Today the Commonwealth Bank of Australia [ASX:CBA] launched StepPay, a BNPL offering to rival Afterpay Ltd [ASX:APT] and Zip Co Ltd [ASX: Z1P].

Seeking to keep up with the rise of BNPL, especially after Square’s looming acquisition of Afterpay, CommBank today officially launched its own BNPL offering to about 100,000 customers.

The official launch of StepPay saw the bank’s shares rise 1.2% in noon trade.

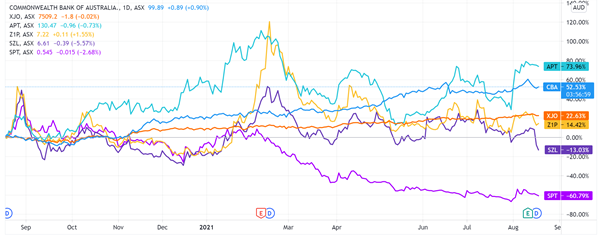

StepPay’s launch didn’t really budge the market’s view of APT, however. At time of writing, APT shares are slightly down by 0.6%.

And Z1P share price is actually up 1.4%.

What does CBA’s StepPay offer?

CBA’s StepPay will be a digital-only BNPL product users can add to their CommBank app, digital wallet on their smartphone, or their iPad.

The offering will let customers split purchases from $100 to $1,000 at any retailer that accepts Mastercard.

Users can use StepPay in-store using tap and pay or online anywhere Mastercard is accepted ‘without needing a physical card.’

What are the payment limits?

Another point to note is that StepPay will be available to ‘eligible CommBank customers subject to credit assessments.’

CBA said StepPay also charges no interest, $0 monthly fees, and no international transaction fees.

However, a $10 late payment fee applies if you miss a repayment, preventing you from spending with StepPay until ‘you have enough available funds in your repayment account.’

What does this mean for CBA and APT?

What is interesting is that while the news did not seem to move APT and Z1P share prices, the smaller BNPL players did dip today.

Sezzle Inc [ASX:SZL], with a market cap of $1.3 billion, is down 5% at time of writing.

In SZL’s case, the dip may also have to do with the market digesting yesterday’s 2Q21 results which saw Sezzle post a net loss for the six months ended 30 June 2021 of $30.4 million.

Splitit Ltd [ASX:SPT], with a market cap of $255 million, is currently down 3.5%.

Openpay Group Ltd [ASX:OPY], with a $135 million market cap, is down 2.3%.

But the lack of movement in APT and Z1P shares suggests the market might not believe the launch of CBA’s StepPay BNPL offering will have a significant impact.

Of course, CBA flagged its BNPL offering way back in March — so there was also plenty of time for the market to price in today’s launch already.

We should also note that Afterpay’s shares were unlikely to move much on today’s StepPay news since the APT stock is now closely tied to the share price of its slated acquirer — Square.

As we covered earlier, the ASX tech darling is set to be acquired by the Jack Dorsey-run Square in an all-stock acquisition which will see APT shareholders own about 18.5% of SQ shares.

Too little, too late?

What stood out to me was the seemingly cautious nature of the rollout.

For one, the launch applied to pre-registered users who, said CommBank, had to be ‘model customers, with no defaults or late payment history.’

CBA said 86,000 customers pre-registered for the service but believe a further four million CBA customers will be eligible to access StepPay.

For reference, Afterpay counted 3.6 million users in Australia and New Zealand as of 30 June 2021.

The key question is how many out of the four million eligible will choose to use StepPay, especially considering that since announcing StepPay in March about 86,000 users chose to register for the service.

Of course, the four million eligible customers are a substantial addressable market.

It is also likely that a chunk of those eligible will be current Afterpay and Zip users.

So StepPay could steal some users away from the big BNPL players.

Someone already with a CommBank account may find it easier to stick with StepPay, especially since it allows a customer to pay using BNPL anywhere Mastercard is accepted, not just participating partners.

Additionally, the Australian Financial Review reported that CBA’s StepPay will be cheaper for merchants than accepting other BNPL options, including the latest entrant PayPal.

With StepPay, merchants will pay the normal credit card processing fee, which is about 1.5% of the cost of the goods.

This is much lower than the average 4% fee charged by Afterpay.

That’s appealing to merchants on the cost side.

But as some detractors may note — Afterpay gets away with higher fees because it purports to drive extra sales and increase basket sizes.

Merchants could tolerate the higher fees if they know the extra sales Afterpay brings in via its ecosystem outweigh the costs.

All this also makes me wonder what will happen if other banks follow CBA.

What happens to the BNPL sector when all the big banks offer their own BNPL option? What will this mean for Afterpay, Zip, and the rest?

Jefferies analyst Brian Johnson, for one, thought that ‘just as Aussie Home Loans triggered a dramatic drop in mortgage margins in the 90s, StepPay could herald BNPL margin contraction.’

This is an interesting point and will make the Australian BNPL space one to watch as it continues to innovate and evolve.

But as for banks in general, it’s easy to say they aren’t going anywhere. Especially with the strong results the Big Four posted this year.

But there’s one thing I think you should keep an eye on if you think the big banks will remain a dominant force for the foreseeable future.

For instance, when you start digging into the developments surrounding central bank digital currencies (CBDCs) and their potential long-term effect in 5–10 years, it’s not really contrarian to argue the Big Four are on borrowed time.

If you’re keen to read more about these ideas, then our latest advisory service New Money Investor may be a perfect place to start.

It’s time to start playing the new money game.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here