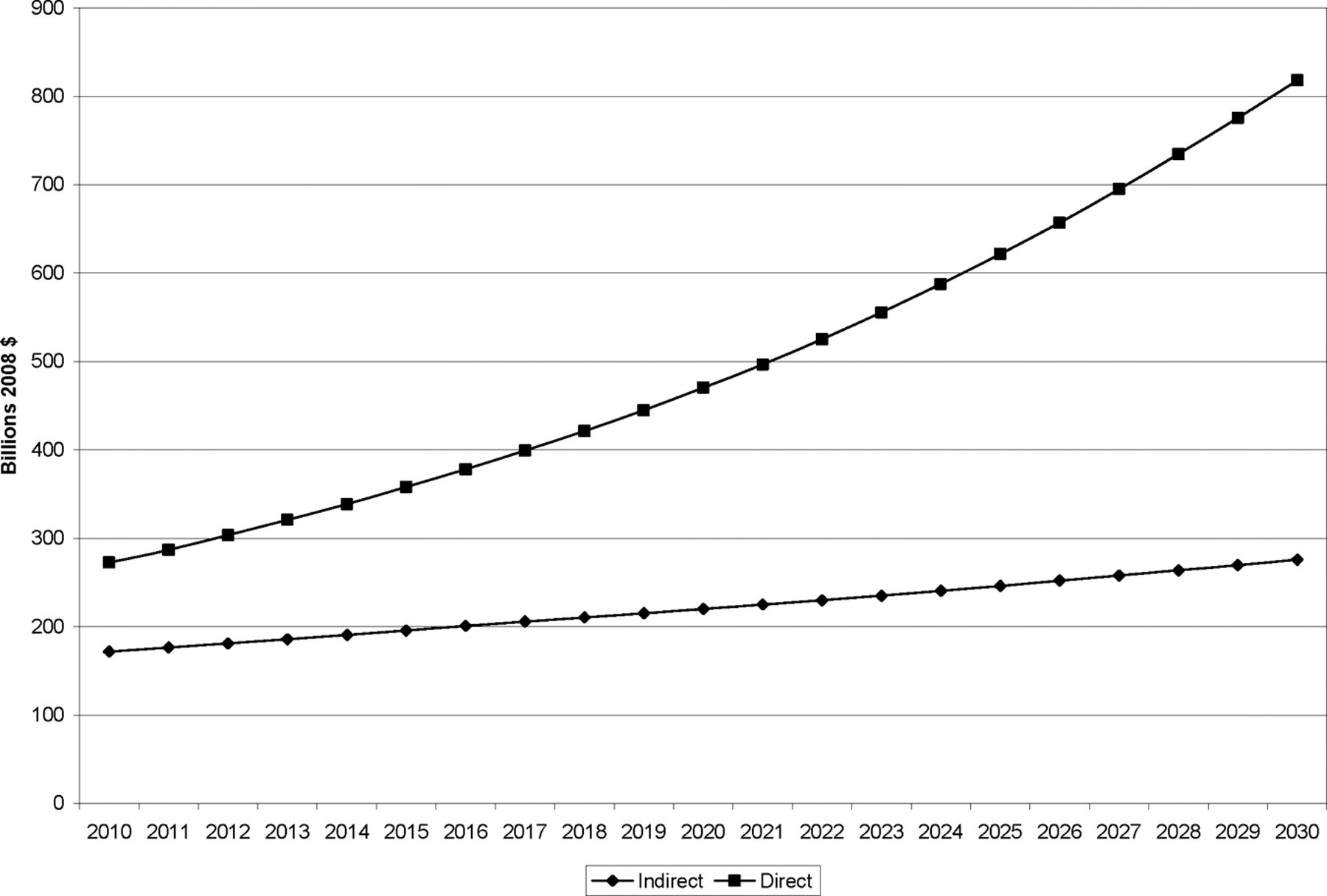

And here’s the total direct and indirect spending on cardiovascular disease projected in the US through to 2030:

|

|

| Source: American Heart Association |

I would speculate that much of the growth in these diseases may already be priced into the ABT and IHI share prices.

What ASX-listed medtech companies are there?

The ASX has two notable medtech growth stories.

This includes PolyNovo Ltd [ASX:PNV] and Cochlear Ltd [COH].

PolyNovo does skin regeneration solutions while Cochlear does high-tech hearing devices.

The PNV market cap stands at $1.51 billion today, and the COH market cap dwarfs that, coming in at upwards of $12 billion.

In the last five years, both companies went on immense share price runs.

It shows that if you have a breakthrough product, then investors will move on the stock, even before you are profitable.

What makes medtech so appealing?

The desire for health is a non-negotiable part of human nature.

The willingness to pay for it, well it depends what country you are in.

That’s why the US healthcare market is the holy grail for many of these companies.

Medtech is not limited to just devices, AI-enhanced service delivery and decision-making platforms are also likely to become part of the push to improve medicine.

The coronavirus is shifting resources towards immediate problems, but the second order effect of this will be a huge backlog of health issues that are currently deemed less pressing.

I think this will inevitably lead to a massive surge in interest in companies that can deliver efficiency gains.

These companies may get special treatment from a regulatory perspective (FDA clearances, etc.), and may become takeover targets for cashed-up healthcare giants.

The smart investor will be looking to capitalise on this push well before it shows up in the share prices of these future stars.

Medtech is a big theme in our Exponential Stock Investor service. You can learn all about that here.

Regards,

Lachlann Tierney,

For Money Weekend

Lachlann is also the Junior Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.