‘We look at the present through a rear-view mirror. We march backwards into the future.’

— Marshall McLuhan

Investors spent much of 2025 fixated on Trump and everything with a T. Tariffs, tax cuts, and trade wars dominated early headlines. The D’s followed close behind — DOGE, deportations, deregulation, and drilling.

But this political theatre, while entertaining, has obscured the unfolding structural story.

Technology has become the sole financial trade, the market narrative, and a fuite en avant of our era.

Apologies for the French, but if there are two things the French are good at, it’s retreating and turns of phrase. La fuite en avant — the forward escape — has both.

Our almost reckless lunge towards AI and superintelligence has become the central story of our time.

Two years ago, AI systems were still fumbling at basic reasoning. Now they’re drafting complex legal documents and advanced mathematical proofs.

No one knows the upper bounds of this improvement. And as I outlined earlier this month, it’s difficult for our minds to comprehend the rate of improvement we’re seeing in AI.

Meanwhile, the upper echelons of power seemed locked in a race towards a technology that could grant the country or company that wields it the power to dictate the terms of the 21st century.

That is, unless this Faustian bargain backfires…

CapEx Race (To the Bottom or Top?)

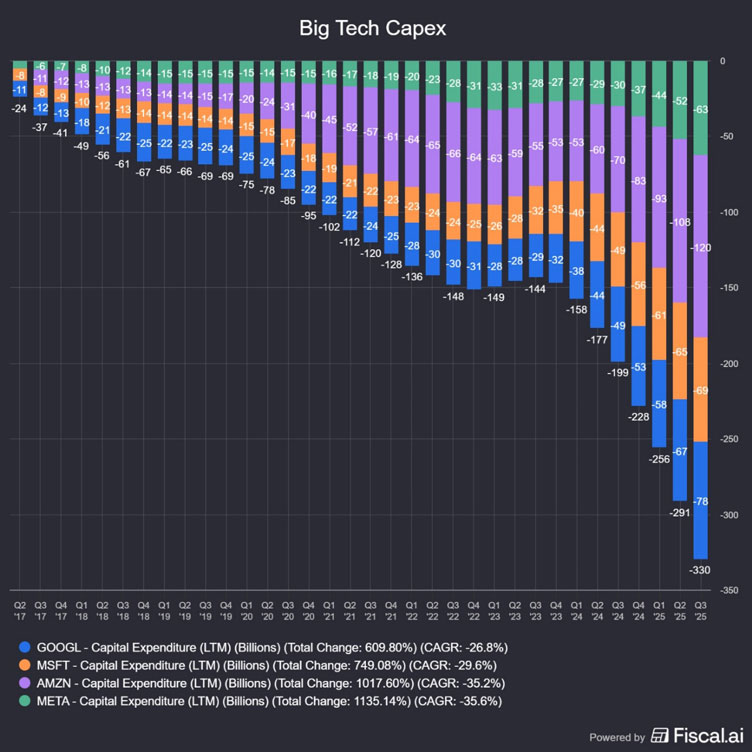

AI-related capital expenditure (CapEx) accounted for a staggering share of growth this year.

Here’s the capex growth of the big four tech names: Google, Microsoft, Meta, and Amazon, in billions.

Source: Fiscal.ai

[Click to open in a new window]

Due to the government shutdown, we don’t have the latest hard data; however, based on the first half of 2025, AI-related capex accounted for 1.1% of GDP and over half of the total growth.

That’s the equivalent of the GDP from the entire US mining and oil & gas sector in 2024. In other words, AI data centres are now the primary engine of growth for the US, outpacing the US consumer.

Technology firms show no appetite to slow spending. Data centres proliferate, and energy demand is surging.

The infrastructure buildout is real. The productivity payoff? Is still harder to find.

This gap between AI investment and AI delivery sparked the late 2025 sell-off, and I think it will shape the contours of 2026.

If I were to boldly predict next year, I would say:

The AI sentiment wave breaks in 2026, bringing weaker returns — and possibly a harder correction.

This isn’t about fundamentals. It’s about stories.

In Narrative Economics, Nobel laureate Robert Shiller argues that economic events are driven less by data than by the viral spread of compelling stories.

Narratives catch fire, shape expectations and move markets, often far beyond what reality justifies. AI is clearly the dominant narrative of this cycle.

The story writes itself: transformative technology, exponential growth, winner-take-all dynamics. It’s easy to believe, easy to repeat, and almost impossible to verify.

But narratives don’t need to be wrong to unravel. They just need to meet an air gap. A stretch of time where the story outruns the evidence.

That’s the risk heading into 2026. The AI investment thesis requires continued proof of delivery: productivity gains, revenue growth, and a return on those billions.

If that proof arrives slowly — or unevenly — the narrative loses momentum. And when narratives stall, sentiment can shift faster than fundamentals ever could.

It’s always a challenge to predict how the next generation of AI systems will look. Behind the scenes, they’re scaling from hundreds of billions to trillions of internal data points.

The next AI could be great. But I don’t think it’ll be enough to keep the market afloat.

In saying that, I’ve been wrong before.

The Agentic paradox

Twelve months ago, I predicted Agentic AI systems ‘could supercharge AI adoption’ by year’s end. I was dead wrong.

The thesis was sound: AI models were improving rapidly, investment was flooding in, and the logical next step was AI that could act autonomously. Not just answer questions, but execute tasks, manage workflows, and multiply human productivity.

That future remains out of reach — for now.

Top AI companies have shipped increasingly capable reasoning models. But the true Agentic worker, the AI that books your flights, manages your projects, and handles your inbox without supervision, is still ‘months away’ in the same way it was ‘months away’ a year ago.

It could arrive sooner than I expect with a breakthrough, but I think it’s at least a couple of years away.

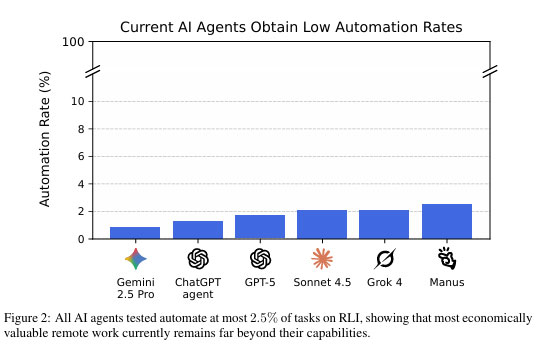

Here are some concrete results from a recent paper that tried to directly compare the latest Agentic AI outputs with realistic remote work jobs, in something they called the Remote Labor Index.

As you can see below, Agentic AI is near the floor, with a pass rate of 2.5% at most for what was deemed an acceptable quality of work.

Source: Mazeika, Gatti, et al. 2025: Remote Labor Index

I have covered these AI shortfalls at length in the past. To overcome these problems, big tech is pushing for size over ideas.

R&D can be spotty and (as Meta learned this year), pushing for new algorithms can end with no real gains. Better to pull the lever you know gives clear results.

Here, I believe investors can capitalise on this trend by focusing on the energy and High Bandwidth Memory markets as key bottlenecks.

Essentially, without new ideas coming to the fore, we’re going to brute force the problem with ever greater scale.

Bigger data centres. More power. More Capex needed. La fuite en avant…

Zooming out, this isn’t a failure of the underlying ‘AI workforce’ thesis. It’s really a timing mismatch that reveals something important about where we sit in the AI cycle: capital has flooded into infrastructure, but the applications that justify that investment haven’t yet materialised at scale.

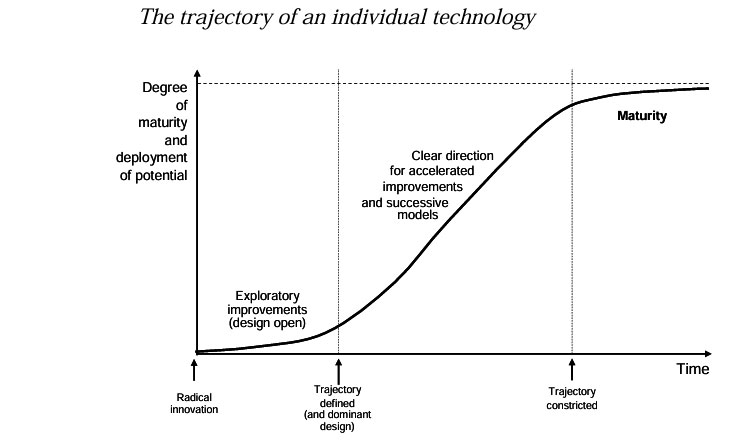

History suggests that these early phases eventually give way to periods of explosive growth. Often called the S-Curve:

Source: C.Perez (2009) Technological Revolutions and Techno-Economic Paradigms

While that acceleration could suddenly appear with a major breakthrough, for now, the market is pricing in a future that keeps slipping to the right.

That spells danger.

What 2026 demands

Late-cycle signals are flashing.

The AI narrative that has driven market gains over the past few years is looking more vulnerable to sentiment shifts.

Investors are beginning to demand stronger returns on the billions flowing into data centres and chips.

Ahead, harder questions about valuations, productivity payoffs, and energy constraints will likely fuel volatility in 2026.

Inflation or a weaker consumer may eventually bring this party to a close, but not without a final run-up in markets.

That means 2026 could be a year of paradox: lifted by rate cuts, markets may brim with optimism even as questions about the durability of tech-driven gains cast a shadow that could quickly turn bearish.

For investors, I would look back to the examples of prior bubbles, such as the railways or the dotcom era, for lessons.

Back then, both the infrastructure companies (Cisco, etc) and the speculative users of that tech (Pets.com, etc) collapsed when the bubble burst.

But in the preceding decade, the companies using that technology were the clear winners.

Suppose we do see a larger fall. Then, it could be your greatest opportunity to buy a collection of the top AI application-layer companies.

Some may go to zero. At the same time, others could be the next Amazon of the AI era.

And when the dust finally settles, those opportunities will favour those who already know where to look.

This is where having the best ideas in your inbox each week can set you up for success in 2026.

This Christmas, I’m offering readers a golden opportunity to join me in Small-Cap Systems and continue exploring these themes.

I have spent countless hours this year building on and improving the AI signals that my system uses. And there are some huge changes ready to be unveiled in the new year, and I’d love you to be a part of it.

That’s why I REALLY encourage you to take advantage of Fat Tail’s 50%-Off Christmas Discount campaign, which Small-Cap Systems is included in.

All you need to do is plug in the discount code CHRISTMAS50 in the order page here, and you will receive one year of Small-Cap Systems for half price. $1,749 instead of $3,499.

And, like I say, this is going to be a year where the system levels UP.

If you wish to try your hand at AI-assisted small cap trading, now’s the time to do it.

IMPORTANT POINT: this massively discounted offer expires midnight New Years’ Eve.

So, if you park the idea for now you may forget about it and be kicking yourself next year.

Head to the order page here and enter the coupon code: CHRISTMAS50 before this 50%-off invitation expires.

Or, if you’d like to learn a bit more about what you get with Small-Cap Systems, go here.

Getting a grasp on where AI is headed is perhaps your most important job as an investor in this cycle.

The gap between AI investment and delivery will eventually narrow. The question for 2026 is whether it happens fast enough to justify the prices already being paid.

Mind the gap.

Until next year,

Regards,

Charlie Ormond,

Small-Cap Systems and Altucher’s Investment Network Australia

Comments