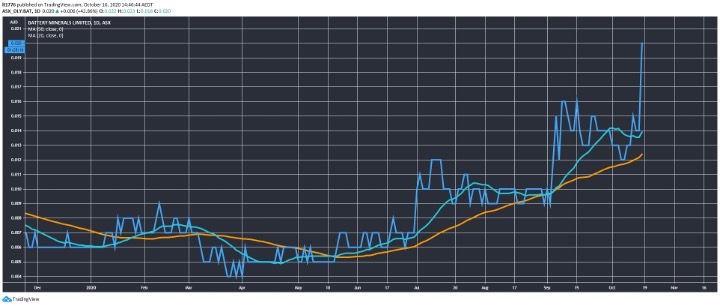

At time of writing, the share price of Battery Metals Ltd [ASX:BAT] is up more than 35%, trading at 1.9 cents.

This small-cap miner is now charging as you can see in the BAT share price chart below:

Source: tradingview.com

The company is pivoting to gold; we look at the key terms of the announcement.

BAT share price up on Victorian gold move

Here are the key terms of the announcement:

- ‘Battery Minerals will now proceed to complete the acquisition of 100% of Gippsland Prospecting, the owner of a copper-gold project next to Stavely Minerals’ (ASX: SVY) Thursday’s Gossan Copper Project in Victoria

- ‘EL6871 includes a +40km strike length of the highly prospective Stavely volcanics, as well as a +40km strike length of the adjacent Stawell Gold Corridor

- ‘The Stavely volcanics host significant copper, nickel and gold mineralization on the adjoining Stavely Minerals tenement group to the immediate south

- ‘The +5M oz Au Stawell Gold mine is situated just 7km to the east of EL6871

- ‘The historic Moyston gold mine, which produced 75,000oz of high grade ore at 22g/t Au, is located on the Moyston Fault within EL6871

- ‘ EL6871 has had minimal exploration since the 1990s’

So a bit of ‘nearology’ hype may have investors excited today.

Outlook for BAT share price

Just based on what I’ve seen, I’ve noticed a lot of companies that are focussed on battery metals pivot to gold in recent history.

It makes sense as the gold price is up, but many battery metal prices are down.

Get a mine going in the short-term and then pivot back to battery metals when the dynamics change.

Long-term though, it’s the battery metals that may be the long-term driver of price.

If you are excited by battery metals and the renewables upheaval, I can’t stress enough how valuable our free seven-day seminar on the clean energy revolution is.

You can get a seat at the conference right here.

You will hear from seven world-class energy experts and get insights on how to invest in the renewables space in the coming years.

It’s entirely apolitical. If you see the money flowing towards the sectors we do, it’s thoroughly convincing from an investment angle.

Regards,

Lachlann Tierney

For Money Morning

Comments