Bendigo and Adelaide Bank Ltd [ASX:BEN] shares are down after a company’s mixed earnings report for the financial year ending 30 June.

Despite reporting an increase in statutory profits and topping its guidance, its shares are down by -2.10% at the time of writing.

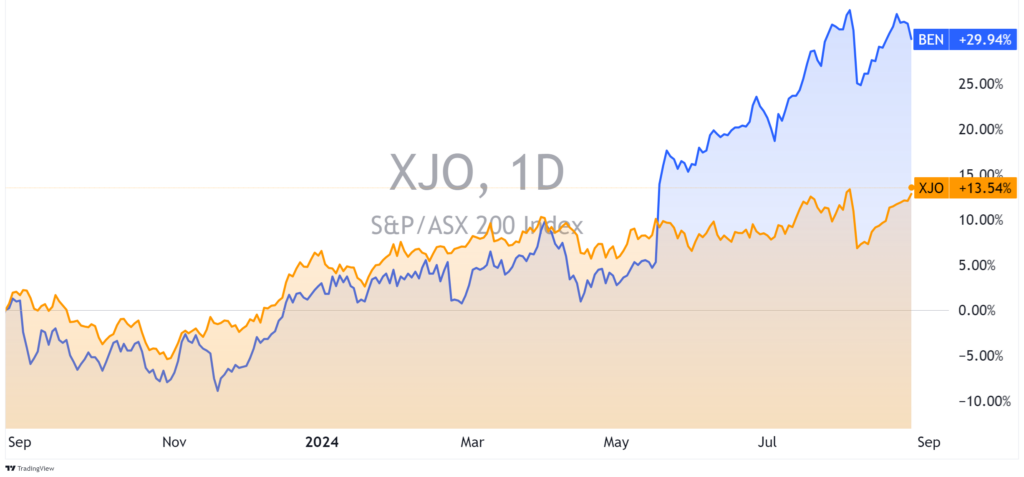

That puts the regional bank’s shares at $12.14 per share, putting its 12-month gain to around 30%.

That came as the company finished a four-year-long process of combining its core banking systems. With that, it released a new wave of digital platforms targeting mortgage brokers, young bankers, and businesses.

But with cash earnings falling and challenges on the horizon, is this pullback a sign of things to come or a buying opportunity for investors?

FY24 Results

Bendigo Bank reported a statutory net profit after tax (NPAT) of $545 million, a 9.7% increase year-on-year.

However, cash earnings after tax, often viewed as a more accurate measure of underlying performance, fell 2.6% to $562.0 million.

The bank’s net interest margin (NIM) contracted by 0.04% to 1.90%. This reflects the intense competition in the mortgage market in the first half of the year.

However, management noted an improvement in NIM during the second half.

On a positive note, Bendigo Bank’s common equity tier 1 (CET1) ratio, a key measure of financial strength, increased by 0.07% to 11.32%.

CET1 can be seen as a crucial part of a bank’s capital structure, especially in weathering any financial crises.

This capital position enabled a final fully franked dividend of 33 cents per share, up 3.1% from the prior year.

Growth and Challenges

Bendigo Bank’s CEO, Marnie Baker, highlighted several growth areas, saying:

‘Customer growth continued in FY24, with a year-on-year increase of 9.1% to more than 2.5 million customers and the Bank’s Net Promoter Score is +27.9 points above the industry.’

‘Up, our leading digital bank, grew customer numbers by 29% over the year helping to expand our reach and drive our vision to be Australia’s bank of choice.’

The bank’s residential lending book also grew by 3.1% to reach $60.4 billion, while customer deposits increased by 3.4% to $68.3 billion.

However, the results weren’t without challenges. Cash return on equity (ROE) fell 0.44% to 8.18%, and gross impaired loans increased by 8.7% to $135.7 million.

While this only represents 0.17% of gross loans, it hints at pressures facing some borrowers in the high-interest rate environment.

But what perhaps shifted the needle most for the share price today was the mixed FY25 outlook.

Outlook and Strategy

Looking ahead, Bendigo Bank expects official interest rates to remain elevated into 2025. They believe this would continue to pressure households and potentially impact loan quality.

Despite the darker warnings, it said that loan arrears remain ‘benign’.But as you see below, there has been an uptick among homeowners.

These challenges with margins and arrears have seen the bank doubling down on its winning formula.

In response, the bank plans to increase investments in key areas, particularly its digital capabilities.

Management is targeting an increase in investment spending of $30 million to $40 million in both FY 2025 and FY 2026 compared to FY 2024 levels.

While these investments will hurt short-term profits, their digital investments have so far been a great growth driver.

UP Bank has been great at pulling customers from its larger rivals and pushing customers to a lower-cost banking model.

Despite these higher costs, Bendigo maintained its medium-term targets. That’s to reduce its cost-to-income ratio to 50% and lift its return on equity above its cost of capital.

Looking ahead, the focus on digital growth could position it well for the future, but it comes with risks.

Investors should watch its ability to expand digital offerings while maintaining customer satisfaction.

Another key area to look at will be its lending book. Reports from banks like Westpac have shown that competition in mortgage lending has eased since the start of this year. But it’s not gone.

Profit margins will continue to be squeezed by loan pricing competition. This could worsen if further pressure on households from high interest rates hurts loan quality.

These areas could be key to deciding whether its new platforms will have space to shine or if today’s dip is a sign of tougher times ahead.

Market Meltdown or Market Opportunity

As always in the banking sector, broader economic conditions will also play a crucial role in shaping Bendigo Bank’s fortunes.

But those are harder to predict in our current high-interest rate environment. Central Banks often keep rates high until something breaks.

With volatility returning to the markets, investors should be cautious about their next move.

So, if things are looking vulnerable, where should you invest?

Editor Murray Dawes thinks the markets ahead are due for a SHAKEOUT.

He called the 5 August panic and recovery a week in advance and thinks he sees another.

But this time, he’s found a position to potentially profit from the changes.

He’s built a shopping list around stocks he wasn’t to own on the next down-move.

And he’s sharing them with listeners in a video that is launching at 7pm EAST Tonight.

CLICK HERE to secure your spot and hear from Murry first-hand about three stocks you want to own now.

Regards,

Charlie Ormond

For Fat Tail Daily

Comments