Bitcoin was hovering around US$62,000 at time of writing. Levels not seen since Trump won the presidency in 2024.

You probably missed it, as the drop was overshadowed by a far larger fall in precious metals.

Still, as my colleague Murray Dawes pointed out earlier this week in his ‘chart of the day’, the leading crypto is currently teetering.

Source: TradingView – Murray Dawes

[Click to open in a new window]

Strange timing, given the US now enjoys its ‘most pro-crypto president ever’.

Now I’m certainly not blaming crypto’s woes on Trump.

The recent sell-off was seen as a response to the nomination of Kevin Warsh.

Warsh, like Treasury Secretary Scott Bessent, is a Druckenmiller acolyte, one of Wall Street’s legendary investors.

Stanley Druckenmiller, in recent interviews, has dismissed claims about Warsh’s past as a ‘policy hawk’ (meaning he favours higher interest rates).

‘I’ve seen him go both ways,’ Druckenmiller told FT this week.

And this is a man who’s called Bitcoin a ‘sustainable store of value,’ and the ‘new gold‘ for anyone under 40.

So why isn’t Bitcoin surging?

The Trust Collapse

We often underestimate how much of the modern economy runs on trust.

Trust in central banks to preserve the buying power of currencies. Trust in governments to honour their commitments.

For much of the last century, developed markets were considered trustworthy.

That trust appears to be eroding.

Sweeping tariffs that rattled global trade. Mounting debt in the West.

Questions swirl about the Fed’s independence as the administration pushed to put its stamp on monetary policy.

These are symptoms of a slow erosion of the institutional trust that underpins global markets.

Gold and silver have responded accordingly. Both are among last year’s top-performing assets.

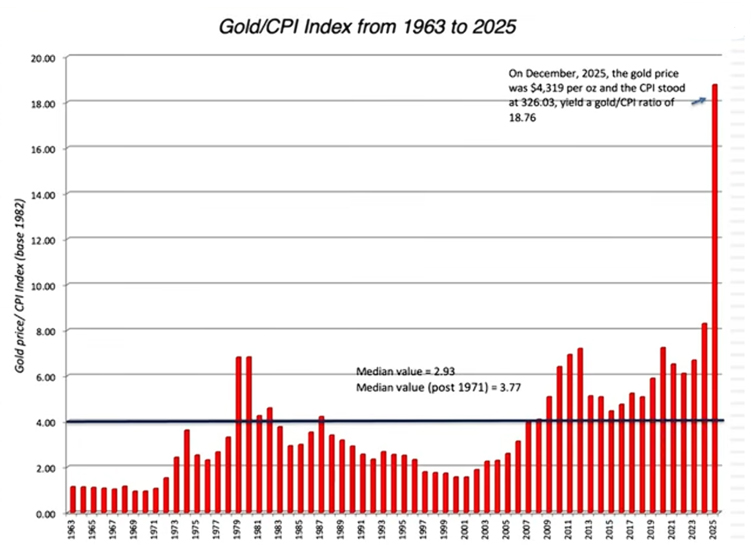

Just take a look at this chart below. Measuring gold relative to CPI (inflation) has been a traditional yardstick for judging gold as an inflation hedge.

By December, things had moved well outside of historic norms.

Source: Aswath Demodaran

[Click to open in a new window]

To me, this points to two things. First, obviously, things got out of hand in the precious metals market. Speculative bubbles aren’t new.

But second, the market is not reacting to today’s inflation but to the fear of what comes next.

Debt, and the temptation to inflate it away.

But Bitcoin? The so-called ‘digital gold’, with its resistance to inflation, is struggling. Why?

A Tech Stock in Disguise?

Here’s the uncomfortable truth: Bitcoin isn’t behaving like gold at all.

Thanks to big institutions now in the crypto market, BTC is behaving more like a volatile tech stock.

This is because big institutional investors trade around risk. When the VIX (volatility index) rises to high levels, their algorithms kick in, selling stocks, commodities, and BTC to reduce portfolio volatility.

Back in 2021, Bitcoin’s correlation to equities was only 0.15. Now, Bitcoin has steadily moved closer in lockstep to the US indices, with a ~0.8 correlation.

Source: Bezinga

[Click to open in a new window]

When big tech rallies, Bitcoin rallies. When tech sells off, Bitcoin follows.

That’s a problem for anyone who bought Bitcoin as a hedge against institutional chaos or as a diversification play.

But the story may not end there.

That correlation trend says more about the structure of global liquidity than about Bitcoin itself.

When the same capital flows drive both tech stocks and crypto, assets start to move in sync. Not because they share fundamentals, but because they share funding conditions.

Think of it this way. A rising tide lifts all boats. But that doesn’t make a speedboat and a sailboat the same vessel.

The real question is how these correlations behave once liquidity shifts. That’s usually where the underlying character of an asset shows up.

And liquidity is about to shift.

Reading the Warsh Tea Leaves

The Warsh nomination is a case in point.

Reading the tea leaves of his past speeches, I’m expecting two things to change:

- The Fed will likely see interest rate cuts in the near term (liquidity rises)

- A steady reduction of the Fed’s balance sheet (liquidity tightens)

Near-term rate cuts are likely a tailwind for Bitcoin because they ease financial conditions and lift liquidity. But an ongoing reduction of the Fed’s balance sheet is a countervailing headwind.

If strong enough, that could cap or even offset those gains by draining liquidity. So, Bitcoin’s performance will hinge on which force dominates.

As 10x Research founder Markus Thielen put it:

‘Markets generally view a resurgence of Warsh’s influence as bearish for Bitcoin, as his emphasis on monetary discipline, higher real rates, and reduced liquidity frames crypto not as a hedge against debasement but as a speculative excess that fades when easy money is withdrawn.’

In other words, when the money printer slows down, Bitcoin doesn’t shine. It sinks.

At least, that’s the conventional wisdom.

But if Bitcoin’s tech-stock behaviour is really just a liquidity artefact, not a fundamental truth, then the coming policy shift could finally reveal what Bitcoin will become in this new age.

A speculative plaything? Or a genuine store of value?

We’re about to find out.

The Trustless Promise Option:

Trust Not Required

This creates an identity crisis for Bitcoin believers.

The original pitch was simple. Bitcoin is a trustless system. No central bank can debase it. No government can freeze it. The code is the law.

In a world where trust in institutions is collapsing, that should be incredibly attractive.

And yet, the market treats Bitcoin like just another risk asset. Something to buy when times are good and dump when volatility spikes.

Why the disconnect?

Part of it is market structure. Institutional investors now dominate Bitcoin trading. They don’t care about decentralisation or monetary philosophy. They care about risk-adjusted returns. And in their models, Bitcoin sits in the ‘speculative tech’ bucket.

Part of it is liquidity. When markets panic, investors sell what they can, not what they should. Bitcoin is liquid. So it gets sold.

And part of it is simply that Bitcoin hasn’t been tested through a genuine loss of faith in the US dollar. We’ve had volatility, yes. But not a true currency crisis.

The Contrarian Case

So, should you avoid Bitcoin entirely?

Not necessarily.

If you believe, as I do, that institutional trust will continue to erode, then Bitcoin’s core value proposition remains intact.

Yes, it’s volatile. Yes, it trades like tech for now.

But the underlying thesis hasn’t changed: a decentralised, censorship-resistant store of value could prove invaluable if traditional systems falter.

The question is timing.

Right now, Bitcoin is caught between two narratives. The ‘digital gold’ crowd sees it as a hedge. The institutional crowd sees it as a risk asset.

Until one narrative wins out, expect continued volatility.

But here’s the contrarian angle.

If Bitcoin keeps falling in this macro environment, you might get an opportunity to buy at a nice discount.

That’s not without risk. Bitcoin could easily fall further if Warsh tightens policy or tech continues to slide.

But for investors willing to take a long view, the current dislocation could be a gift.

In my eyes, these moments are perfect for dollar-cost averaging if you buy into the idea long term.

The world is losing faith in its institutions. Bitcoin was built for exactly that moment.

Whether the market recognises it yet is another question entirely.

Regards,

Charlie Ormond,

Small-Cap Systems and Altucher’s Investment Network Australia

Comments