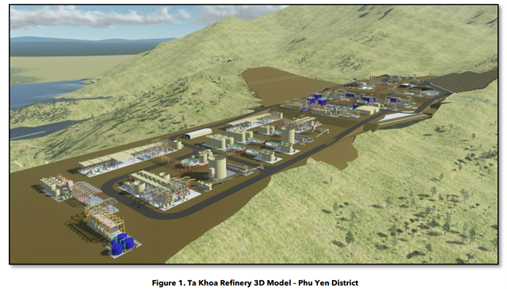

Blackstone Minerals [ASX:BSX], explorer of Southeast Asia’s premier nickel sulphide district, completed the Ta Khoa Refinery piloting programme for its flagship Ta Khoa nickel-copper-platinum project just over a month ago.

Today, the company wished to provide an update on the project’s optimisation, as well as off-take engagement, as the group progresses negotiations with prospective partners and looks for ways to enhance its development strategies in Vietnam.

BSX was trading at 15 cents a share early on Friday afternoon, the minerals stock having climbed 15% in 2023 so far: however, it’s down 67% since March last year:

Source: TradingView

Blackstone: Ta Khoa strategies and partners

BSX said that with the completion of its piloting program, further critical milestones progress through talks with prospective technology and offtake partners.

The company also provided a brief development strategy update for critical activities encompassing four main areas: partnerships, multi-project strategies, permitting and community.

BSX reported five groups visited the project site in 2022, as part of due diligence protocols. Visits included meetings with government representatives, other financial institutions, regulators, and important stakeholders.

Potential partners were reportedly intrigued by the multi-product strategy, which uses flexibility in nickel and cobalt sulphate products simultaneously with cathode-active material qualification processes.

Combined, these strategies are expected to provide secure cash flow during the project’s ramp-up phase.

BSX noted its multi-strategy had attracted several more downstream players, who were particularly drawn in by short-term nickel sulphate offtake deals.

Blackstone’s Managing Director Scott Williamson said:

‘Blackstone continues to deliver major project milestones to progress development of the Ta Khoa Project. Completion of the pilot program, dossier submission and commencement of major permitting activities are great examples of our team’s commitment to drive the project forward. The Project development strategy has matured, driven through partnership collaboration. Incorporating a multi-product strategy and staging opportunities into the design has brought increased interest from prospective partners, and de-risked the projects pathway to cashflow. This is an exciting time for Blackstone as we continue our ambition to develop the greenest and most resilient nickel business in the world.’

Source: BSX

Pushing battery mineral strategies at a critical time

Blackstone Minerals remains focused on improving battery metals processing in Vietnam to capitalise and assist in Asia’s growing lithium-ion battery industry.

Strategy success will depend on BSX’s ability to obtain nickel concentrate through Ta Khoa, especially with several exploration targets still to be tested.

BSX reported new initiatives are rolling out in Europe and seemed excited by its unique position with the existing Free Trade Agreement (FTA) between Vietnam and the EU.

Blackstone said it looks forward to developing relationships established in 2022 and is working closely with advisors to ensure ‘the right partner’ will be chosen to provide the best outcomes for its shareholders.

Blackstone stated:‘As we start 2023, Blackstone will continue to focus on critical path items while limiting spend in this current market environment. With the completion of the Refinery pilot program and integration of learnings into the Ta Khoa Refinery flowsheet, focus will convert to completion of the Ta Khoa Refinery DFS. Test work and piloting for the mine and concentrator will continue, with completion expected in Q2 2023.

‘BPNM is also assessing additional nickel sulphide exploration opportunities in northern Vietnam.’

Australia’s next commodity boom

Speaking of critical metals, our resources expert thinks the Australian resources sector is set to enter a new era based on the world’s transition to carbon-emission-free energy.

It could be an era that paves the way for commodity corporations to make big gains, just like Fortescue Metals when it struck gold — well, iron — the last time around.

James Cooper, trained geologist turned commodities expert, is convinced ‘the gears are in motion for another multi-year boom in commodities’…and the best part is that Australia and its stocks are in prime position to reap great benefits.

You can access a recent report by James on exactly that topic AND access an exclusive video on his personalised ‘attack plan’ right here.

Regards,

Mahlia Stewart,

For The Daily Reckoning Australia