The Bank of Queensland [ASX:BOQ] share price spiked on Wednesday (12/10/2022) following the release of its FY22 results.

The bank said the results showed ‘good business momentum, tightly managed costs and improved portfolio quality.’

BOQ reported a 15% rise in statutory net profit after tax to $426 million.

BOQ shares were up 10% in late afternoon trade but are down 10% year to date:

Source: Tradingview.com

Queensland Bank presents FY22 results

On Wednesday, the Bank of Queensland released its financial results for FY22.

Here are the key results:

- Statutory Net Profit After Tax (NPAT) up 15% to $426 million

- Revenues up 34% to $1.68 billion

- Cash NPAT down 5% to $508 million

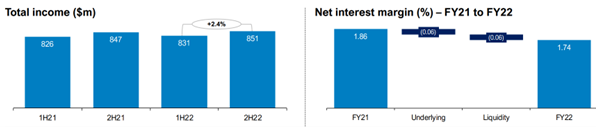

- Net interest income fell 1% to $1.5 billion

- Net Interest Margin (NIM) fell 12 basis points to 1.74%

- Operating expenses stayed flat on FY21 at $937 million

- Final Dividend Per Ordinary Share went up 9%, at 24 cents

BOQ said the decrease in cash NPAT was mainly due to NIM pressure.

As for the drop in NIM, the bank said this was primarily driven by ‘industry dynamics including ongoing competition, higher fixed rate lending volumes and volatile swap rates.’

BOQ said it managed to keep operating expenses flat via ‘ongoing productivity initiatives and synergy savings from the ME Bank integration’.

Source: BOQ

BOQ speculates on the Australian economy

BOQ gave both a positive and cautious outlook for Australia’s economic recovery.

BOQ commented that while low unemployment, increased household savings, improving trade terms, growing businesses, and spending plans are some positive signs of growth and improvement — the ongoing pressures of inflation, high interest rates, geopolitical tensions, and a weaker global economy bring concerns.

The bank acknowledged economic uncertainty going into FY23, forecasting a likely slowing in economic growth over the next 1–2 years, and inflation to peak by 2022’s end.

Nevertheless, BOQ asserted that it’s focused on its quality, sustainable, and profitable growth targets, such as its integration of ME digital transactions, for example.

‘Growth across all brands in FY22 provides a revenue tailwind moving in to FY23,’ BOQ stated.

‘We have positive NIM momentum, with tailwinds from rising interest rates partly offset by headwinds from rising funding costs. Inflation and the costs of the new digital bank create near term headwinds for expenses, however, these will be partly offset by ongoing benefits from the integration and productivity programs.

‘The integration of ME is well progressed and we continue to execute against our strategic transformation roadmap. We have a clear pathway to the inclusion of ME on the digital bank platform and a plan to launch the new ME digital transaction and savings product and migrate existing ME deposit customers by the end of calendar 2023.’

Five inflation-busting stocks

Few are immune to inflationary pressures.

Households and businesses are feeling the pinch.

But some businesses are better placed to deal with inflation than others.

In fact, some stocks might even be ‘inflation busters’ in the current environment.

Our team has recently put together a research report on our five top dividend stocks.

Regards,

Kiryll Prakapenka,

For The Daily Reckoning Australia