Today you’re going to learn a bit about a lady called Bertie Buffett.

This girl’s got some serious cash – her donations are in 9 figures.

I doubt you know the name though. Who is Bertie?

Warren Buffett’s sister!

You know Warren.

He’s the “Oracle of Omaha”…stock market maestro at 93… ultra billionaire…Charlie Munger’s best mate.

You’ll see why I mention Bertie shortly…

First, I would like to ask you a question. Do you remember the ‘mortgage cliff’?

The idea of the cliff was that rising interest rates would send highly leveraged property borrowers crashing down.

All those Aussie mums and dads and first home buyers couldn’t handle rates at 3 or 4%, right?

It was an easy dystopia to believe in back in 2022 and even 2023.

Perhaps even now for some?

Except that the mortgage cliff never happened.

The big default cycle just never materialised in the way we collectively imagined.

It’s still not showing up!

How can we be so confident? I’ll show you in a sec…

Look at this screenshot first. I grabbed it last night:

|

|

|

Source: The Australian |

Oh dear. Shades of the same mortgage cliff story there clearly…just expressed more directly.

This might give you pause for thought.

It could even mean that you decide today, this week or this month is no good to invest in shares.

Indeed, my own brother asked me yesterday if he should sell his shares because the ‘economy is slowing down’.

I’ll share what I told him below too.

Let’s get this big mortgage default bogey man out of the way first.

There’s an easy way to test if we on the cusp of a mortgage wipeout…

It’s via the finance sector.

You see… the people that go into mortgage stress and/or can’t repay their loans are easy to see.

They must always show up as bad debts in the banking system.

That means right now is perfect timing for a health check.

Most ASX companies are updating the market with their latest results and news…including the banks.

Let’s use Westpac as a typical big bank.

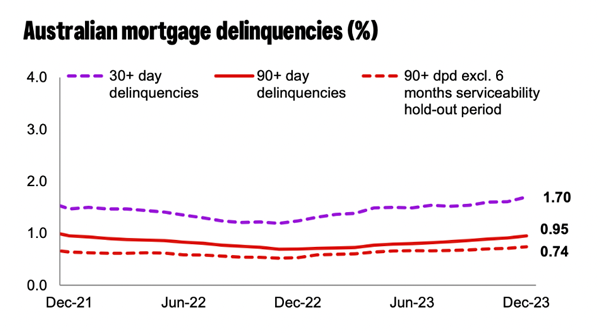

Westpac’s 90+ day delinquencies are at 0.95% of their loan book.

You can see that’s not extreme at all looking back to December 2021…

|

|

|

Source: Westpac |

The time period on this chart covers the entire rate rising cycle of the RBA so far.

No mortgage cliff evident here, right?

No.

But we can stress test this idea in

an even more potent way

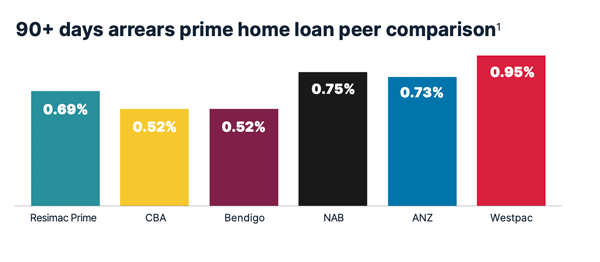

We can look at mortgage lender Resimac [ASX: RMC] too.

Resimac is what they call a ‘non-bank’. It can take on niche or less creditworthy borrowers.

Non banks don’t offer fixed loans either. That means rising rates go straight through to their customers.

That makes companies like RMC a bellwether for the bad debt cycle.

Resimac released its results yesterday. What did they say?

Resimac’s prime 90+ day arrears are even better than Westpac’s.

See that here…

|

|

|

Source: Resimac |

Now, it must be said that the number of Resimac’s “non prime” borrowers falling behind a lifting up over 1%.

These are often the more marginal borrowers that rising rates do hit first.

However, Resimac has been prudently “provisioning” for this outcome (actually, a worse outcome) for years.

That means it can absorb the cost of these bad debts as long as they stay modest, as they are now.

In other words, the official ASX results of both Westpac and Resimac suggest that news stories like the above are overplaying the stress factor.

I’m not saying it’s all hunky dory out there, or that further rate rises wouldn’t hit, either.

But, as of now, mortgage stress is in line with historic averages and nothing to be overly concerned about.

That brings me to my brother. He may be right to say the economy is slowing down, but he has the causal relationship backwards.

He should be BUYING stocks – and not selling them.

The stock market moves ahead of the economy.

The market has priced in the current slowdown…and is now looking beyond it.

This is why retail stocks are going up – some quite strongly indeed – even if their results are down.

Take a look at Adairs [ASX: ADH] this week as example…

|

|

|

Source: Market Index |

Adairs bottomed around November last year. This was the market pricing in a potential recession in 2024.

Now investors are realising that the slowdown is here but it’s not anywhere near as bad as feared.

Adairs is up 30% in the last month. Westpac is up 10% too.

What’s this got to do with Bertie Buffett?

You remember I mentioned her at the start.

Her brother Warren just released his latest annual report.

He comments on Bertie in that piece and says she has now held his company, Berkshire, for over 40 years – and hasn’t bought another share the entire time.

In other words, Bertie let time and compounding do the heavy lifting for her (with a great brother for this kind of thing, it must be said).

Most of all, she was patient.

Right now, you have a chance to do a bit of Buffett style investing – both Warren and Bertie.

There are cheap stocks like Adairs all over the market. Most of the economic “bad news” is well and truly battered into them.

It only takes a small shift in sentiment and outlook to get shares like these moving up.

Not every stock will take off like Adairs right away. It may not be tomorrow or next week.

But next year? 2026? The longer you look out, the closer you get to a slam dunk.

Keep perspective. This is the share market, after all. Things can go wrong, go down and go haywire.

But please consider BUYING shares now that the worst looks behind us.

That’s what I told my brother, and what I’m telling you. It’s what I’m doing too.

I’ve got five ideas for you right here in this report.

Bertie Buffett backed the share market to grow her wealth over time. I suggest you do the same.

Mortgage cliffs…mortgage stress…blah blah. The mainstream media sells fear. Investors do their own thinking.

Which lead do you follow? We know the choice Bertie made.

Best,

|

Callum Newman,

Editor, Small-Cap Systems and Australian Small-Cap Investigator