The much-anticipated Federal Reserve Open Market Committee meeting concluded early on Wednesday afternoon in the US (early Thursday morning our time).

What was the verdict?

The Federal Reserve kept the federal funds rate steady at 0–0.25% (breathe a sigh of relief that there was no rate hike!).

However, the committee indicated that they would increase the pace of tightening their currency supply.

The previous meeting in early November suggested that the Federal Reserve would stop buying back debt from the market by mid-2022. Now, the plan is to bring that forward by another three months to March 2022.

The committee members appear to suggest that there could be three rate rises in 2022 instead of the one they suggested previously.

Their goalposts are clearly shifting very fast!

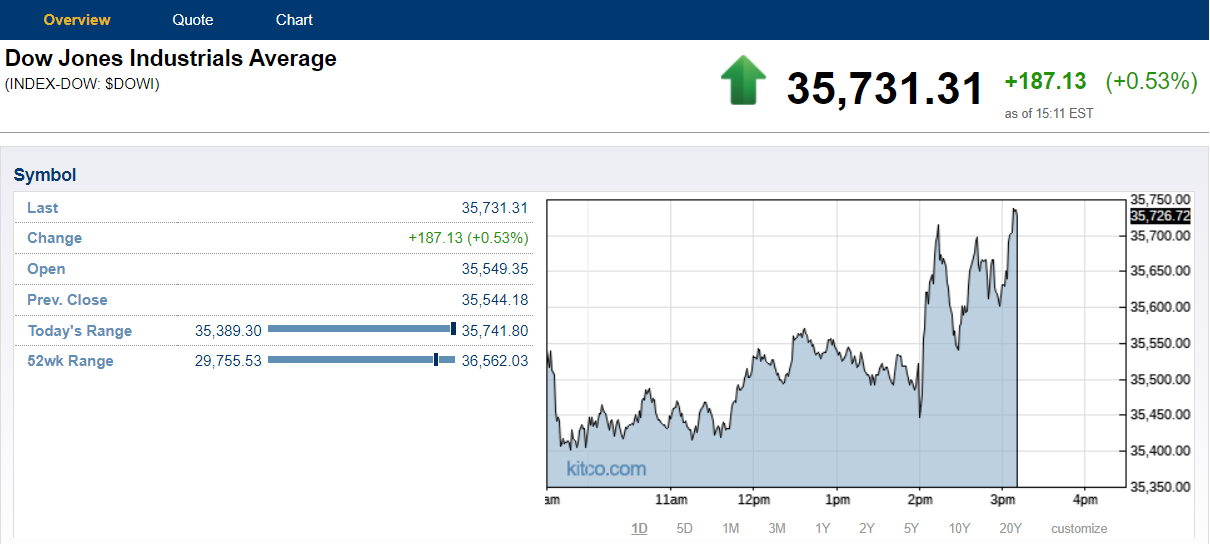

Initial market reactions to this announcement appeared to signal some relief. The market may have been too bearish about what the Federal Reserve would do. You can see it in the way the Dow Jones Index bounced quickly soon after the announcement that came out at 2:00pm:

|

|

| Source: Kitco.com |

The Dow closed for the day almost 400 points up.

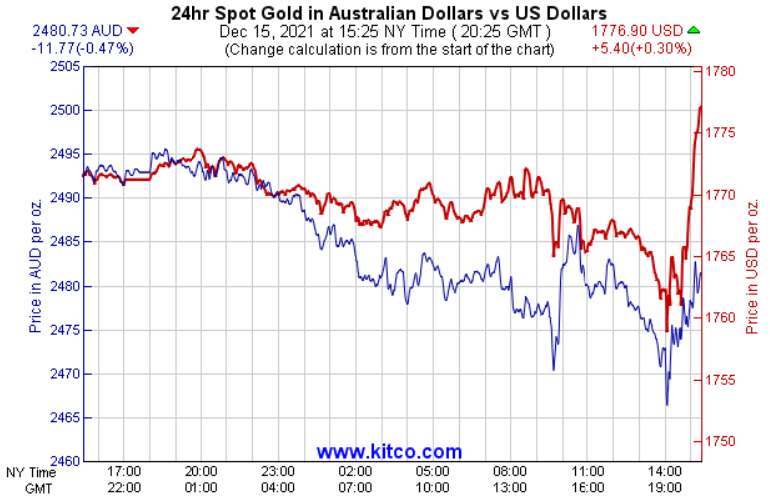

To my surprise, even gold joined in the chorus after initially taking a tumble further into negative territory. Here is a chart showing the price of gold in US and Aussie dollar terms within an hour after the Federal Reserve minutes release:

|

|

| Source: Kitco.com |

Again, you can see how gold dipped about US$5 an ounce moments after the announcement before recovering US$15. All this happened within an hour. It gained another US$3 by the close of trading.

As for gold in Aussie dollar terms, our dollar moved up against the greenback and offset the gains that gold made.

The market appears to be resuming its rally after the anticipated speed hump of the Federal Reserve meeting. Perhaps it will accelerate into Christmas?

In other words, it’s business as usual…

Everyone was cautious leading up to it, held their breath, and then breathed a sigh of relief.

But I think it is worth looking at this from another angle.

How to Survive Australia’s Biggest Recession in 90 Years. Download your free report and learn more.

Federal Reserve’s policy failure accumulates

If you follow my weekly articles, you are familiar with my critical stance on the Federal Reserve (and central banks for that matter). It has been more than a failure, and it seems to grow by the day.

The initial mandate of the Federal Reserve is to maintain inflation and facilitate the economy reaching full employment. In other words, it is supposed to help keep the economy stable so the nation can prosper.

Their track record may suggest it has been able to do it over the long term. This is if you go by the official statistics. Every now and then, these figures suggest there are periods where the economy experiences turbulence with higher-than-expected unemployment and/or inflation.

This includes the recent year as official inflation figures reach 6.8% in the US on a year-on-year basis. That is much higher than the 2% target in their mandate.

The Federal Reserve came clean last month to concede that this elevated level of inflation could stay around for longer than it initially expected.

I don’t believe that those in the Federal Reserve were that clueless in not seeing inflation linger more than the ‘transitory’ phase it talked of in the middle of the year. These people are not the average Joe. It’s their job to monitor the economy, and they have access to much more data than we do.

People can feel it in their wallet or when the credit card bill arrives. The data is showing itself to be rubbish.

Australia behind the pack…

Meanwhile, in our backyard, the Reserve Bank of Australia (RBA) seems to position itself further behind than the Federal Reserve in dealing with inflation. The official figures say Australia’s inflation rate is 3%.

Yes, apparently your cost of living rose by 3% compared to last year.

I doubt you believe that.

The RBA still appears reluctant to act as property prices have spiralled out of control and many households are deep in debt.

It can’t raise the interest rate without risking toppling the market nor can it keep the rate at this level as there is excess risk-taking. Curbing bank lending would have a similar effect as raising rates at this point in time.

Actually, that is exactly why the RBA can’t do anything meaningful.

They are stuck in a more precarious position than the Federal Reserve, if that was even possible.

This Christmas rally could be heady, but 2022 looks rocky. Those at the top have spoken, make sure you listen.

God bless,

|

Brian Chu,

Editor, The Daily Reckoning Australia

PS: Our publication The Daily Reckoning is a fantastic place to start your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.