AVZ Minerals Ltd [ASX:AVZ] share price is up 4.7% after announcing its third offtake agreement, this time with Yibin Tianyi Lithium.

Today AVZ Minerals Ltd [ASX:AVZ] signed a binding offtake agreement with Chinese lithium converter Yibin Tianyi Lithium Industry (Yibin Tianyi).

Yibin Tianyi agreed to purchase up to 200,000 metric tonnes per annum of spodumene concentrate (SC6) for an initial three-year term following AVZ commencing production.

The agreement contains an option to extend the partnership for a further two years.

AVZ shares are up 4.7% on the news at the time of writing.

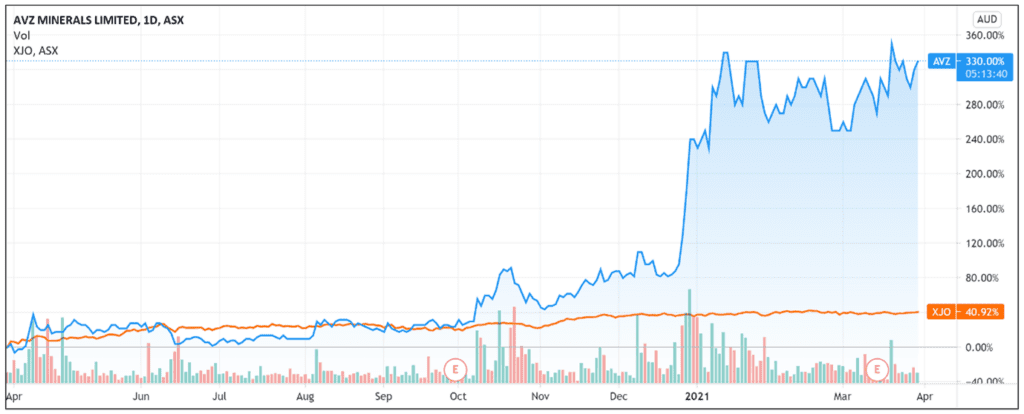

The stock is now up 25% YTD and up 310% over the last 12 months.

Source: Tradingview.com

Source: Tradingview.com

AVZ Minerals and Yibin Tianyi

AVZ Minerals is a mineral exploration company that has a 60% interest in the Manono Lithium and Tin Project in the Democratic Republic of Congo.

According to AVZ, the Manono Project is one of the world’s largest lithium-rich LCT (lithium, caesium, tantalum) pegmatite deposits.

Is Lithium Ready for a New Bull Run in 2021? Free report reveals three stocks that could make serious gains.

AVZ’ has updated details that Yibin Tianyi is a global battery materials producer and a key participant in the supply chain of Contemporary Amperex Technology (CATL), the ‘world’s largest lithium-ion battery maker’.

As Reuters reported last year, Contemporary Amperex Technology supplies lithium iron phosphate batteries to Tesla and recently partnered with Honda.

CATL also supplies Volkswagen AG and Daimler AG.

AVZ stated that Yibin Tianyi aims to become the largest lithium hydroxide producer in China with expected production to increase to 100,000 tonnes per annum.

Yibin Tianyi expects it will need about 700,000 metric tonnes of SC6 per annum to meet its internal demand.

AVZ and Yibin Tianyi offtake agreement

Here are the key terms of the binding offtake agreement.

- Initial three-year term with extension options.

- Annual supply of 200,000 metric tonnes of SC6 per annum (+/- 12.5% in seller’s option).

- Pricing will be determined by a formula that references numerous published market prices of lithium carbonate and lithium hydroxide products. The price will be underpinned by a floor price agreed by both parties.

AVZ’s Managing Director Nigel Ferguson stated that ‘this agreement takes our SC6 binding offtake commitments to more than 80% of the Project’s annual SC6 production.’

According to the company, reaching 80% of annual SC6 production from its Manono Project satisfies an important condition precedent for prospective financiers.

Outlook for the AVZ Share Price

As I’ve covered earlier this month, Pilbara Minerals Ltd [ASX:PLS] announced on 15 March that Yibin Tianyi will provide a US$15 million unsecured prepayment to Pilbara’s operating subsidiary Pilgangoora Operations (POPL), to increase the existing offtake agreement.

The increased offtake is in addition to the 75,000 tonnes per annum, five-year agreement struck with Yibin Tianyi on 25 March 2020.

According to Pilbara, following the successful commissioning of its Stage 1 improvement works, the offtake agreement will total up to 115,000 tonnes per annum of spodumene concentrate.

Yibin Tianyi entering offtake agreements with both AVZ and Pilbara spotlights the competitive landscape facing lithium suppliers and explorers.

Since lithium is a commodity, suppliers will find it hard to differentiate themselves and customers like Yibin will shop around on price and convenience.

Sam Berridge, Portfolio Manager for the Perennial Global Resources Trust, told Livewire Markets that ‘lithium is a very common mineral and there are a number of new projects, new capacity and idled capacity that can meet demand as prices allow.’

I think long-term partnerships will be key for lithium suppliers.

For instance, imagine if a lithium company secures a long-term supply deal with Volkswagen for the automaker’s ambitious electric vehicle goals. That company will likely fare quite well.

Indeed, when Piedmont Lithium Ltd [ASX:PLL] signed a five-year deal with Tesla to supply the automaker high-purity lithium ore mineral last September, PLL shares surged 83%.

Especially for junior lithium suppliers, securing forward sales via offtake agreements or partnerships is vital.

AVZ Managing Director Nigel Ferguson concluded in today’s release that his company is ‘continuing to explore strategic opportunities for our offtakes in both traditional and emerging lithium markets including Europe, US and India.’

Despite the potential challenges, lithium stocks have enjoyed positive momentum lately as investors seek to position themselves for a future of electric passenger transport.

If you want to learn more about investing in lithium stocks, then you should definitely read our free report.

It outlines three stocks that could surge on the back of renewed demand for lithium in 2021. Click here to get your copy now.

Regards,

Lachlann Tierney,

For Money Morning