One.

‘I believe there is one big run coming for gold stocks in 2024.’

Two.

‘One thing I want people to understand is that gold is an inflation hedge in the long-term. But if you buy gold to hedge inflation in the short-term, you could be for a very rough ride.’

Three.

‘I believe that in 2024 the politicians will recognise a recession when everyone’s living in a depression. And when they recognise a depression, most people are out on their butts.’

Three highlights from the latest episode of What’s Not Priced In.

But there were more.

This week, I spoke with Brian Chu – Fat Tail’s preeminent gold expert.

Topics we covered in the episode:

- Gold’s historic rise in 2023 and outlook for 2024

- Main drivers of the price of gold

- How the four most popular arguments for holding gold stack up

- Brian’s BIG prediction

- How to evaluate gold miners and why oil plays a crucial role

- FIVE gold stocks on Brian’s radar

Why hold gold

Gold’s had quite the history.

People have revered gold. People have hoarded gold. People have fought over gold.

And people continue to buy gold.

Why?

The four main arguments advanced have remained the same for decades:

- Gold as inflation hedge

- Gold as currency hedge

- Gold as attractive alternative to assets with low real returns

- Gold as safe haven

Brian unpacked each argument in the episode with nuance.

One point stood out.

Gold’s ability to hedge against inflation isn’t as clearcut as some assert.

Gold is often associated with protection against rising prices.

But what investors must pay attention to is not the nominal price level, but real interest rates.

If inflation expectations are at 5% but rates are at 7%, the real yield is 2%.

And real yields matter.

Brian explained this better than most on the pod, so do check it out.

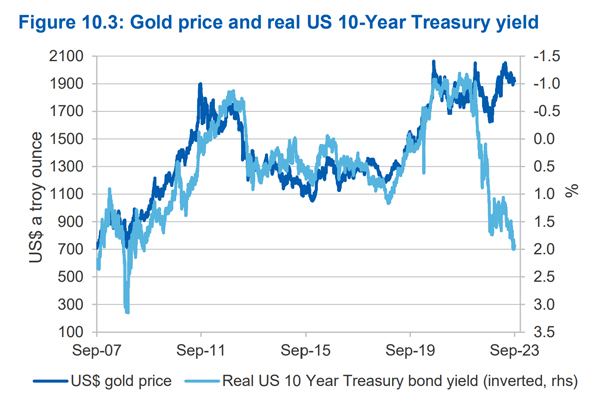

But here’s a telling chart from the Department of Industry in its latest Resources and Energy quarterly.

It pits the US dollar price of gold against the real US 10-Year Treasury yield (the yield that accounts for inflation).

Notice that the Treasury yield plot is inverted to better highlight the relationship. As real yields rise, gold tends to fall. As real yields fall, gold tends to rise.

| |

| Source: Department of Industry |

The Department explained it this way:

‘Rising bond yields tend to decrease gold’s appeal to institutional and retail investors as a secure asset to hedge against inflation or other risks. This is because increases in the yield of a US Treasury (or other credible government bonds) increase the so-called market “risk-free rate”, and hence the opportunity cost of holding gold (pushing prices down).

What’s interesting is the recent decoupling.

As real rates pushed higher in recent months, gold didn’t fall.

The department brought up one of the four arguments for gold as the reason:

‘However, the relationship between real bond yields and gold prices weakened sharply following the Russian invasion of Ukraine — as prices were lifted by heightened safe-haven demand for gold. This has persisted as a driver since, muting the effect of interest rates.’

And while you could argue geopolitical volatility has propped up gold, Brian thinks the safe haven argument is too short-term.

Tensions resolve or the market quickly looks through them.

Brian doesn’t think a safe haven argument holds much sway in the long run.

So the recent strength in gold implies a bet on real yields falling.

Just overnight, US real yields fell from 2.06% to 1.88% on the back of Jerome Powell’s dovish comments.

That’s the biggest daily fall for real yields in a while.

So where is gold headed?

Check out the full episode for the details!

But Brian thinks gold will have a strong 2024. And a strong gold price is good news for gold stocks…

Brian’s unique metric to assess gold miners

During the episode, Brian shared that he’s working on a book about gold investing.

He just started.

But…

I was lucky enough to read a draft chapter.

In it, Brian wrote of his realisation that traditional valuation metrics hardly apply to gold miners. Here’s a snippet:

‘I learnt the hard way that the benchmark ranges for the financial and valuation ratios which I had been using DO NOT apply to mining stocks. I had let those numbers draw me into value traps.’

So Brian came up with his own.

One of these new ratios centred on the key issue for gold miners — cost.

Gold miners can’t control the price of gold. Hedging has its limits.

What miners can control is costs. How efficiently they mine ore. How speedily they process it and at what grades.

Cost separates the best from the rest.

If a miner has the lowest costs, they enjoy the best margins. And when the price of gold rises, they see the strongest cashflows.

And what Brian realised is that oil is a massive input cost.

Oil powers miners’ trucks, machinery, and tools.

A rising oil price is a drag on operating cashflows. A falling oil price a boon.

So Brian uses the gold-to-oil ratio as a metric to assess near-term profitability of gold miners.

With oil prices falling and gold prices rising, Brian thinks gold producers are set to enjoy better margins.

He’s also buoyed by the fact that more miners are having an unhedged exposure to the gold price.

This week, Regis Resources took a short-term hit to close its hedge book. It cost $98 million, but Regis said all new sales are now exposed to spot gold prices.

In all, Brian is excited about the prospects for gold stocks in 2024.

And he’s happy to go on the pod next year to see how his outlook pans out!

Here’s to 2024 then.

Enjoy the episode!

Regards,

|

Kiryll Prakapenka,

Analyst and host of What’s Not Priced In

Kiryll Prakapenka is a research analyst with a passion and focus on investigating the big trends in the investment market. Kiryll brings sound analytical skills to his work, courtesy of his Philosophy degree from the University of Melbourne. A student of legendary investors and their strategies, Kiryll likes to synthesise macroeconomic narratives with a keen understanding of the fundamentals behind companies. He’s the host of our weekly podcast What’s Not Priced In where he and a new guest week figure out the story (and risks and opportunities) the market is missing to give you an advantage. Follow via your preferred channel and check it out!