At time of writing the Bod Australia Ltd [ASX:BDA] share price sits at 47.5 cents, up 10.47%.

The company recently announced a large increase in sales in the second half of 2020.

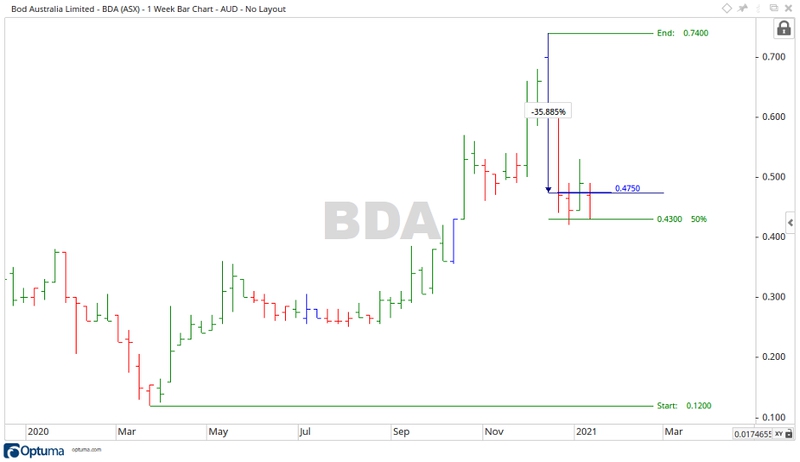

Source: Optuma

Huge increase in sales

Bod Australia are a medicinal cannabis company who produce the product MediCabilis.

Typically prescribed for chronic pain and anxiety.

Throughout 2020 the company moved ahead in leaps and bounds.

In February, the company launched their CBD products into the UK in conjunction with the Happiness Group.

March saw the company team up with Swisse Wellness here in Australia to unveil nine initial hemp seed oil products under the Swisse brand to be sold in Coles, Priceline, and Chemist Warehouse.

By November the company received a $1 million order from Italian company H&H for Swisse-branded hemp seed oil products, to be sold in over 4,000 pharmacies across Italy.

BDA recently announced an incredible increase in sales of their MediCabilis product for the second half of 2020:

- 3,941 MediCabilis™ prescriptions filled during H2 CY2020 — 91% increase on H1 CY2020 (H1 CY2020 prescriptions: 2,063) and 114% increase on PCP (H2 CY2019 prescriptions: 1,844)

- Bod has now filled over 8,000 MediCabilis™ prescriptions since July 2019

- Repeat prescriptions accounted for 62% of H2 CY2020 volumes outlining patient satisfaction

- Ongoing growth expected across coming quarters — upward trajectory in prescription volumes set to add to Bod’s growing revenue

Discover our top three ASX-listed pot stocks in 2021. Click here to learn more.

Bod Australia share price

Like most shares this last year, Bod Australia fell into the March low due to COVID-19 but recovered well to move up to a high of 74 cents in December.

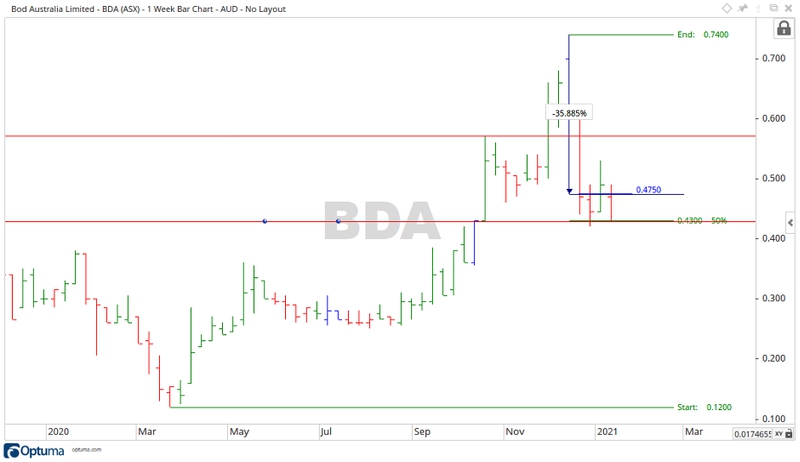

Source: Optuma

In recent weeks the share price fell to 42 cents, a 50% retracement from the high before moving up to trade at 47.5 cents at the time of writing.

Moving up from a 50% retracement is generally a sign of strength.

Should the move up continue, then the level of 57 cents may become the focus.

If it falls back again, the 50% retracement level of 42 cents could be tested again.

Source: Optuma

Today more countries than ever have legalised cannabis.

The field of medical research into the uses of cannabis is only getting larger and shows no sign of slowing down.

The global cannabis market is expected to grow to US$44.4 billion by 2025.

For Bod Australia there is a lot of space to grow in the global market.

While the share price took a dip recently, it may just be one step back to take many forwards.

One for the watchlist.

Regards,

Carl Wittkopp,

For Money Morning

PS: Aussie cannabis boom — Discover why the Aussie cannabis market is ready again for long-term growth and how you can capitalise. Click here to learn more.

Comments