Australia’s largest building and construction materials supplier Boral [ASX:BLD] has returned to its former glory with significant gains across most metrics in a challenging economic climate.

Boral also told shareholders it will continue raising the price of cement, gravel, and asphalt in the new financial year as soaring interest rates push down the construction of new homes.

Shares of the company were up by 8.12%, trading at $4.72 per share this afternoon, as the results understandably enthused investors.

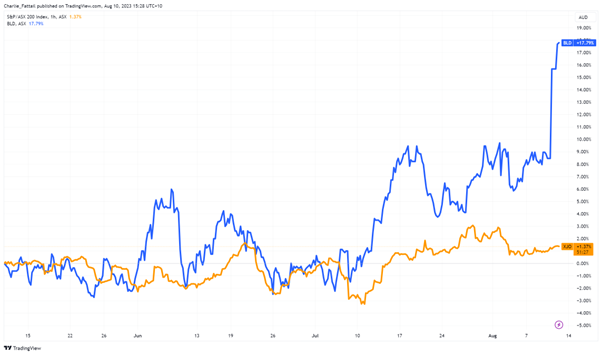

Boral has seen its share price rise by 63.28% in the past 12 months, outperforming the sector by almost 50% this year.

Source: TradingView

Boral’s FY23 results

Boral beat most expectations and guidance this year with a strong earnings report today.

The company’s net revenue rose 17% to $3.5 billion in the year to 30 June, while earnings jumped 38% to $454.4 million. Operating cash flow lifted 65.5% to $358.7 million.

However, Boral’s statutory net profit after tax came in at $148.1 million for the 2023 financial year, down from $150 million in the previous year. This also included a post-tax income of $977.6 million from the sale of its US business, Eco Material Technologies.

In other disappointing news for shareholders, the company will also not pay dividends this year.

Boral CEO Vik Bansal said he expects cost pressures to linger for the next 12–18 months, which the company will pass on to its customers.

However, he signalled that the increases wouldn’t be as sharp as last financial year.

‘There will be price increases because cost will increase.

‘I’m not saying the price is going to remain steady. All I’m saying is the rate of increase will slow down.’

Bansal said he was bullish about starting the new financial year and boasted about a solid project pipeline from the second half of the year onwards. About today’s results, he commented:

‘I am pleased to see Boral deliver a set of full-year results that show clear improvement across the entire business and point to the opportunities that remain ahead. We have seen volume growth across all our products, coupled with a disciplined approach to price, cost, and cash.’

Boral is a major supplier of construction materials in Australia. It operates more than 300 sites nationwide, making concrete, cement, quarrying stone, recycling construction waste, and processing asphalt and bitumen.

Outlook for Boral

Today’s results give shareholders and investors a good peek into a company that has successfully turned around many parts of the company.

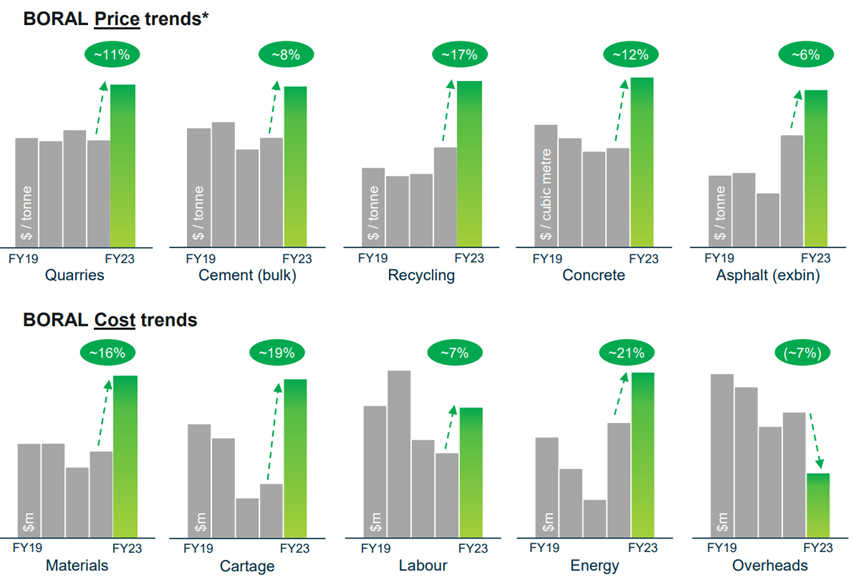

With the rising costs of inputs, the company implemented ‘long overdue’ price increases across all its products, shown here:

Source: Boral

Some may blame the company for sharp raises under the pretext for inflation but as the cost figures indicate, these were in line with rising costs.

With these increases, the company’s margins will allow it to withstand economic headwinds.

The company is facing a slowdown in the construction sector as interest rates rise and investment appetite declines.

New-home building approvals have fallen by 7.7% in June while higher-density building approvals have dropped by 21%.

Boral expects to deliver underlying earnings of between $270 million–300 million for FY24, assuming no major shifts in demand or prices — both are big assumptions in today’s market.

Regardless of the uncertainty, it’s clear that Boral is in a healthy position.

More than just growth

Uncertain times have made investors hunt for businesses offering more than just growth.

With the stock market starting to lose pace, maybe it’s time to change tactics.

Smart investors are focusing on quality stocks that can provide safety and pay dividends.

But only buying the dividend income earners could be a fruitless move beyond the short term.

That’s why our investing expert and Editorial Director, Greg Canavan, has spent his time finding the smart move.

He calls it the Royal Dividend Portfolio, and it’s the sweet spot between growth and dividends.

If you think you’re overexposed in uncertain times or simply too defensive with cash and bonds, you may want to consider a different strategy.

Click here to learn more about what that looks like.

Regards,

Charles Ormond,

For The Daily Reckoning Australia