In today’s Money Morning…security or economics?…Biden shakes things up, be ready…old alliances will fail, new alliances will form…and more…

In 1981 President Ronald Regan imposed sanctions on the Soviet Union.

It was in response to a plan to create a pipeline from its vast gas fields into an energy-hungry Western Europe.

40 years later history is repeating itself.

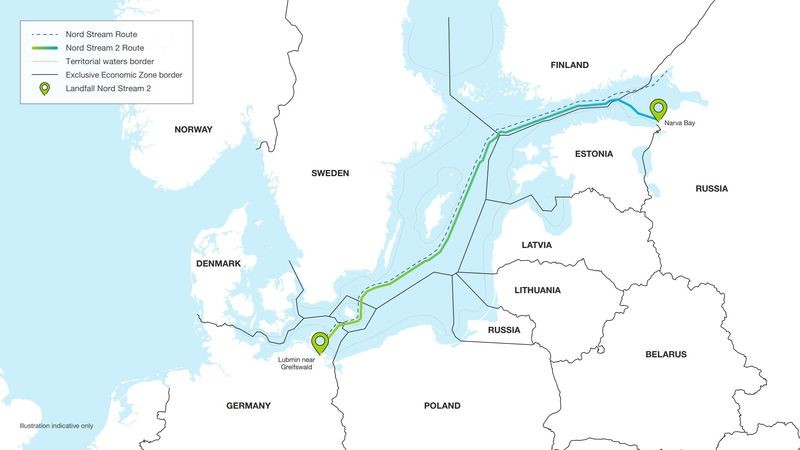

The Nord Stream 2 natural gas pipeline is an $11.2 billion project that connects Russian gas fields, under the Baltic Sea, direct to Northern Germany.

|

|

| Source: Bloomberg |

But, like 40 years ago, the Americans aren’t happy about it.

The project — which was just weeks away from completion — was put on halt a year ago when US President Trump imposed sanctions on companies working on it.

Some European lawmakers were suspicious of their motives…

Security or economics?

While the US publicly stated ‘strategic imperatives’ — namely they saw a risk of Europe becoming a hostage to Russian energy sources — some NATO allies were less sure about this being the real reason.

They think the US intervention is just a ploy to direct them to buy from US LNG providers instead.

And they want to stick with Russian gas as it will give Germany — who are transitioning away from coal and nuclear — the cheapest alternate source of energy.

There’s also a line of thought in Western Europe that by consuming Russian gas, Russia becomes tied to Europe in a more cooperative way too.

This might taper down Russian aggression on the region.

Think of it as a sort of updated — and far less dramatic — form of the mutually assured destruction (MAD) pact that existed in the nuclear arms race of the cold war era.

Still, other European countries, especially in the east, aren’t too keen on Russians having more influence in the region.

Poland’s Prime Minister called the pipeline a ‘hybrid weapon’. They’ve a long history with Russia and can’t forget the past so easily.

In a month where a ‘no-deal’ Brexit seems an odds-on outcome, it looks like the troubled Euro zone will have more disagreements to deal with in 2021.

For the Nord Stream 2 project, what happens next seems to hinge on the Americans…

Biden shakes things up…be ready

With Joe Biden coming into the White House soon, the project backers have decided to restart the project.

Obviously, they’re hoping a new US regime will be friendlier than its predecessor, and so they’ve decided to roll the dice and see what happens on the project.

But it’s not a certainty that the incoming administration be for it.

The Democrats have consistently held a tough line on Russia through Trump’s presidency and may seek to extract ‘revenge’ for slights, both real and imagined.

We’ll have to wait and see how they respond.

What’s more certain about a Biden presidency is a renewed focus on promoting green energy industry.

As Bloomberg reported a few days ago, this was the one area he went out on a limb over in the election:

‘That started to change this summer. In a surprise move for a cautious candidate, Joe Biden put a 100% clean grid at the core of his climate agenda. Even more remarkable was his proposed timeline: 15 years. It was startlingly ambitious, considering his prior goals for eliminating emissions focused on a more gradual and familiar 30-year timetable.’

Anyway, the last 160 kilometres of pipeline (its 1,230 km all up) will be completed within months and we’ll know soon enough what happens next.

The deeper point about all this though, is the domino effect of changing energy markets.

As the world weans itself off oil and fossil fuels, the effects will be profound.

Old alliances will fail, new alliances will form, and slowly the winners of this new world of energy will emerge.

It’s going to be fascinating to watch and will also throw up amazing investment opportunities for the prepared.

Good investing,

|

Ryan Dinse,

Editor, Money Morning

Ryan is also editor of Exponential Stock Investor, a stock tipping newsletter that looks for the biggest investment opportunities on the market. For information on how to subscribe and see what Ryan’s telling his subscribers right now, click here.

PS: Check out our free comprehensive online guide to learn more about renewable energy investment in Australia.

Comments