Mobile-betting platform Bluebet Holdings [ASX:BBT] released its FY22 annual results earlier this morning, declaring ‘significant strategic progress’ for the year.

Despite its positive take on FY22, BBT shares were down more than 10% in late Tuesday trade.

Year to date, BBT is down 70%.

Peers Pointsbet Holdings [ASX:PBH] and Betmakers Technology Group [ASX:BET] are both down 50% year-to-date, with BET shares some of the most shorted shares on the ASX.

Source: www.tradingview.com

Bluebet provides full-year 2022 results

This morning, BBT released its FY22 results, highlighting market share growth in Australia and the US.

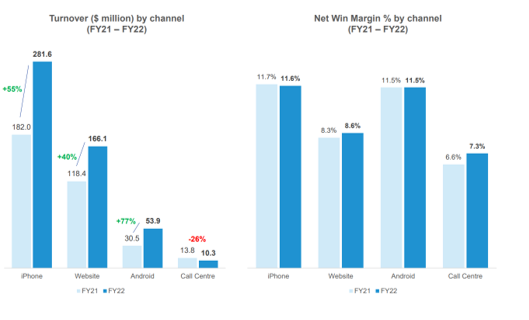

The wagering stock reported a rise in total turnover of 48.5% on the previous year, totalling $512 million.

Wagering Revenue (Net Wins) rose 53.5% from $35.6 million in 2021 to $54.6 million.

Gross profit rose 48% to $27 million.

That means BBT’s gross profit margin based on total turnover was about 5.2%. It was 5.3% in FY21.

Despite the top line growth, EBITDA sank a material 215% to a loss of $5.5 million.

Net loss after tax was $6.3 million, a swing from a net profit of $3 million in FY21.

Source: BBT

Bluebet emphasised that since its mid-2021 ASX listing, it hit its prospectus’ key focus areas.

Net Win margins expanded 10.7% due to ‘strength of trading teams and disciplined approach to managing promotions’ and higher returns were achieved in growing brand awareness, with Annual Customer Value to Cost to Acquire First Time Depositor ratio more than doubling.

BBT’s ClutchBet brand has been launched in Iowa and the company now has access to markets across four US states.

BlueBet’s CEO, Bill Richmond, commented:

‘I am very proud of the progress we have made in our first year as a listed company, having achieved a number of major strategic milestones, including touching down in the US, developing a leading technology platform and continuing to grow our market share in Australia.

‘Our IPO provided us with the financial firepower to invest for growth. With our US B2C brand ClutchBet now live in the US, having taken our first bets in Iowa in this month, we are committed to executing the first stage of our differentiated “Capital Lite” US strategy. The strength of our technology and our team is now on display as we move towards our B2B Sportsbook-as-a-Solution model in FY23.

‘We have demonstrated our ability to grow a challenger brand in Australia while delivering strong margins and generating cash, which separates us from many of our competitors. We will continue to deploy our capital in a disciplined way as we grow.’

Source: BBT

BBT’s betting tech versus battery tech

Bluebet has been pouring money into technology and marketing, particularly in chasing coverage across four US states.

Its recent marketing campaign drove Active Customers up 64.2%.

‘We know that in order to keep attracting bettors in Australia and in the US we must continue to invest in our technology to provide a seamless user experience’, said BBT Chairman Michael Sullivan.

‘Looking ahead, as we move further into an uncertain macroeconomic environment, we expect our business to remain resilient and to continue to deliver growth and take market share. Having been in this game for almost five decades, I have been through several of these cycles and I am confident in the robustness of the market in Australia and abroad.’

BBT said its Australian business was ‘well positioned for continued growth in FY23 driven by increased marketing investment’, with US market entry ‘on track’.

Now that’s betting technology, but what about battery technology?

The world is hastening the adoption of EVs.

But EVs require tonnes-upon-tonnes of lithium, copper, nickel, and graphite.

Lithium stocks appear to have had their time in the spotlight, with much of the easy money having rushed in.

But is truly over?

Our small-cap expert, Callum Newman, has found three battery material stocks that suggest it isn’t.

Click here to read about ‘Elon’s Chosen Ones’.

Regards,

Kiryll Prakapenka