[ASX:BUB] is rattling the can to raise $68 million to support ‘growth opportunities.’

No — today’s announcement from Bubs is not about a new US supply deal.

Neither is today’s update about a new plane packed with tins of baby formula set for the US.

Today’s announcement is about BUB seeking to raise funds to accelerate growth.

BUB is set to issue 121.2 million new shares at an offer price of 52 cents per new share to raise $63 million.

Source: Tradingview.com

Bubs growth: $63 million equity raising

On Tuesday, Bubs entered a trading halt to announce an equity raising.

Bubs will hold a $63 million underwritten capital raise of fully paid ordinary shares at 52 cents a share.

The offer price represents a discount of 17.5% to the 5-day volume weighted average price of 63 cents recorded prior to the trading half on Monday.

The equity raising will be split into two parts, an institution placement of around 62.4 million new shares intended to raise about $32.4 million and a 1-for-10 pro-rata non-renounceable entitlement offer of new shares expected to raise $30.6 million.

Bubs anticipates around 121.2 million new shares will be purchased under the equity raising — 19.8% of Bubs issued capital.

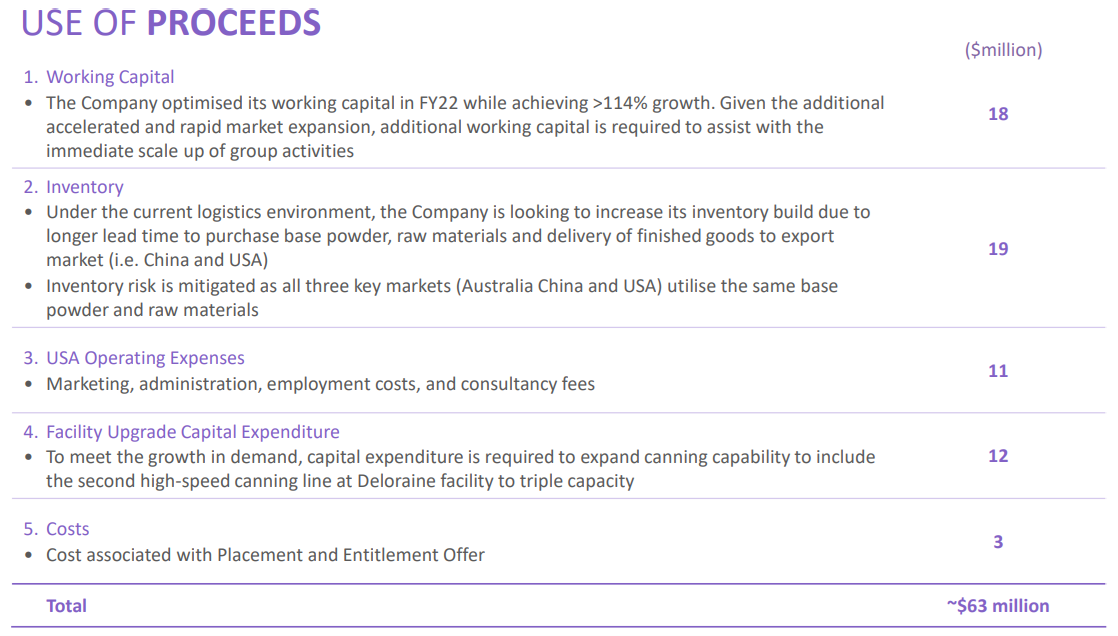

Bubs said that considering the recent and very abrupt ‘market expansion’ it will use the funds to scale-up group activities, build inventory, cover US-based operational expenses and install a high-speed canning line at Deloraine.

Source: Bubs

BUB’s outlook as US-focused growth really heats up

In its announcement today, Bubs reiterated the existing FY22 guidance.

FY22 gross revenue is expected to exceed $100 million and underlying EBITDA is expected to exceed $2.4 million.

Bubs said this will be its first year of EBITDA profitability.

However, some investors will likely have questions about the dilutive nature of the capital raise.

The new shares will comprise about 20% of BUB’s existing issued capital. That’s hefty.

Given that FY22 will be the very first year of EBITDA profitability, the big dilutionary capital raise may mean shareholders will have to accept a lower return on equity in the near term.

Inevitably, BUB did not pass on the opportunity to provide further detail on its US strategy.

In an investor presentation, Bubs provided volume forecasts for the US market.

Bubs said that in FY23 it is targeting gross revenue of $80 million to $140 million.

This is subject to an FDA temporary no-objection extension beyond November 2022.

Now, Bubs has been a bit of an anomaly in the current market conditions, finding in the US infant formula crisis a growth opportunity at a time when many producers and retailers are retrenching.

It can be a challenge to find opportunities in the current market.

But they’re out there.

Our small-cap expert Callum Newman has a knack for finding them.

His latest report names three battery stocks that he believes have the potential to be the next ‘chosen ones’ for leading battery mineral supply partners.

You can find out more by reading the report ‘Elon’s Chosen Ones’.

Regards,

Kiryll Prakapenka,

For Money Morning