Infant nutrition producer Bubs Australia [ASX:BUB] came out with another supplier update today, signing supply agreements with two more US retailers.

BUB shares rose as much as 5% on Monday morning before levelling off, trading up 2% in late afternoon.

Year-to-date, Bub shares are up 30%:

Source: TradingView.com

BUB: planes and supply deals

Another day, another BUB supply deal announcement.

Bubs has not been shy about publicising its role in helping the US resolve its baby formula shortage crisis.

As we covered earlier this year, BUB signed an emergency deal to supply the US with tins of baby formula, with the US FDA approving the immediate import of Bubs’ products.

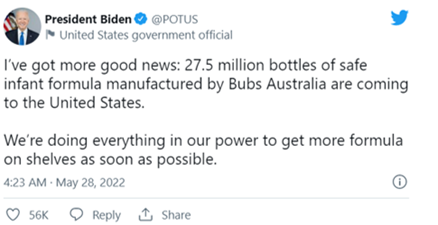

Even President Biden got involved, mentioning Bubs in an official POTUS tweet:

Source: Twitter

Since then, Bubs has released a steady trickle of ASX updates on the situation, from planes launching off with thousands of Bubs tins to agreements with US retailers.

Today, Bubs gave another such update featuring more planes stuffed with baby formula and more supply agreements.

The company announced it entered into supply agreements with two new retailers, H-E-B and Meijer.

H-E-B is a supermarket chain in Texas with 340 stores.

Meijer is a supercentre chain with 259 stores in the Midwest, including Michigan, Ohio, and Wisconsin.

As part of today’s announcement, Bubs also noted that a fourth plane holding 90,000 tins of its infant formula product is set to land in the US in two days with all stock presold.

Importantly, Bubs was ablet to quantify the financial impact of these cross-border flights.

The company said the 90,000 tins have a total gross revenue of about $3 million.

BUB approved for WIC program

Bubs also announced its products were approved suitable by the US government-run Special Supplement Nutrition Program for Women, Infants, and Children (WIC) in 22 US states.

The US Department of Agriculture describes WIC as:

‘The Special Supplemental Nutrition Program for Women, Infants, and Children (commonly known as the WIC program) serves to safeguard the health of low-income women, infants, and children younger than 5 who are at nutritional risk.

‘As the third largest food and nutrition assistance program, WIC served about 6.2 million participants per month in fiscal year 2020, including almost half of all infants born in the United States. Federal program costs for WIC totalled $4.9 billion in fiscal year 2020.’

As of 29 June, 22 US state agencies have authorised BUB infant formula products under the WIC program, ‘including California, which had the highest total number of births of over 419,000 in 2020’.

BUB’s outlook, tariffs, and overall US market

Bubs CEO Kristy Carr commented:

‘We are grateful for the opportunity to assist parents under the WIC Program.

‘As Bubs continues to replenish retailer shelves with up to six Bubs Infant Formula products, it is comforting that many more American parents will have the opportunity to access our clean nutrition that is and will continue to be available on shelves.’

While Bubs was pleased about the WIC announcement, it will be interesting to see how it works out financially, given the subsidies involved.

As the US Department of Agriculture noted about the WIC program (emphasis added):

‘WIC State agencies are legally required to enter into cost-containment contracts for the purchase of infant formula used in WIC.

‘After competitive bidding, WIC State agencies typically award a contract to a single manufacturer of infant formula for the exclusive right to provide its product to WIC participants.

‘In return, WIC State agencies obtain significant discounts in the form of rebates from infant formula manufacturers.

‘In fiscal 2018, infant formula rebates totalled about $1.7 billion and supported almost one in every four WIC participants.’

For Bubs, the recent US supply deal and the improving outlook of China’s market have been good news, leading to last month’s material guidance update.

The company revealed it now expects FY22 revenue to exceed $100 million, with 1H22 EBITDA to jump 100%.

When Bubs first broke the US supply deal news, in May it said it will provide ‘at least 1.25 million tins in the coming weeks and months’.

Using the $3 million per 90,000 tins as a very rough yardstick, Bubs’ expected gross revenue windfall could be at least around $42 million.

Now, it can be a challenge to find opportunities in the current market.

But there are still opportunities out there.

Our small-cap expert Callum Newman has a knack for finding them.

His latest report names three battery stocks that he believes have the potential to be the next ‘chosen ones’ for leading battery mineral supply partners.

You can find out more by reading the report ‘Elon’s Chosen Ones’.

Regards,

Kiryll Prakapenka,

For Money Morning