Word choice has a subliminal, yet powerful influence over our collective thinking.

Peers in the British Empire knew this when they bestowed upon each other the honorific title of ‘The Right Honourable’.

The tradition carried over to Australian politics.

With members of federal and state parliaments being referred to as ‘The Honourable’.

According to the Merriam-Webster Dictionary, the definition of ‘honourable’ is:

‘…deserving of respect or high regard’.

A meeting of politicians who satisfy this definition could be held in a telephone box.

The more fitting title for the (vast majority of the) political class would be ‘The mostly wrong and Dishonourable’.

But for the sake of community confidence, the protocol of deception is retained.

Speaking of deception, let’s get to the topic of today’s Daily Reckoning Australia…the BitCON…no that’s not a spelling mistake.

The fraudsters who set-up the crypto scam were very clever in their word choice…cryptocurrency.

According to the Merriam-Webster Dictionary, the definition of ‘currency’ is:

‘…circulation as a medium of exchange’.

This stuff was not and NEVER, EVER will be a medium of exchange.

Yes, a couple of fourth or fifth world countries (run by despots) tried to introduce BitCON as a medium of exchange, but even their poorly educated citizens were smart enough to figure out this stuff is useless in the real world…where, like it or not, love it or loathe it, fiat currency is the only medium of exchange.

Yes, in the real world, the fiat money game is rigged.

A bunch of ‘The mostly wrong and Dishonourable’ elected and unelected officials stack the deck in favour of themselves and their political benefactors.

However, if you want to buy groceries, pay taxes, make a loan repayment, fill up your car, pay your power bill etc. — all the things we do in the real world — you need a medium of exchange the government agencies and service providers will accept.

Cryptos ain’t it.

The more apt description of what crypto is can be found in Wikipedia under…‘Gambling Chip’:

‘Money is exchanged for tokens in a casino at the casino cage, at the gaming tables, or at a cashier station. The tokens are interchangeable with money at the casino. Generally they have no value outside of the casino, but certain businesses (such as taxis or waiters—especially for tips) in gambling towns may honor them informally.’

You can see why calling it what it is, ‘Crypto Gambling Chip’, kind of takes the (unwarranted) legitimacy inferred by ‘cryptocurrency’.

But a gambling chip it is.

You trade fiat (Australian, US, Canadian dollars, euro, pounds, yen, etc.) for tokens. The tokens ONLY have value within the ‘casino’…maybe a pizza shop or café might accept payment, but nothing of real-life consequence (other than ransomware, drug deals, or terrorism) can be exchanged for this stuff.

If you want to cash out, you have to go to the cashier and get the folding stuff your nation State recognises as a medium of exchange.

And, in the US, with the failures of Silvergate Bank and Signature Bank, finding a cashier (bank) is getting a little harder.

Not to mention this ‘helpful guide’ issued by the Fed and other US regulators to US banks:

|

|

| Source: US Federal Reserve |

If you’re a US bank and want to stay on the good side of the regulators, it would be wise to steer a wide berth around anything to do with cryptos.

Bitcoin is the latest in a long list of failed experiments

While Bitcoin captured the imaginations of those wanting to be freed from the shackles of the centralised money system controlled by corrupt officials, it’s only the latest in a long line of ‘alternative currency’ experiments that started back in the 1970s.

To quote from Finn Brunton’s 2019 book, Digital Cash: The Unknown History of the Anarchists, Utopians, and Technologists Who Created Cryptocurrency:

‘…you now have a history of digital cash, utopian computing projects, and the precursors of contemporary cryptocurrencies in mind: the earliest experiments with “objects made in new ways,” blinded e-cash, the CryptoCredits of BlackNet; hashcash and bit gold, RPOW and b-money; Extropian idea coupons and thornes and hayek note sketches; libertarian coinage and certificates and digital gold currencies; and, finally, the initial version of Bitcoin and its chains of digital signatures. You have a sense of the challenge of creating different kinds of digital media objects that can prove, certify, and authenticate themselves…’

What do all these ‘currency’ iterations have in common?

They all failed…and, yes, that includes Bitcoin.

Why?

Because Bitcoin [BTC] and Ethereum [ETH] cannot be applied commercially.

In September 2022, Molly White, a software engineer, researcher, and a writer, gave a guest lecture at the University of Texas at Austin, titled:

|

|

| Source: University of Texas |

To quote from the lecture (emphasis added):

‘There’s a pretty long list of cons when it comes to blockchains. They’re really slow. They’re really, really slow. Bitcoin does, I think it’s seven transactions per second. Which is nothing compared to Visa or very similar systems. Ethereum’s a little faster, but not much. And so when you’re talking about using this at the web scale, you start to run into problems with speed. It’s also very expensive.’

This is why, after more than a decade, cryptos are nothing more than gambling chips, being used in a…

Rigged casino

When ‘Scam’ Bankman-Fried and his FTX exchange imploded last year, this left only one crypto casino standing…Changpeng Zhao’s (CZ to his mates) Binance.

In January 2023, CoinDesk alerted us to just how much market share Binance now has:

|

|

| Source: CoinDesk |

According to the article (emphasis added):

‘Binance’s market share of bitcoin (BTC) trading volume rose to 92% by the end of 2022, according to Arcane Research.

‘The exchange’s market share was just 45% at the start of last year, but the elimination of trading fees in June, not to mention the collapse of rival FTX in November, served to push users to Binance, which is the world’s largest crypto exchange by trading volume.

‘“No matter how you look at it in terms of trading activity, Binance is the crypto market,” Arcane wrote. “After lifting trading fees for its BTC spot pairs this summer, Binance completely overtook all market share in the spot market.”’

‘Binance is the crypto market’…thank Heavens the company has impeccable ethics and business practices…

Just kidding.

On 27 March 2023, the US Commodity Futures Trading Commission (CFTC) issued this Press Release:

|

|

| Source: CFTC |

Here are a couple of screenshots from the CFTC legal action:

|

|

| Source: CFTC |

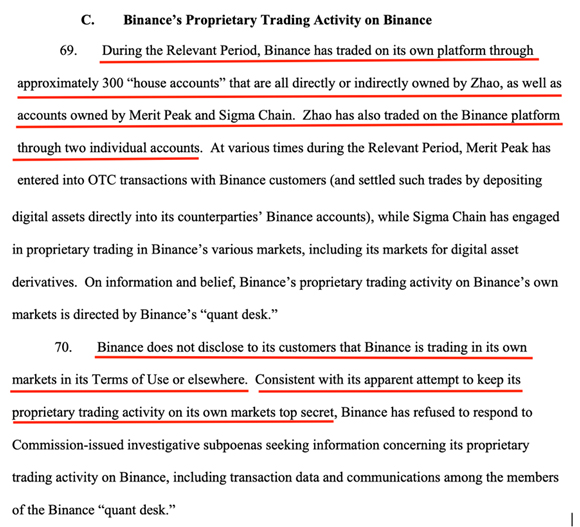

|

|

| Source: CFTC |

CZ is being accused of rigging the game by using approximately 300 ‘house accounts’.

Naturally, he pleads ‘not guilty’.

The CFTC accusations continue (emphasis added):

‘…does not sufficiently contest the presence of possible sources of fraud and manipulation in the bitcoin spot market generally that the Commission has raised in previous orders. Such possible sources have included (1) “wash” trading, (2) persons with a dominant position in bitcoin manipulating bitcoin pricing, (3) hacking of the bitcoin network and trading platforms, (4) malicious control of the bitcoin network, (5) trading based on material, non-public information, including the dissemination of false and misleading information, (6) manipulative activity involving the purported “stablecoin” Tether (USDT), and (7) fraud and manipulation at bitcoin trading platforms.’

Maybe, just maybe, the exhaustive discovery process the CFTC conducted prior to launching legal action was a case of ‘misunderstanding the facts’.

But given the history of scams, pump, and dumps, ‘wash’ trading and the not-so-honest characters attracted to this casino, you have to think ‘where there’s smoke, there could be fire’.

Yes, I know the BitCON price has been going up, so why worry?

Well, the question is ‘why is the price going UP’?

As reported in Almost Daily Grant’s on 11 April 2023 (emphasis added):

‘Bitcoin logged a bullish milestone today, blowing past the $30,000 mark for the first time since June of last year. The pre-eminent digital ducat has now nearly doubled in the year-to-date, while enjoying a snappy 50% advance from its mid-March lows despite the demise of key industry cogs like Signature Bank and Silvergate.

‘Digital intelligence platform Santiment identifies another potential driver. Yesterday, the top 11 largest bitcoin transactions all featured 2,000 tokens moving from existing on-exchange addresses to brand new off-exchange ones, with that combined tally of 22,000 bitcoins equivalent to just over $700 million at current prices. Eight of those trades took place at precisely 17:28 UTC (1:28 EDT), with the other three occurring 57 minutes later. “This is certainly not normal behavior,” the Santiment team concludes.’

I’m not sure how much more evidence is needed to convince the crypto faithful that their utopian dream is a sham and scam.

The list of failures, frauds and fines is extensive:

Quadriga CX

Bitfinex

Tether

Celsius

Luna

Three Arrows Capital

Voyager

FTX

In the wake of the blatant fraudulent behaviour, US lawmakers and regulators (Department of Justice, Securities Exchange Commission (SEC), CFTC, and the New York Attorney General) are stepping up enforcement efforts.

I know the true believers will say ‘yes, that just proves the system is rigged’.

Maybe it is. But it is no less rigged or centralised than the Crypto Casino.

Where the power to set the price and print tokens is held in the hands of a few powerful whales.

Everything the cult members hate about fiat is in existence in cryptos.

But there are TWO HUGE differences.

Firstly, fiat is the medium of exchange needed to function in the real world.

Secondly, if a bank holding your fiat money collapses, there’s a government guarantee to fall back on. Whereas if your crypto exchange fails or is hacked or the operator shuts up shop and heads to Montenegro with your coins, you got diddly squat.

And…

Finally some good news for crypto lovers

This is the last article I intend to write on this rubbish.

If, after all the data that’s out there and the news coverage of the SBF and others is not enough for the lights to go on and to motivate you to get out while you can, then nothing is going to convince you.

However, I do make one request.

When the whole thing fails, like all the previous experiments have, DO NOT go off to the regulators claiming to be a victim or lobby your ‘mostly wrong and dishonourable’ member of parliament to ‘do something, anything, to make you whole again’.

Regards,

|

Vern Gowdie,

Editor, The Daily Reckoning Australia