In today’s Money Morning…no room for doubt…despite a few road bumps, the bold move has been pretty successful…do as we say, not as we do…and more…

One of my favourite Bitcoin [BTC] related resources is the ‘Bitcoin Obituaries’.

It’s a web page hosted on the 99bitcoins website that tracks the number of times someone has declared ‘bitcoin is dead’. And, as the current tally (at the time of writing) proudly notes, bitcoin has had a whopping 444 deaths:

|

|

|

Source: 99bitcoins |

What you’re looking at is a graph of the price of bitcoin overlayed with markers for ‘bitcoin deaths’. Basically, they just plot a point every time some article or opinion says bitcoin is going kaput.

Suffice to say, that’s a lot of deaths for one asset — a very tongue-in-cheek way to mock the many bitcoin and crypto critics.

As you can also see, though, the end of the graph paints a very distinct picture. The price of bitcoin has fallen — quite steeply, might I add — and as a result, there is a bunch of markers.

So could the doubters finally be right?

Is bitcoin on its last legs?

No room for doubt

As I’m sure you can guess, the answer is no.

Bitcoin, as of right now, isn’t going to die. In fact, I’d wager that the only way bitcoin may ever truly die is if it is superseded by a superior blockchain.

Right now, though, as volatility runs rampant, it is certainly testing the mettle of all crypto investors. There is no denying that it has been a rough couple of weeks.

However, we have seen a slight bounce in the bitcoin price over the past two days — an indication that perhaps the bearish mood may be lifting.

Just don’t be surprised if it starts falling again, because if there is one thing you should expect when it comes to crypto, it is strong volatility.

The bigger issue, though, is that this volatility gives critics more ammo to spread their FUD.

A fact that can be seen by the IMF’s statements toward El Salvador on Wednesday.

If you’re unaware, El Salvador made bitcoin legal tender late last year — becoming the first nation to truly test whether bitcoin could function as a working currency.

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

Despite a few road bumps, the bold move has been pretty successful. Even this most recent bitcoin price crash has simply been met with enthusiastic buying. President Nayib Bukele literally bought 410 more bitcoins (roughly US$15 million worth) in the wake of the sell-off.

That clearly hasn’t sat well with the IMF, though, as they stated:

‘The adoption of a cryptocurrency as legal tender, however, entails large risks for financial and market integrity, financial stability and consumer protection.’

A pretty big claim with not much evidence to back it up…the kind of empty words that, in my view, reek of a centralised system not wanting to lose control.

But it doesn’t end there…

Do as we say, not as we do

See, the worst part about this jab at El Salvador is the fact that the IMF is intertwining its disdain for bitcoin and a need for sound economic policy.

For example, the IMF first raises the matter of El Salvador making bitcoin legal tender after stating this:

‘Against this backdrop, public debt vulnerabilities emerged. Persistent fiscal deficits and high debt service are leading to large and increasing financing needs. The fiscal deficit is projected at 5¾ percent of GDP in 2021 and about 5 percent of GDP in 2022. Under current policies, public debt is expected to rise to about 96 percent of GDP in 2026 on an unsustainable path.’

So while they may not be outright saying that bitcoin is a part of this ‘unsustainable path’, they’re clearly alluding to it. More importantly, though, this concern about debt rising to 96% of GDP seems fairly unusual.

After all, the entire global economy has had to borrow heavily to stave off the impact of the pandemic. And while the IMF’s focus is obviously on underdeveloped and developing nations, debt-to-GDP is a big issue in developed nations too.

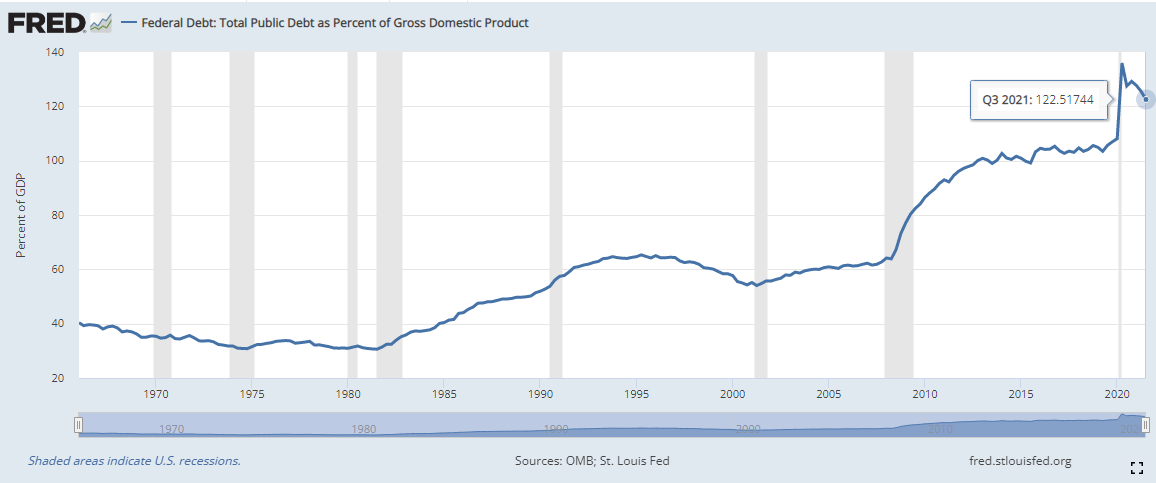

Take a look at the US’s public debt-to-GDP, for instance:

|

|

|

Source: St Louis Federal Reserve |

As you can see, it is sitting at a whopping 122% — which is an improvement from the 135% recorded in the second quarter of 2020.

You won’t find the IMF critiquing the US over that, though…

Nor will you find them addressing the fact that their lending can lead to corruption as well. Something that is just as damaging to market integrity, financial stability, and consumer protection as they suggest bitcoin may be.

Regardless, my point is that the IMF isn’t really at liberty to be pointing fingers, not when there are far bigger and more systemic threats to financial markets.

But, of course, when you’re part of the centralised structure that benefits from the status quo, it makes sense to want to do away with the competition.

Keep that in mind when the next institution or ‘expert’ declares bitcoin dead for the 445th time.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

PS: Ryan is also the Editor of Australian Small-Cap Investigator, a stock tipping newsletter that hunts down promising small-cap stocks. For information on how to subscribe and see what Ryan’s telling subscribers right now, click here.