Afterpay and Square parent company Block Inc [ASX:SQ2] shares fell by 10.16%, trading at $104.48 per share, as it reported an operating loss for the quarter and saw its gross profit slow from its Q2 trends and missing analysts’ expectations.

The company saw healthy growth in its banking and POS-related businesses, with Square and Cash App seeing a solid increase in revenue.

However, Afterpay’s buy now, pay later (BNPL) platform struggled globally as consumers hesitated to make larger purchases or take on debt in uncertain market conditions.

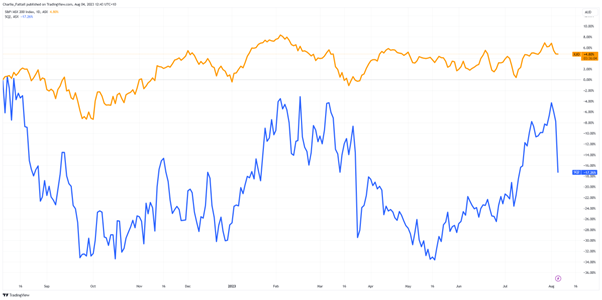

Trading in the past week has wiped out all gains the company has seen on the ASX, with Block now down 17.13% in the past 12 months.

Source: TradingView

Macro headwinds slow Afterpay

Block Inc saw its shares fall by 10.16% today despite reporting better-than-expected Q2 results and upping the full-year profit forecast.

SQ2 reported an adjusted EPS of 39 cents on net revenue of $5.53 billion — up 26% YoY.

Its second-quarter results show it made a $1.87 million gross profit. Most of this was from its banking products and payment apps, which showed resilient growth.

Financial services platform Square reported a $167 million gross profit — an increase of 24% YoY.

While its popular US-focused phone application, Cash App, made a gross profit of $968 million — up 37% and beating expectations.

Both of these results were the strongest the company has seen in the last 15 months, but investors’ concerns were focused on rising costs and its net profit outcomes that were not as rosy.

The payments business made a net loss of $132 million in the quarter, a significant drop from the $6 million loss in the first quarter of 2023.

Following Q2 performance, the company expects full-year adjusted EBITDA of $1.5 billion, up from the forecasted $1.36 billion.

Block has faced pressure since becoming the target of short-seller research that accused the company of facilitating criminal activity on its Cash App and fake accounts bolstering its user numbers.

Block denied the allegations and has held firm to its plans to bring Cash App to Australia in a move seen as a significant disruption to the big banks.

The app will offer a broader range of financial services to Australian users, such as buying Bitcoin [BTC] and the Afterpay BNPL service, which Block acquired in 2021.

But the parent company admitted it faced maco-economic headwinds with the Afterpay service, announcing it would shut its buy now, pay later (BNPL) operations in France, Italy, and Spain.

Block co-founder and former Twitter head Jack Dorsey admitted these problems in the shareholder meeting, saying:

‘These markets have not seen the growth and profitability we had expected over the past several years

‘We see an opportunity to shift these resources towards strategic areas that have a higher potential return on investment.’

On the same call, Block Chief Financial Officer Amrita Ahuja highlighted Australia as being a particularly challenging market for the company, saying:

‘From a geographic perspective, what we’ve seen is some of those macro-related headwinds — which are more pronounced in Australia — in the second quarter.‘

Outlook for Block Inc

Overall, Square’s Q2 results showed a mixed performance, with some metrics beating expectations and others falling short.

Investors may have reacted negatively to the deceleration in gross profit growth and the slightly lower-than-expected gross payment volume.

However, the company’s raised guidance for adjusted EBITDA and adjusted operating income may have provided some positive outlook for the future.

The company seems to be expanding its market position in the US and Australia, but whether this can translate into net profit will be the focus for investors as costs seem to rise faster than gross profits.

If Block can overcome the controversy surrounding Cash App and build stronger know-your-customer (KYC) practices, its growth into countries like Australia could herald stronger results.

The app’s expansion could recover its Afterpay BNPL services and even capture broader demographics as we see the rise of older generations using the service in Australia.

Source: Finder

Block Inc’s strategy of acquiring customers onto its app could pay off as its young users mature, grow their incomes and increase their borrowing needs in the future.

Companies like Amazon have illustrated that market share is king in competitive sectors.

It will just have to ensure that it can control costs in the future to generate margins without running into any regulatory walls along the way.

Window of opportunity

Before you go, I wanted to show you a recent presentation by our veteran trader, Murray Dawes.

Murray has the experience and patience to know when to pursue great trades.

He has had a 33% average portfolio return since 2018 and is known for waiting for the perfect time to move.

And he’s just spotted an opportunity to pick up bargains he thinks don’t come around too often.

He’s dubbed it Window 24.

Murray isn’t a fast and loose trader but a meticulous reader of charts and manager of risk.

So when he thinks there are buying opportunities, it’s worthwhile to listen.

You can check out Murray’s ‘Window 24’ presentation here.

Regards,

Charles Ormond,

For Money Morning