Shares in online luxury goods retailer Cettire [ASX:CTT] are in freefall today after the company issued a profit warning due to challenging market conditions.

Cettire revealed that softening demand and heavy competition have squeezed margins and impacted its Q4 FY24 performance.

As of this writing, Cettire shares are down -49% to $1.14 per share. This dramatic fall has erased Cettire’s gains for the past 12 months, with the stock now down nearly -60%.

Today’s blow certainly takes the wind out of a company that gained nearly 70% in February alone.

Much of that momentum was stalled by questions raised by AFR reporting, which raised concerns about taxation and operations at the retailer earlier this year.

With Cettire shares now trading at a significant discount, is this a potential buying opportunity for investors bullish on the luxury e-commerce sector?

Or does it signal deeper troubles ahead for the company?

Source: TradingView

Profit warning details

Cettire told investors this morning that its adjusted earnings before tax for 2023–24 would be between $32–35 million, well below the estimates of $44 million.

Despite forecasting some positive year-over-year growth in key metrics, Cettire’s update highlighted several challenges facing the business.

In the update, Cettire noted that the global online luxury market had become ‘more challenging’.

Softening demand has broadly impacted sales, forcing many luxury brands to heavily discount to compete — squeezing margins.

CEO Dean Mintz remarked on the situation:

‘A softening demand environment and an increase in promotional activity has been visible across our footprint, particularly in the last several weeks as the market has entered the Spring Summer 24 sale period.’

He added:

‘Additionally, we believe the market is currently being impacted by clearance activity as certain players exit parts of the market.’

To maintain market share, Cettire said it had ‘selectively participated in the promotional activity’, which has pushed up marketing costs relative to sales and reduced margins.

Despite the near-term headwinds, Cettire said it still expects to deliver significant growth for FY2024.

Forecasts given today estimated sales revenue growth of 77–79% year-over-year to $735–745 million. A strong number, but below market expectations of around $750 million.

Mr Mintz repeatedly circled the theme of the company’s continued expansion today, stating:

‘The company continues to grow rapidly, is profitable and cash generative.’

The company plans to release its full FY2024 results in the second half of August, which should clarify just how strong that growth is looking.

So, is there anything here for potential bargain hunters?

China launch and future outlook

In a potential bright spot, Cettire launched its direct platform in China on Sunday and is already processing orders.

While it has been a rocky start, the new market could provide a boost to future growth if it is successful.

We’ve seen many reports that have highlighted the challenges of the Chinese market and consumption there. However, a longer horizon view could be taken when looking at Cettire.

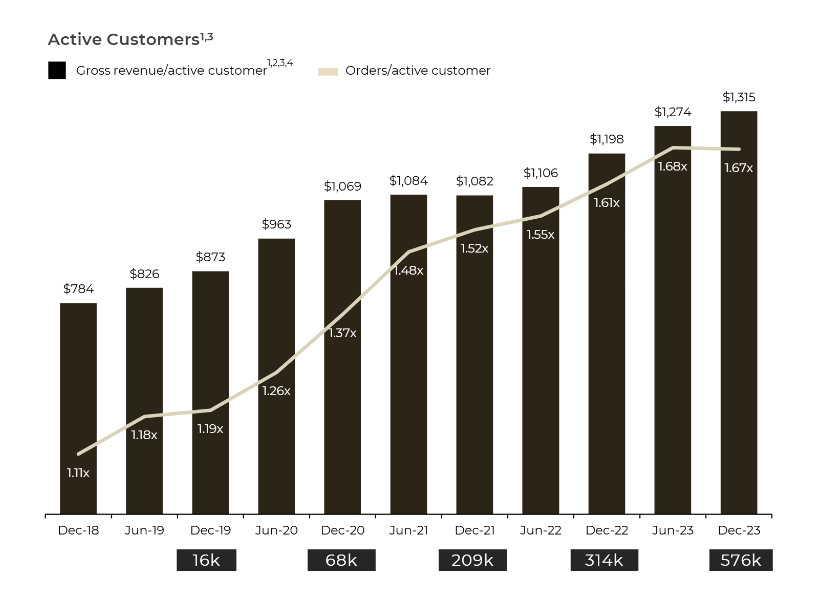

Prior to the Chinese push, some investors had noted that it seemed like Cettire’s customer growth had begun to slow.

Source: Cettire, Feb 24 Presentation

Today’s sharp selloff may attract investors looking for a discounted entry into a high-growth e-commerce stock.

Cettire has demonstrated strong revenue growth in the past and remains profitable, which could appeal to some growth-oriented investors.

However, the profit warning raises questions about the sustainability of that growth and its ability to maintain margins in the competitive luxury e-commerce landscape.

Value-focused investors may want to wait for further clarity on the company’s financial position and market outlook before considering a position.

If you’re interested in the retail space for investing, the upcoming full-year results in August could be one to mark on your calendars.

Ultimately, potential investors will need to weigh the risks of a challenging market environment and compressed margins against the potential upside of Cettire’s continued growth and expansion into new markets like China.

A time to protect wealth?

Markets could be exhibiting signs similar to those of a previous decade, one that left many people’s stocks lost in the doldrums.

Don’t let history repeat itself at your expense; learn what you need to shift to stay on top.

Our latest report reveals the key to potentially benefitting from soaring inflation, early gains in the commodity boom, and the rising gold market.

We’ll show you the top investments for 2024, including cutting-edge growth assets that weren’t available 50 years ago.

Plus, learn which investments to avoid in this volatile climate. This isn’t just about survival — it’s about turning this economic flashback into an opportunity for growth.

Ready to protect your wealth from the looming ’70s-style economic storm?

Click here to learn how to access the full report and start preparing for the ‘decade of decimation’ today. Your wealth and legacy may depend on it.

Regards,

Charlie Ormond

For Fat Tail Daily

Comments