‘Fools’ names and fools’ faces always show up in public places.’

Old Saying

Here’s the latest from Bloomberg:

‘A 48-hour crypto drama ended in shock Tuesday as Binance Holdings Ltd. agreed to acquire its most formidable rival, FTX.com, after helping whip up an investor exodus from billionaire Sam Bankman Fried’s three-year-old exchange.

‘The sharp turn of events will reshape the more than $1 trillion industry amid a possibly prolonged market downturn. The two founders made the announcement on Twitter concurrently. “To protect users, we signed a non-binding LOI, intending to fully acquire FTX.com and help cover the liquidity crunch,” Changpeng Zhao, CEO of Binance, said in a tweet. Terms weren’t disclosed.

‘“A huge thank you to CZ, Binance, and all of our supporters,” said Bankman-Fried, CEO of FTX.com, on Twitter. “Our teams are working on clearing out the withdrawal backlog as is. This will clear out liquidity crunches; all assets will be covered 1:1. This is one of the main reasons we’ve asked Binance to come in.”’

Poor Sam. He that did ride so high…just got unhorsed.

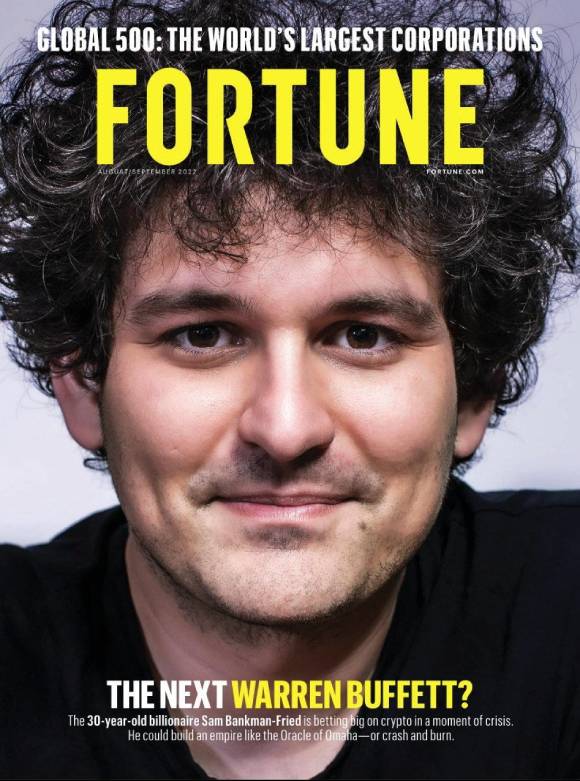

Sam Bankman-Fried (SBF) had become such a big name in the crypto space, with his double-barrelled moniker and his mane of curly dark hair; he’s shown up in the press almost constantly over the last three years. Just a few months ago, he was generously bailing out troubled crypto firms such as BlockFi and Voyager Digital, using his US$32 billion FTX much like JPMorgan, who used his own fortune to bail out Wall Street in the Panic of 1907. And in August, Fortune magazine’s cover was a photo of Bankman-Fried with the headline: ‘The Next Warren Buffett?’:

|

|

| Source: Fortune |

But today, Bloomberg tells us that his fortune has been ‘eviscerated’.

Here, we have a warm heart for bankrupts, drunks, diehards, and lost causes (there but for the grace of God!).

Doubt and cynicism

But our sympathy for Mr Bankman-Fried is tempered by doubt and cynicism.

First, we are suspicious of people who hyphenate their last names. It suggests a kind of schizophrenia…as if they are not quite sure who they are. Mr Bankman…or Mr Fried? And pity the poor secretary who has to answer the phone:

‘Hello. This is Mr Bankman-Fried’s office.’

‘Is Mr Bankman there?’

‘No, I’m afraid he is at his home in the Bahamas…’

‘Well, can I speak to Mr Fried?’

‘No, I’m afraid he is away too.’

Second, here was a man who was born with a silver spoon in his mouth and a laptop in his hand. He entered the world in 1992, never once suffering the pangs of un-connectedness of a pre-internet world. He grew up in the dotcom bubble…lived in a Bay Area bubble of wealth and privilege…and then graduated from MIT and went to work on Wall Street just as another huge bubble was forming.

His parents — Mr Bankman and Ms Fried — were both professors at Stanford Law School. This alone would have put him on an inside track. But he was also gifted at arithmetic, arriving in young adulthood just as maths skills were much in demand.

He soon was trading ETFs…arbitraging Bitcoin [BTC]…and by the time he was 26 years old, the bubble prodigy had founded FTX, which quickly became one of the biggest crypto exchanges in the world.

So successful was he that, before turning 30, he already had a fortune that it would take most men a whole lifetime to acquire — US$24 billion.

Carnegie…Rockefeller…Bankman?

US$24 billion is a lot of money for a 29-year-old. And it’s another source of sceptical curiosity. Money is meant to reflect one’s contribution — in terms of goods or services — to the wealth of others. Andrew Carnegie gave us steel. Rockefeller struck oil. What was Sam’s contribution?

Whatever it was, it had a short half-life. Ars Technica adds detail:

‘The bailout of one of the biggest and most prominent companies in the global cryptocurrency industry by its chief competitor reverberated across the market. Bitcoin, the most actively traded token, fell as much as 17 percent while smaller coins faced steeper falls. US-listed crypto exchange Coinbase dropped about 14 percent.

‘FTX hit a valuation of $32 billion at the start of this year, with blue-chip investors including BlackRock, Canada’s Ontario Teachers’ Pension Plan, and SoftBank backing the company. In an industry that has been called the “Wild West” by Wall Street’s top regulator, FTX was widely considered to be one of the better-managed players, with its founder Bankman-Fried regularly lobbying lawmakers in Washington.

‘Known as SBF and noted for his unofficial uniform of shorts and T-shirt, Bankman-Fried had a paper fortune of an estimated $24 billion only six months ago. He is among the best-known crypto executives, often appearing at conferences where he has interviewed the likes of Bill Clinton and Tony Blair.’

‘Out there’

That’s another thing that makes us unsympathetic. SBF was ‘out there’. In public. He seemed to thrive on getting his name in the paper…and attending events with celebrity politicos. There is clearly something wrong with people like that.

Another thing that made us suspicious of SBF was his disregard for money. It’s all very well for a man to buy a lottery ticket, win big…and spend his money on fast cars, fast women, and fast-talking hustlers. Then, he could waste the rest of it. But SBF, like Bill Gates, wanted to waste it all — by giving it to good causes. It was like inviting your friends to a good debauch but taking them instead to a prayer meeting. The unearned wealth will still ruin their lives…but with none of the fun that makes it worthwhile. ‘Effective altruism’, he called it.

And the money he did manage to give away went down the biggest rathole of all. In the last presidential election, he was the second largest donor to Joe Biden — giving the candidate US$5.2 million.

But now, SBF’s bubble has popped.

Thank you, Mr Market.

Regards,

|

Bill Bonner,

For The Daily Reckoning Australia