Do you remember President Biden’s oil gambit?

In March last year, Joe Biden made the drastic decision to free up US oil reserves. At the time, he called for 180 million barrels to be released in order to cool petrol prices.

In reality, it would be much more over the course of the past 14 months or so.

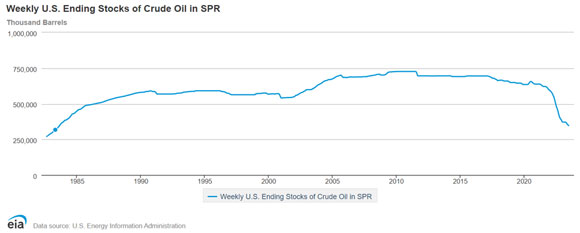

Just look at the dent his mandate has put in the Strategic Petroleum Reserve (SPR):

|

|

| Source: Forbes / EIA |

This vital release of oil has pushed the reserve to its lowest amount in more than 40 years. It was a move that sparked plenty of debate about the long-term energy security of the US.

However, Biden’s administration has stated that it’s committed to refilling the reserves. Energy Secretary Jennifer Granholm bluntly stated that ‘the bottom line is we are going to replenish’.

The real question, though, is when it will be replenished…

Because earlier this week, on Tuesday, Biden’s team backed out of an offer to buy 6 million barrels of oil. According to a spokesman knowledgeable on the deal, market conditions didn’t suit the US Government’s goals.

In other words, with oil prices on the up, they didn’t want to pay overs.

But that just begs the question, what happens if or when they need to buy in a few months’ time?

Risk of a recession

A quick check on the chart of the oil price reveals why Biden’s team is kicking the can down the road:

|

|

| Source: Trading Economics |

You can see for yourself how much the price of crude has rallied in the past month. It seems the ongoing cuts from OPEC are starting to be felt as prices climb back over the US$80-per-barrel mark.

Apparently, US officials aren’t interested in refilling the stockpile until prices are closer to US$67–72 a barrel. An awkward declaration to make in a market such as this, especially with inflation still threatening an economic downturn.

Who knows, maybe Biden is trying to use the SPR as some sort of political weapon. With the next US election a little over a year away, I wouldn’t be surprised if he’d want a downturn sooner rather than later.

Of course, rising oil prices don’t necessitate a recession.

It’s simply adding pressure to an already strained economic situation.

For early investors like yourself, though, it could also be a massive opportunity!

Big on black gold

See, amidst the price swings and politics, the real issue for oil long term is raw supply.

During the pandemic, for example, investment in oil and gas exploration all but evaporated. Thankfully, we’ve seen a turnaround on this front during 2023.

US$50 billion is expected to be spent looking for new oil and gas wells this year, the highest level of investment since 2019.

But despite the increased exploration, we’ve yet to really see any reward.

As oilprice.com reports:

‘Our estimates show that in the first half of 2023, explorers found 2.6 billion barrels of oil equivalent (boe), 42% lower than the first half of 2022 total of 4.5 billion boe. Fifty-five discoveries have been made, compared to 80 in the first six months of last year.

‘This means discoveries in 2023 have averaged 47 million boe, lower than the 56 million boe per discovery for the same period in 2022.’

So, even with the increased investment, we’re struggling to find new supply. That’s bad news for those explorers throwing cash at dud projects, but good news for existing producers.

After all, this dwindling capacity all flows into the futures market. That’s part of the reason why the price of oil is already on the up, and also why it may continue to climb.

I certainly wouldn’t be shocked if we see a barrel worth triple digits again before the year is over. Granted, a reversal in OPEC’s cuts could have something to say about that…

For investors who like a bit of a punt, though, I think oil is a decent consideration. Because as our commodities expert James Cooper knows all too well, supply can often be a bigger catalyst for price jumps of key producers.

Check out his research on copper for another example.

That’s why I’d be keeping an eye out for energy stock results in the coming weeks. Because while some are already on the up, there may be more room yet to run…

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning