The Bubs Australia Ltd’s [ASX:BUB] share price are up 26% after BUB’s infant formula range goes live on Walmart.com.

BUB shares spiked as high as 32% in early trade. While pulling back somewhat in afternoon trade, the Bubs share price is still up a significant 26% at time of writing.

The US launch contributed to a positive few weeks for the premium infant nutrition firm, with the BUB stock up 45% over the last month.

Apart from the US launch, BUB’s recent performance was also supported by developments in China. The government of the key infant nutrition market replaced its two-child policy with a three-child policy.

Bubs launches into US formula market

The premium infant nutrition company today revealed the launch of its branded formula range on Walmart.com, the online platform of the world’s largest retail group.

The ‘Aussie Bubs’ range is expected to be available online from September 2021.

The initial launch range will consist of two products: Aussie Bubs Australian goat milk-based toddler formula and Aussie Bubs grass-fed nutritional milk-based toddler formula.

Further to the Walmart news, the company will now extend its products on Amazon AU to Amazon.com (US).

For context, infant nutrition peer a2 Milk Company Ltd [ASX:A2M] reported that its products are available at more than 12,000 retailers in the US.

This includes ‘big box stores like Walmart and Costco as well as your local grocery stores.’

BUB ASX outlook

The obvious question following BUB’s US launch is whether the news will trigger a sustained run-up in the Bubs share price.

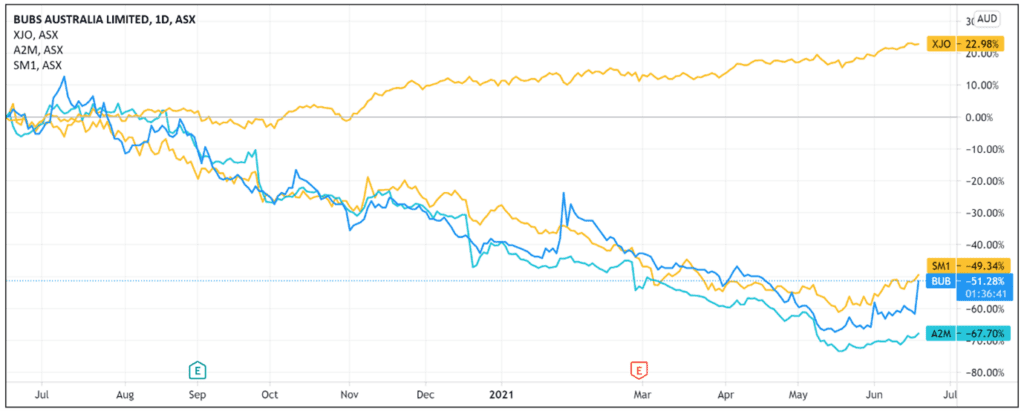

Despite today’s big jump, the infant nutrition stock has still dropped 50% over the last 12 months.

Bullish investors may be wondering if, by going live on Walmart.com and Amazon.com, Bubs can recoup those losses and return to its 52-week high of $1.115.

Citing Euromonitor data, Bubs reported that the US infant nutrition market is worth US$5.1 billion annually, with 93% of total sales being powder formulations.

The bullish case will rest on how much of that market Bubs can capture.

For instance, 1% of that US$5.1 billion is $51 million; 5% is $225 million.

For context, BUB posted $27.1 million in total revenue for the six months ended 31 December 2020.

So capturing even a tiny fraction of that US market could greatly boost BUB’s sales.

The question, however, is how difficult will it be to penetrate that market even at a small scale?

It pays here to look at A2M, a pretty good benchmark.

A2 Milk reported $34.2 million in 1H21 revenue from its US market, up from $28 million in 1H20.

Investors have certainly reacted very positively to today’s news, but whether Bubs can sustain the positive momentum will depend on how much of the new market it can capture and at what margin.

If you’re looking to navigate this wild and low-interest rate, I recommend watching Greg Canavan’s ‘Life at Zero’ presentation.

There are plenty of great insights, and he also shares his favourite stock for 2021.

Regards,

Lachlann Tierney,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here