With today’s Bitcoin [BTC] price at such a lofty height (just shy of US$40,000), it’s a fair question to ask.

I’m going to go out on the smallest of limbs here, and say most likely.

It’s not that I’m blinded by a crypto-fetish, but more so, it’s hard to see other asset classes keeping pace.

It’s a process of elimination.

Bonds? Don’t be silly.

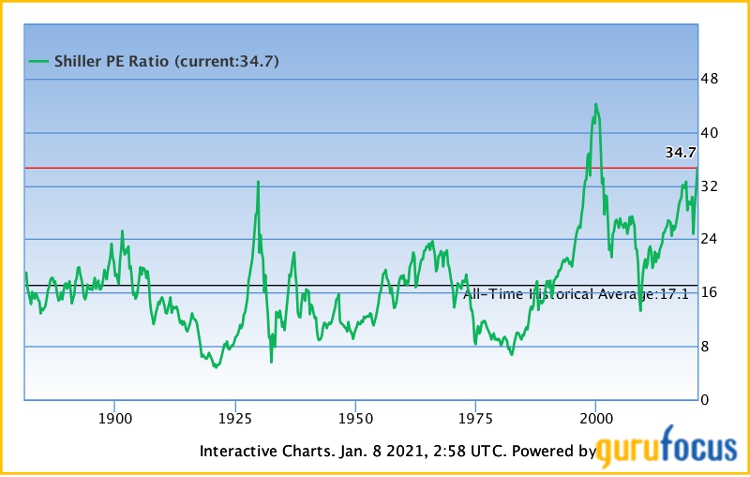

Equities/Index ETFs? Well, the multiples are getting pretty darn high, as you can see below:

Source: gurufocus.com

This is the Schiller PE Ratio, which is ‘a more reasonable market valuation indicator than the PE ratio because it eliminates fluctuation of the ratio caused by the variation of profit margins during business cycles.’

This means that the valuation of stocks on the S&P 500 is starting to get stretched — you pay more for access to these companies’ earnings than at any time except for around 2000.

Maybe the Fed could just continue to flood the market with cash relentlessly, but point is, the big equities may run out of steam this year after a massive run up.

The same logic applies to Bitcoin as well, but as I will get to at the end, I don’t think it holds.

With equities out, that leaves cash, commodities and real estate as the main competitors.

If cash is to beat the BTC price this year, then this is what I believe would need to happen…

Here are the three things (and they would need to happen in a coordinated way):

- Market implosion and DXY (US Dollar Index) spikes again

- Multiple exchange hacks, or even a quantum hack (which is unlikely for now)

- Central banks reverse course on devaluing their currencies (raising rates), while #2 happens

The problem is that if #3 were to happen, economies would have to miraculously recover for central banks to even consider it. But then #1 would be the most likely response from the market on raised rates.

After all, the Fed is on record as saying that low rates are here for a prolonged period.

It’s an impossible bind, so cash is clearly out.

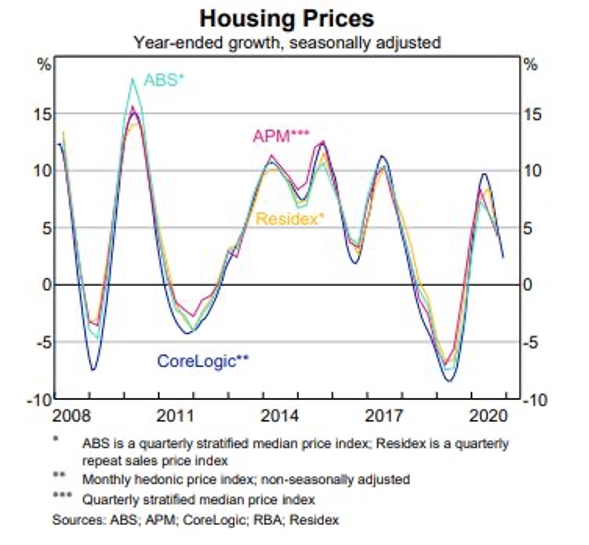

What about real estate though?

Well, if you are in Australia, it’s not inconceivable that real estate continues on its merry way this year.

In fact, it’s looking promising. The RBA has slashed rates to just above zero and Victoria’s intense lockdown may be gone for good — fingers crossed.

I doubt it will be enough to outstrip the BTC price though.

The growth is in a downtrend (as you can see below), and it would take a lot for it to spike back up to the 10% range.

The country would probably need international borders reopened quick smart for that to be possible.

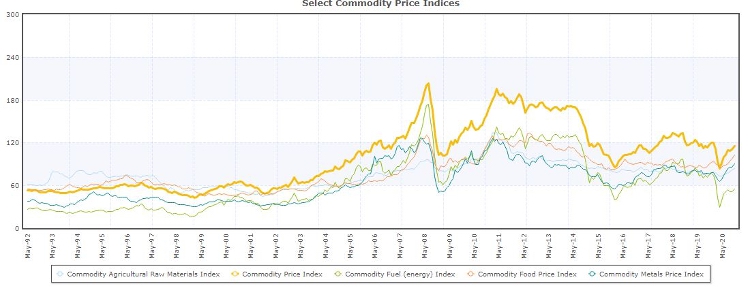

So, what about commodities?

Well, this is a super-intriguing question.

Here’s a selection of commodity price indices going back to 1992:

Source: indexmundi.com/commodities/

You can see a big spike back in 2007/2008.

I think commodities have a significant amount of headroom going into this year, particularly if inflation picks back up in a big way.

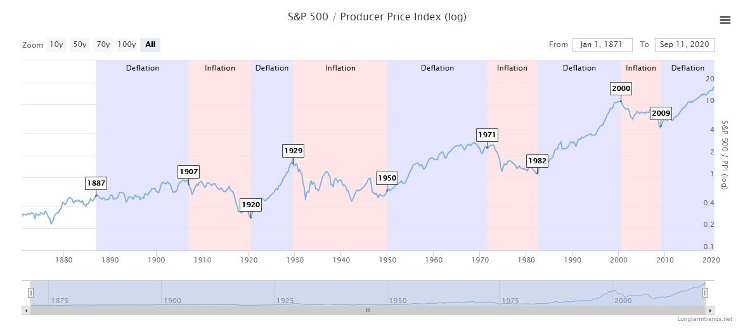

Again, it’s worth looking at the following chart for a guide as to what could happen to commodities:

Source: longtermtrends.net

Should this deflationary channel reverse and turn inflationary, we could see a quick and sharp commodities renaissance this year.

Something you can learn all about right here.

Importantly though, you need to sort the gold from the dross here.

As in, which commodities?

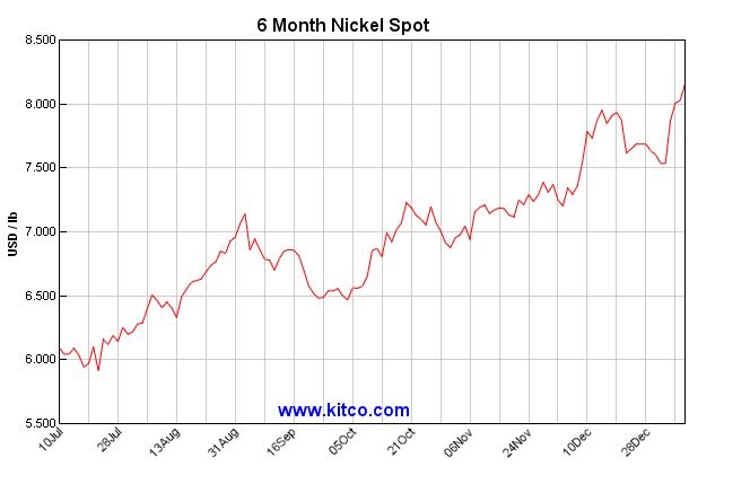

Well certain metals like copper and nickel look to be on an inexorable rise, which you can see below:

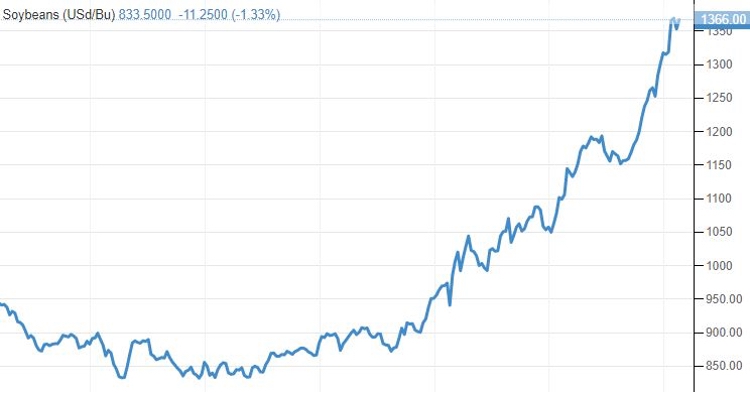

Then there are agricultural commodities, which shouldn’t be over looked as supply chains shift due to China–US trade dispute.

Take a quick look at soybean prices for instance (one year period):

Source: tradingeconomics.com

That is a steep rise if I’ve ever seen one.

There are just too many commodities to go through though, so I’ll finish this section on gold.

You see, the gold price in AUD terms looks to have bounced off support a couple times recently:

Source: tradingview.com

Should it crack above the middle resistance line at $2,500, I’d be tempted to say gold is back on the menu.

By the way, people frequently compare Bitcoin [BTC] and gold. You can learn all about the different properties of the two monetary technologies in Selva Fregeido’s excellent report on the topic here as well.

The way I see it though, gold (despite its appeal) won’t beat the BTC price this year in terms of a percentage rise for one primary reason.

One reason why BTC could be the best performing asset class of 2021

I like this explanation…

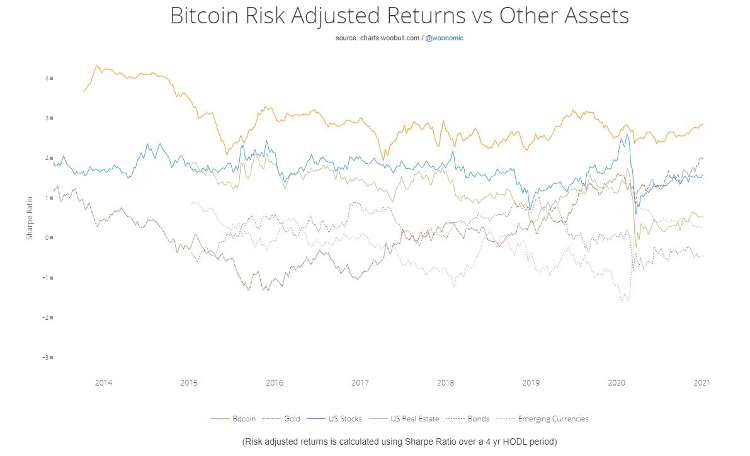

Basically, BTC risk adjusted return has always been better (if you HODL for four years):

Source: charts.woobull.com

You can learn more about the Sharpe Ratio on a variety of different outlets, but in a nutshell it ‘is used to help investors understand the return of an investment compared to its risk. The ratio is the average return earned in excess of the risk-free rate per unit of volatility or total risk. Volatility is a measure of the price fluctuations of an asset or portfolio.’

There are a lot of intricacies to how this chart could be interpreted, and you may take issue with the four-year HODL period.

But realistically, that’s about how long I think a sensible investment (note: not trade) should last.

Definitely not less than a year, and ideally at least two–three years.

Here’s the thing though…

If you want to really dive into the crypto trading world it can be extraordinarily difficult. As history has shown, cryptos can be widely volatile and risky.

It can be hard to know when to buy/sell/swap, and timing is everything.

If this is what you want to get into, a reliable guide is needed.

His name is Ryan Dinse, and he runs the Crypto Flip Trader service.

You can learn more about this service by subscribing to Money Morning, where we cover crypto topics as well as a whole host of cutting-edge investment ideas.

I trust you will find it a valuable tool, and at the very least spark some big investment ideas.

You will also get first bite at a subscription to Crypto Flip Trader when it opens up again.

So sure, HODL your BTC and potentially watch it beat the market, gold and real estate again.

But it’s time to consider a new strategy as well.

Regards,

Lachlann Tierney

For Money Morning

PS: Bitcoin vs Gold — Expert reveals how these assets stack up against each other as investments in 2021. Click here to learn more.

Comments