At time of writing, shares of Tyro Payments Ltd [ASX:TYR] are in a trading pause, having last traded down nearly 12%, or $2.32.

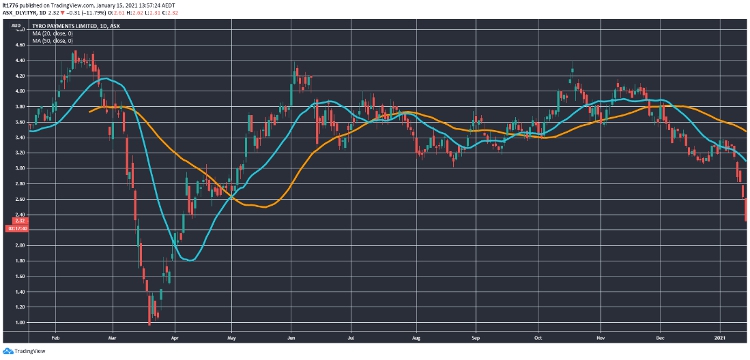

Having shown some promising signs since March on a relatively strong Australian economy, the TYR share price went into free fall today as you can see below:

Source: Tradingview.com

We look at the recent events surrounding the company, after previously covering the outage.

Tyro moves to halt trading on activist report

The Australian Financial Review gives a good account of what happened:

‘The problems at ASX-listed Tyro have compounded after activist short-sellers Viceroy lobbed a report that alleged the payments company’s terminal outages are far more widespread than it is willing to admit.

‘The 14-page report, which landed an hour into Friday’s trading session, alleged that about 50 per cent of Tyro’s payments terminals used by small businesses had been “bricked” and that the hit to Tyro’s business was impossible to quantify.’

At issue was Tyro’s recent update which claimed that 70% of customers were unaffected.

After a sharp sell-off, a trading pause was put in place just before noon to give TYR time to make an announcement.

Now who is right or wrong here, is not something that is possible to say at this stage.

But it will mean that, regardless of what happens over the next few days and weeks, there may be some latent reputational damage, according to one fund manager quoted in the Australian Financial Review.

Outlook for TYR share price

Now given the chaotic day for TYR, it may take some time for the company to get things back to normal.

Perhaps the main takeaway is that technology can be fickle. And as a result, small tech/fintech stocks are not for the faint of heart or risk adverse.

That being said, if you are still interested in fintech companies, then this report is a must read.

It covers three niche small-cap fintechs, each with their own appeal.

These are in no way recommendations, but simply a starting point for your research in this diverse field.

You can download that report for free, right here.

Regards,

Lachlann Tierney,

For Money Morning

PS: Looking to manage risk when trading volatile stocks? Get Murray Dawes’ report on charting for traders.

Comments