How glib and easy the phrase ‘buy panic’ can sound when you hear it in the abstract.

It’s not so hunky dory when the financial system starts to look like a wheezy drunk with a bad leg…and you have to put your hard-earned money on the line.

And yet the best values are clearly when stocks get dumped indiscriminately. We can all remember 2020…what a time to go shopping that was!

I see a similar opportunity today.

I was buying last week. I’ll tell you the two stocks I picked up…and why.

Then I’ll introduce you to a third angle on this situation.

Let’s dig into the banking crisis first. You know about Silicon Valley Bank on the US West Coast and Signature on the east.

Between them, they have US$300 billion in assets out of the US$23 trillion US banking sector.

In other words, this is no Lehman moment. They’re too small.

However, former bank regulator Sheila Blair recently wrote that the powers that be are clearly worried that the rot runs deeper, judging by their actions.

US banks are believed to carry US$620 billion in bonds that are underwater.

This need not be an issue if they can hold them to maturity. Then they’ll receive the face value of the bonds.

Or now, the Fed’s created a new facility where they can swap these bonds for cash — but pay market rates for the privilege.

Much of what happens from here depends on what US depositors do.

Two analysts I respect give different takes.

One says the whole situation is overblown. US banks are fine…and we’ll all move on shortly. Another’s worried there really is the threat of contagion.

My inclination is to think the Fed and regulators will throw everything they can at it to make the problem go away.

I’m also intrigued by the following quote…it comes from a 1998 book that looked at some of the best years in US stocks up until that time.

Here’s the conclusion the writer found:

‘Stock prices begin at a depressed level, reflecting fears that inflation fighting central bankers will inflict more pain.

‘Suddenly a financial crisis reduces the price level to a secondary consideration. As the fed liquifies the system, the stock market quickly and radically adjusts to the changed circumstances.’

That was written 25 years ago. Could it happen again? I think it could.

That’s why I did some shopping. One caveat: The below are not recommendations for you. Merely what I did.

The first stock I bought last week was Abacus Property Group [ASX:ABP].

It’s a Real Estate Investment Trust (REIT).

REITs are copping another pounding lately after a horrible 12 months.

The market cap for Abacus is currently $2.6 billion.

Its assets, would you believe, are valued at around $5 billion.

Roughly 50% of these are in the Storage King self-storage brand and business, with the other 50% in commercial property (mostly offices).

Think about that for moment.

We can debate the future of the office, but without question its commercial portfolio is worth more than zero.

It also has around $260 million in another listed REIT called National Storage REIT [ASX:NSR].

Most of its debt is hedged and on a modest 2.6% interest rate for the moment. It currently pays a 7% yield.

It plans to float the self-storage assets in a separate REIT later this year.

Seems to me there’s a lot of margin of safety there, looking out to the medium term. I’ll tell you how I go in a year or so.

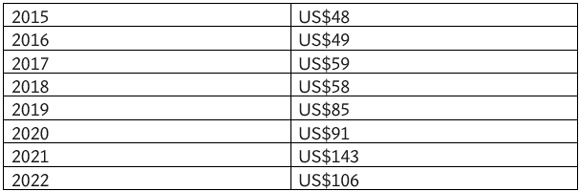

The second stock I bought was BHP [ASX:BHP]. Here’s a table I like to trot out every now and again. It shows the iron ore price going back to 2015:

|

|

|

Source: Rio Tinto annual reports |

Today, the iron ore price is trading around US$125–130. You can see how exceptional that is relative to previous years.

It will gush a river of free cash flow through iron ore miners while it continues. The Economist reports India is going through an infrastructure upgrade in scale only seen before in China.

BHP is also building a big presence in copper — a metal with extraordinary prospects in the next five years.

A single electric vehicle requires 83 kilograms of the stuff.

The above two ideas are, to my mind, fairly conservative. There’s a way to take on more risk and higher potential reward…

One effect of this current banking crisis is to cut off funding to riskier projects as banks become more conservative. Another group likely to suffer the same fate are investors.

Who does this have implications for? The junior resource sector. Suddenly, they might find themselves a little starved for funds.

In times like these, it’s great to have cash because they’re going to need it and will be more prepared (or forced) to offer value in return for it.

The energy transition isn’t going away because of a US technology bank unable to manage its interest rate risk. We still need copper, cobalt, and coal to run the world economy.

But suddenly, the smallest stocks on the market are on the floor because sentiment is so terrible.

Here’s what a fund manager recently said:

‘“There’s a lot of negativity out there. I don’t remember sentiment being this bad in the smaller end of the market in over 15 years. I’d compare it to the Global Financial Crisis at times,” he says.

‘“There’s just a complete lack of interest, particularly in the micro-cap end of the market.”’

He said that before the banking blow up.

How long before investors and other players start moving to take advantage of this?

Not long, by the looks of things.

Just this morning, gold producer Ramelius Resources [ASX:RMS] announced a takeover offer for gold speccy Breaker Resources [ASX:BRB].

And Australian Clinical Labs [ASX:ACL] is making a play for Healius [ASX:HLS].

What can I say? When sentiment and value are on the floor like this, the best and the brightest get active.

My colleague James Cooper is on the hunt for the super-small, speculative mining stocks to snatch up right before other investors take notice of them. If there’s one person that can find a high-potential stock even before drilling begins, it’s James.

You’ll find out more about his methodology, as well as how to become a part of his premium trading service, right here in The Daily Reckoning Australia over the next couple of weeks.

Stay tuned…

Best wishes,

|

Callum Newman,

Editor, The Daily Reckoning Australia