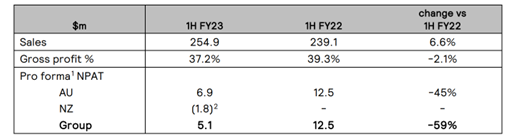

Specialty retailer of baby and infant goods, Baby Bunting Group [ASX:BBN] delivered its 1H 2023 financial year results, revealing a 59% drop in profits compared with 1H 2022.

The results also included the company’s gross profit margin, which fell by 2.1%, despite a 6.6% climb in sales year-on-year of $15.8 million.

Even so, the group says it is ‘on track’ to deliver earnings recovery in the second half.

BBN took an 11% devaluation in its share price once investors reacted to the update.

Baby Bunting’s shares are negatively tracking in the last full-year metrics, at 49%.

Source: tradingview.com

Baby Bunting’s first half takes a slump in profit

The baby products retailer reported total sales of $254.9 million for the first half of FY23, which was up 6.6% on the prior corresponding period.

BBN was anticipating a higher number of sales, describing the 6.6% rise as a softer result.

Baby Bunting’s gross profit margin also fell by 2.1% to 37.2%.

The above factors resulted in a pro forma NPAT (net profit after tax) result of $5.1 million, a decrease of 59% on the same time last year.

CEO of Baby Bunting, Matt Spencer, commented:

‘Baby Bunting’s strategy is to grow market share and we grew total sales by 6.6% for the first half of FY23, with comparable store sales being 0.4%. Positive comparable store sales growth was achieved despite cycling the significant growth in sales of 16.1% in Q2 in the prior year as Victoria and NSW emerged from significant periods of lockdown.’

At the company’s 2022 AGM, the company reported its gross profit margin was down 230 basis points. However, since October, it has improved from 36.4% in Q1 to 37.9%.

The company’s core nursey categories, along the lines of necessary items such as car safety, prams, and feeding products, continued to perform well.

‘During the period, we remained focused on being competitive and delivering value to the consumer,’ Spencer stated. ‘Our Price Beat promise is low at around 1% of sales and we expanded our every day pricing strategy of Best Buys to be 53% of sales for the half, up from 35% of sales in 1H FY22.’

Source: BBN

Baby Bunting looks to 2H 2023

Looking to the 2H of 2023, the company expects FY23 pro forma NPAT to be in the range of $21.5 million to $24 million.

The company’s full-year gross profit margin is expected to be between 38% to 39%.

BBN said that its broad forecast reflects the uncertainty associated with consumer demand and behaviour.

‘The gross profit margin deficit experienced in Q1 improved in Q2 driven by the execution of our recovery plans through the second quarter that will deliver further benefits into 2H FY23.

‘Full year gross profit margin is now expected to be between 38% and 39% and ahead of last year in 2H.’

Baby Bunting plans to grow its business by expanding its network to target 120 stores across Australia and New Zealand.

The company will release its half-year reviewed statutory results on Friday, 17 February 2023.

Callum Newman’s bargain stocks 2023

The end of 2022 was a period fraught with challenges.

For many, 2023 hasn’t begun much better — not just yet, anyway.

With these challenges of the pandemic, war, inflation, and continually rising rates lingering, many are still looking to save a pretty penny where they can.

And it’s in times like these that some real ASX stock bargains can emerge — if you know where to look.

Our small caps expert Callum Newman has done the hard work for you.

He’s found five of what he calls ‘the best stocks to own in Australia’ right now.

And the best part is, right now, they don’t even cost that much.

Click here to discover Callum’s top five Aussie bargain stocks.

Regards,

Mahlia Stewart,

For Money Morning