In today’s Money Weekend…Murray’s caution was wise — how bonds and stimulus are tracking…FAANG/FAMGA club isn’t what I’d call real growth stocks…two stocks to watch…and more…

With Murray Dawes away today, I’ll do my best ‘Muzz’ impression while he gets some much-needed fishing time in.

Today’s piece is all about how things could play out for investors over the next two years.

That would take us through to when the Fed may begin to think about raising rates, should all go according to plan.

There’s been a lot of chatter about bond yields, inflation/reflation, corrections, a pivot to value versus growth, and so on recently.

The main thesis of today’s piece is that value and growth can coexist in the ‘Life at Zero’ era.

It’s cheap to say be discerning, so I’ll argue that investors may need to focus on growth-value hybrid stocks in the mid-cap range going forward.

You may get a less stretched multiple on certain mid-caps, along with the prospect of growth.

First though, a look at how stimulus and bond yields are going at the moment.

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

Murray’s caution was wise — how bonds and stimulus are tracking

Murray recommended Pivot Trader subscribers exit a number of big wins prior to the NASDAQ correction — a move that was wise in hindsight.

It likely spared subscribers a mini-panic.

But with the mammoth $1.9 trillion US stimulus in place, it will be interesting to see what this does to the market.

Do stimmy cheque recipients plough the money into speculative growth on their Robinhood trading app?

That will be really interesting to watch — and it would probably flow through as a boon to ASX-listed small-caps.

It may be a short-lived move though if bond yields grind higher in the coming months.

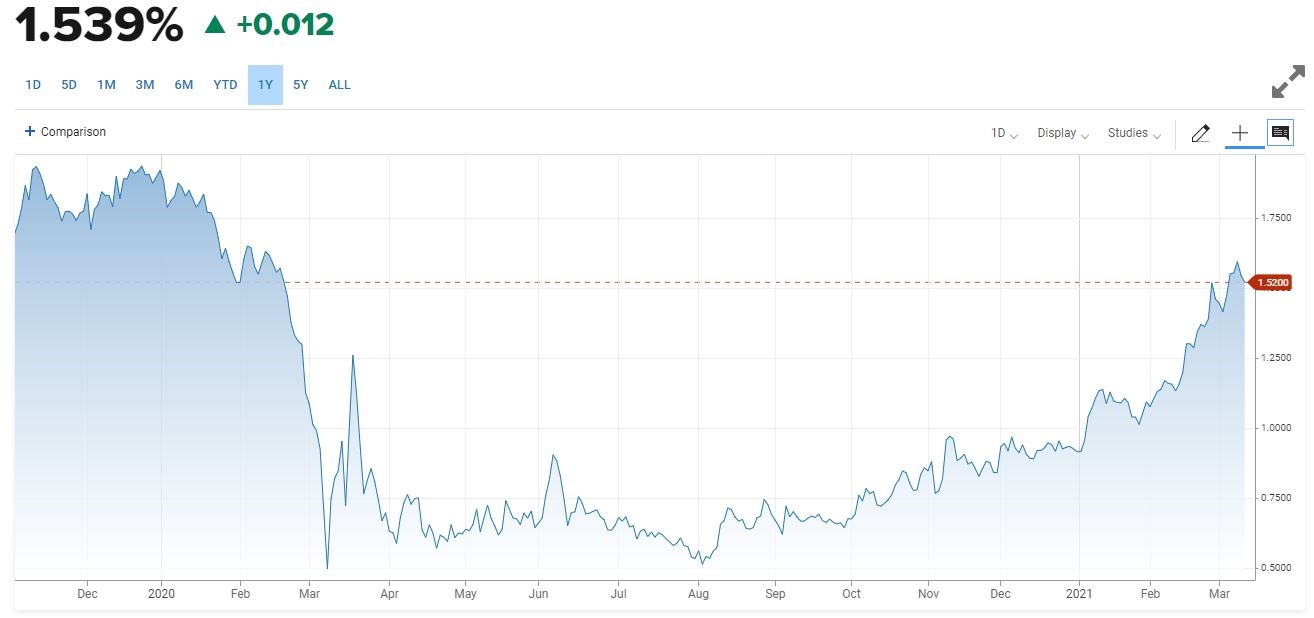

This is how the all-important US 10-year Treasury yield is going right now:

|

|

|

Source: CNBC |

It’s come off a high just a tad, giving growth investors a bit of breathing room.

There’s still a fair bit of resistance on the chart, dating back to just before the pandemic erupted.

If it cracks above say 1.9%, then there could be some more selling pressure on indices in both the US and Australia.

Remember, ‘growth stocks’ like Tesla Inc [NASDAQ:TSLA] and the FAANG/FAMGA club pulled indices higher with many of the gains accumulating to only a few winners.

Perception is everything here, and if the indices sell off it could just open the window for bigger and better value bets.

Here’s the rub though.

FAANG/FAMGA club isn’t what I’d call real growth stocks

I say this because these companies are riding the wave of a mature megatrend — namely people going online.

The internet boom is old hat.

Sure, they should continue to grow revenues and profits, but this isn’t true growth.

It’s more market dominance eking out smaller and smaller wins.

Sort of like how I think CSL Ltd [ASX:CSL] will slowly morph into a dividend stock as its growth stock status stagnates.

If you want proper growth in the ‘Life at Zero’ era, you may need to switch up your attack on the market.

So, check out these two example stocks for how you may get a bit of growth mixed with a bit of value.

These are in no way recommendations, simply examples of how you can think about growth and value coexisting.

Example #1

Medical packaging doesn’t sound too exciting, does it?

But this company could eventually benefit from an ageing population and our incessant love of pills.

The company is called Probiotec Ltd [ASX:PBP].

You can see its chart over the last five years below:

|

|

|

Source: Tradingview.com |

Looks a bit like a CSL chart, they pay a decent dividend and have gone after acquisitions hard.

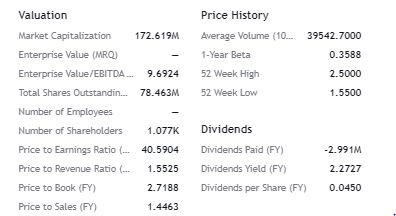

You can see a quick financial snapshot below:

|

|

|

Source: Tradingview.com |

So, there’s one growth/value hybrid right there.

Example #2

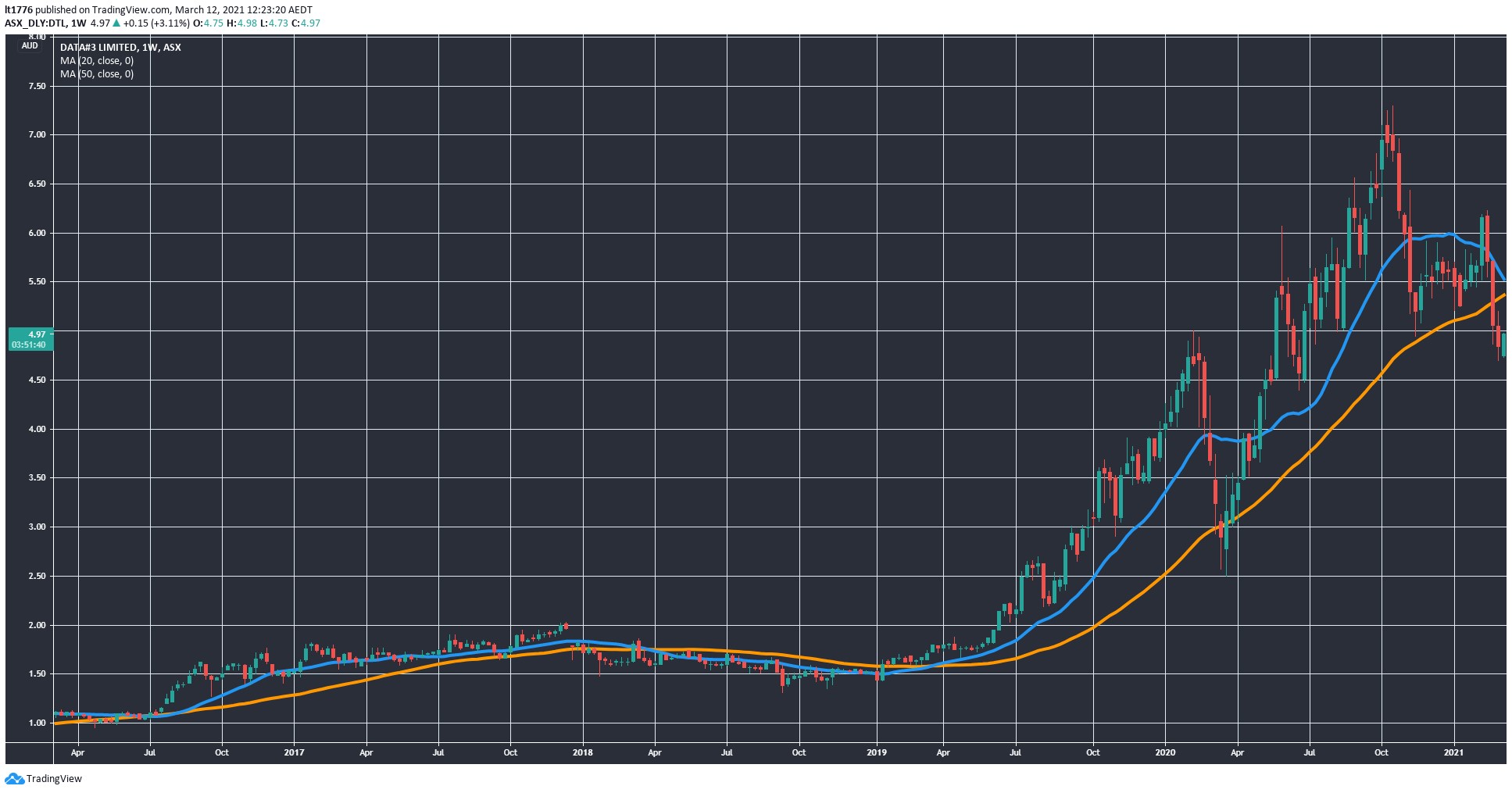

This one is an IT conglomerate.

It’s called Data#3 Ltd [ASX:DTL] and it’s got a similar sort of chart to the last stock:

|

|

|

Source: Tradingview.com |

Like PBP, it’s got a low price-to-sales ratio and a P/E in what could be seen as an acceptable range:

|

|

|

Source: Tradingview.com |

It also has a half-decent dividend yield.

The takeaway point from all this is that caution in the market is certainly warranted, given the bond yield situation.

But that doesn’t mean you should panic.

I’m sure there are a heap of companies like the two mentioned here out there.

You just have to be smart about it.

‘Life at Zero’ is all about making informed decisions when central bankers force investors’ hands.

You can learn all about what Greg Canavan has up his sleeve for this era of investing, right here.

Regards,

|

Lachlann Tierney,

ForMoney Weekend

Lachlann is also the Editorial Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.