Australian booker platform BlueBet Holdings [ASX:BBT] has released its Quarterly Cash Flow and Activities Report for the quarter that ended 31 December 2022, announcing a rise of 6.6% in turnover to a total of $147.7 million.

The company continues its quest to gain market share in Australia while further infiltrating the US, launching in more cities, and upping product and software investments as a new competitor enters the arena.

In its most recent update, the online booker says it has increased its Australian competition, hiking up Active Customers by 32.3%.

Today the betmaking platform’s stock was slipping down 1.5%, tracking at a loss of 4% in share value.

BBT has decreased in share value by 66% over the course of the last 52 weeks, tracking similarly to PointsBet Holdings [ASX:PHB], also down 67% in the past year.

Source: Tradingview.com

BlueBet Q2: Turnover up, wins down

BlueBet, an Australian wagering operator self-funded since it came into existence in 2025, has a strong growth record.

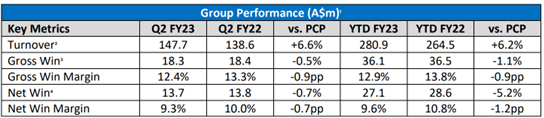

This morning it presented the latest in its Q2 operations, reporting $147.7 million in Group Turnover — up from $138.6 million at the same time last year.

Year-to-date, the total for Group Turnover is at $264.5 million, up 6.2% year-on-year (YoY).

Group Gross Wins were down slightly by 0.5%, with the company churning $18.3 million as opposed to Q2 2022’s $18.4 million.

The booker’s Group Gross Win Margin dropped 0.9pp in Q2 last year, from 13.3% to 12.4%, and also dropped 0.9pp for year-to-date metrics, YoY.

BBT’s Net Wins saw a 0.7% decrease compared with Q2 2022, down to $13.7 million.

Net cash used from operating activities in the quarter came to $6.6 million, said to have been driven by seasonality and front-end marketing spending in response to ‘a new competitor entering the Australian market.’

Source: BBT

BBT increases spending but believes in funds

BBT may have slipped in some metrics but refused to be discouraged, claiming it achieved group quarter-on-quarter growth in its key metrics ‘despite increasing investment in marketing, promotions and pricing in Q2.’

The group expects promotional activity to settle for the second half, with product enhancements to add to the customer retention drive.

BlueBet has reinvested returns from its marketing spend in FY22, including product improvements, as well as its BlueBet Global Platform, launching mid-2023.

The company believes these investments will allow it to scale ‘efficiently’ in both Australia and the US, to better manage administration, results, pricing, and risk.

On 31 December 2022, the Company’s cash balance was $32.2 million, including customer deposits of $3.7 million.

BBT says this is enough to fund further objectives and planned activities this year.

Betting on bargain stocks

2022 was a challenging year — no argument there.

With some effects of the pandemic still lingering, we were handed an influx of new challenges — inflation, war, continually rising rates…

The hard yards aren’t quite over yet, which is why everyone is looking to save a pretty penny where they can.

And it’s in times like these that some real ASX stock bargains can emerge — if you know where to look.

Our small caps expert Callum Newman has done the hard work for you.

He’s found five of what he calls ‘the best stocks to own in Australia’ right now.

And the best part is, right now, they don’t even cost that much.

Click here to discover Callum’s top five Aussie bargain stocks.

Regards,

Mahlia Stewart,

For Money Morning