The macro analysis is hot and heavy right now.

How we all love it.

How useless most of it proves to be.

Today’s Money Morning will take you down a much more useful line of thinking.

Here’s why I say that…

All the mainstream media is doing right now is preoccupying your thoughts with the US debt ceiling and US regional bank issues.

Most likely, by this time next year, most of us will have forgotten about both.

We need trends and dynamics that are more enduring than these two.

Fund manager Nick Griffin captured this sentiment recently.

The Australian Financial Review quoted him as saying:

‘The reality is you can spend the last 20 years in Australia looking at macroeconomics.

‘“You could have tried to work out what interest rates were going to do, what the government was going to do, or what was going to happen to the budget deficit,” he said.

‘Or you could have worked out blood plasma was going to be pretty useful to cure diseases, and you could have just bought CSL.’

Good call? Bad call?

Good call!

What might prove ‘pretty useful’ in the years ahead?

We don’t have to look very far…

BHP is telling us something

There’s an old adage, but a goodie, in markets.

Don’t look at what people say, look at what they do.

Opinions are a dime a dozen. Actions and dollars are not.

Two recent acquisitions tell us that the natural resource industry is chasing one metal in particular.

One is the BHP acquisition of Oz Minerals.

The second is Newmont’s takeover play for Newcrest Mining.

Both are big deals.

BHP is spending nearly $10 billion dollars!

Newmont is going even bigger again. It’s spending US$17.5 billion.

In Aussie dollars, that’s well over $20 billion…double the BHP acquisition.

You know Newcrest is a gold miner. But what you may not know is that it is also the third-biggest copper producer in Australia.

Oz Minerals is a copper producer as well…and now BHP is the biggest copper producer in the world.

Yep, copper is set to be the star of the show in future years.

Now, the price of copper has been a bit out of sorts lately.

Economic worries are no doubt rattling futures traders and making them a little wary.

I urge you not to try and play the short-term game on this one.

Get set and sit back.

Here’s why…

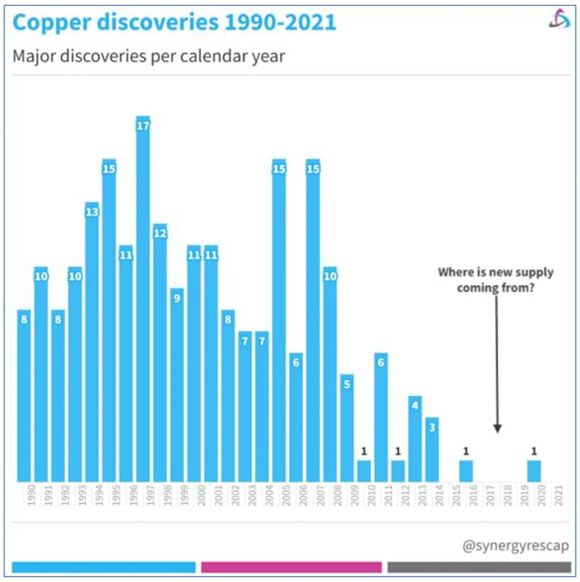

Take a look at this chart via Firetrail Investments recently:

|

|

| Source: S&P Market Intelligence |

Copper, as you can see, is hard to find. That’s not all, either.

A good chunk of global copper reserves is in South America…and always tinged with an air of instability.

It wouldn’t take much unrest over there to make the world very nervous about where copper supply is going to come from.

Here’s another thing…

Most junior mining exploration budgets go into looking for gold. Not only is copper hard to find, the world simply hasn’t been spending enough to find more.

That’s the supply front.

Now we have enormous demand brewing as electric cars, urbanisation, and renewable tech roll out around the world.

We need to widen the scope of our viewpoint here…

I mentioned the US banks above. The mainstream media is focusing on the issues there.

But have you heard about banks in India lately?

I’m going to assume no.

Here’s what The Economist reported in its latest issue:

‘The IMF expects the country to be the fastest-growing major economy this year. As the system has become healthier, banks have lent more.

‘Annual credit growth slowed to 3% in 2017. It is now up to 18%. Interest rates have risen less sharply than in America, helping limit stress.’

That’s bullish for resources. India is an urbanising economy.

It’s much more resource-intensive than mature economies like Australia and the US.

We also know that China’s central bank is injecting liquidity into the Chinese financial system to boost their economy over there.

I can’t say when, but at some point, I expect this to show up in the price of resources like iron ore and copper.

Here’s the kicker with resources…when they go, they really go nuts.

We saw it in coal last year. Suddenly, the demand for coal went bananas after the Ukraine war broke out.

Well, coal producers just can’t snap their fingers and create a new coal mine. Capital and labour had long since ditched the industry.

The price went sky-high as a result. End users had no choice but to pay the market price.

I expect something to happen to copper in the next few years.

However, I’m not trying to finesse this. Over the years, I’ve lost more in opportunity simply by not backing a trend early and holding on.

How to play it? One idea is to accumulate BHP. It’s not a ‘pure play’ on copper. Iron ore is the more powerful earnings driver.

However, I like both, and the inherent diversification. The yield is pretty juicy right now, too.

But the slam-dunk potential exists in the junior miners. Look at how nuts lithium stocks went from 2020–22. Gains of more than 1,000% were common.

That’s the latent potential today.

How to find them?

You can try it yourself. However, over the years, I’ve grown wary of resource stocks. There’s much that can be hidden from average retail investors.

Inside industry knowledge is more crucial here than any other sector on the market, in my book.

The geology of mines is not easy to understand. There’s a reason it takes a degree to understand.

For that reason alone, I urge you to follow my colleague James Cooper, a trained geologist who has worked in the industry.

See what he’s saying here now!

Best wishes,

|

Callum Newman,

Editor, Money Morning