The BrainChip Holdings Ltd [ASX:BRN] today released its March quarter results, showing a cash balance of US$20 million.

Brainchip share price is up as high as 3.3% in early trade before settling to trade at 60 cents a share at time of writing, up 1%.

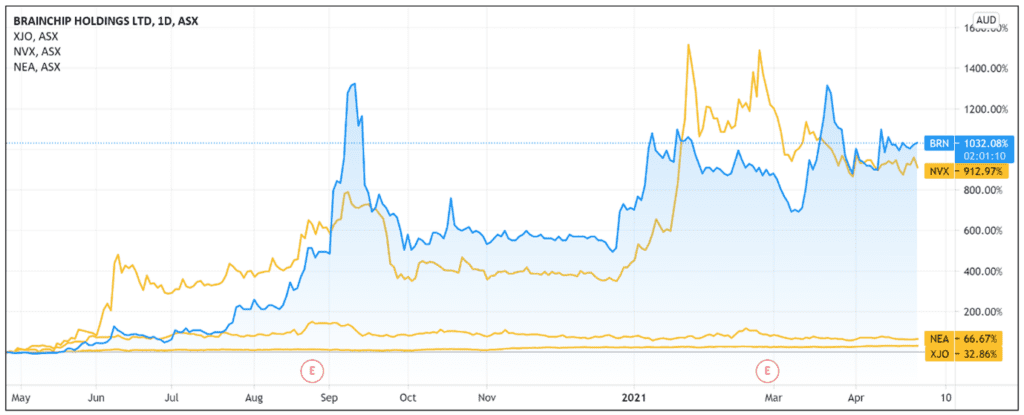

The AI stock had a steep rise in the last 12 months, having previously exchanged hands for as low as 5 cents last May.

Year-to-date, BRN’s share price is up 39% but over the last 12 months BRN gained 1,000%.

Did BrainChip’s latest quarterly indicate the stock is set for further gains?

Let’s examine:

Source: Tradingview.com

BrainChip begins manufacturing Akida AI processors

BrainChip caught the interest of investors last year for being an artificial intelligence (AI) business that develops computer chips that can process information in a similar way to a human brain.

This human-like processing ability could offer new, high-powered solutions to data-driven industries.

But as I’ve pointed out earlier this month, as with a lot of new technology, the challenge is getting the newfangled gadget into the hands of end users.

That’s why BRN’s shares spiked as much as 22% on 13 April when the AI company announced it commenced volume manufacturing its Akida AKD1000 neuromorphic processor chip for edge AI devices.

Leading semiconductor firm Taiwan Semiconductor Manufacturing Company (TSMC) began preparations to manufacture the processor at volume after receiving BRN’s engineering layout.

Mass manufacturing would take BRN closer to commercialising its Akido chips but with production units slated for testing this August, what was the company able to achieve this March quarter?

BraincChip’s March quarter results

In key highlights, BRN ended the March quarter with US$20 million in cash. This compared to US$19.1 million in the prior quarter, an increase of 4.7%.

BRN reported cash inflows from customers of US$1.12 million.

However, the company posted net cash outflows from operating activities of US$3.8 million. This was an increase of 40%.

BrainChip attributed the outflow increase to a ‘milestone payment’ of US$2.25 million to a ‘major supplier in advance of wafer fabrication for the production version of the Akida device.’

Contributing to the net cash outflows was US$1.08 million spent on research and development.

BRN reported that its estimated quarters of funding available came to 5.2 quarters.

BRN share price outlook: what next?

BrainChip pointed out that its design and manufacturing partner Socionext released the Akido chip engineering layout to TSMC subsequent to the quarter.

As today’s quarterly results demonstrate, BrainChip’s slim cash inflows from customer receipts need a boost.

Especially when it reported that it has an estimated 5.2 quarters of funding available as of the March quarter.

Therefore, I think the market will look closely at how the volume manufacturing of BRN’s Akido chip translates to customer receipts and sales.

Addressing this point, BrainChip noted that ‘production units are expected to be available for testing in the 3rd quarter.’

Investors will likely eagerly await the results of this testing.

No doubt, too, investors will likely wish to know how soon after testing production units can BrainChip roll out the Akido chips commercially.

To learn more about the growing AI industry and why it could accelerate in 2021, check out our free report.

There, we also analyse five promising stocks to watch. You can get your very own, free copy, right here.

Regards,

Ryan Clarkson-Ledward,

For Money Morning

Comments