Gold-nickel-copper miner Chalice Mining’s [ASX:CHN] share price was surging more than 12% early Tuesday, after announcing a massive mineral resource upgrade for the Gonneville deposit at Julimar nickel-copper-platinum project in Perth, WA.

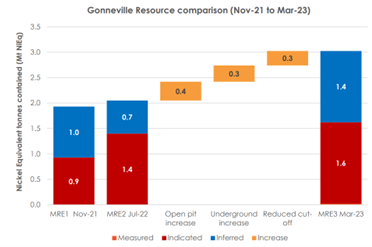

The group has been drilling and reworking the project to a 50% increase in contained nickel equivalent, compared with its estimate in July.

The group is now on the lookout for a mining and operating partner, to help manage the growing project scale.

Shares were worth $6.82 by the early afternoon; the miner having risen 13% in the past month:

www.TradingView.com

Chalice touts sizeable mineral resource

Investors were fuelled with confidence and enthusiasm when the miner announced a grand extension on its initial expectations for the mineral resource at its Gonneville deposit.

The deposit is the company’s first discovery at its wholly-owned Julimar Nickel-Copper-Platinum Group Element (PGE) Project, initially discovered in early 2020, located on Chalice-owned farmland.

A total of 260 new drill holes have been added to the existing 1,000-plus across 275,00 metres of project land.

It was revealed today that drilling and re-modelling resulted in a 50% increase in the contained nickel equivalent metal relative to the July 2022 estimate, to approximately 3Mt.

Chalice says this increase is due to extensional drilling, which has defined new mineralisation along strike and down-dip of the previous resource pit shell, which has also increased.

The company is updating pit optimisation parameters to incorporate the revised long-term metal prices as well as new metallurgical test work on lower-grade sulphide mineralisation.

In addition, Chalice is also revising processing and mining costs, with a slight reduction in resource cut-off grade from 0.40% NiEq to 0.35% NiEq, reducing the strip ratio to 1.6 (from 2).

Chalice CEO Alex Dorsch said:

‘The ~50% increase in the Gonneville Resource to ~3 million tonnes of nickel equivalent is quite a remarkable achievement for the Chalice team given it is barely three years since the discovery of the Julimar Complex. Gonneville is now the 2rd largest undeveloped nickel sulphide resource in Australia.

‘The latest numbers continue to demonstrate the world-class endowment, scale and quality of the Gonneville Deposit, while also highlighting a compelling picture of upside along the remaining ~28km strike length of the Julimar Intrusive Complex.

‘Apart from further increasing the contained metal, this Resource update has also delivered a significant increase in the higher-confidence Indicated Resource component – which now represents ~60% of the open-pit Resource. Importantly, 95% of the Resource above a depth of 200m is now classified as Indicated, which represents a major de-risking step for the Project.’

Source: CHN

Chalice needs partners

Today marks quite the jump for Chalice, and has, in effect, pushed the company to boost its search for mining and operating partners as the scale of the project continues to grow.

Hoping to take advantage of strong strategic interest in its Gonneville product, Chalice said it has already been in talks with a range of downstream, trading, and end-user parties interested in joint venture partnerships.

Drilling will continue at Gonneville, with assays currently pending for 52 drill holes and two diamond rigs being tested for extensions of high-grade mineralisation at depth.

The deposit remains open beyond 800m depth, with step-out drilling having indicated mineralisation extending beyond 1,100m.

Australia’s drilling campaign

Did you know that many in the resources industry are making raging bull market-like gains regardless of recession fears, interest rates, and what the wider market does?

More booms are marked to happen for every single metal that can be found on the period table.

There are small caps primed to grow into mid-to-large caps, but how do you tell which ones?

It’s a big universe, and you may need a little help. That’s where our commodities expert James Cooper comes in.

He’s found six ASX mining stocks that are heading to top the charts for 2023.

Regards,

Mahlia Stewart

For The Daily Reckoning