The AVZ Minerals Ltd’s [ASX:AVZ] share price is up today after the company increased its Manono Lithium Project ore reserves by 41.6%.

AVZ shares rose as high as 5.2% in early trade. At time of writing, the lithium stock was up 3%.

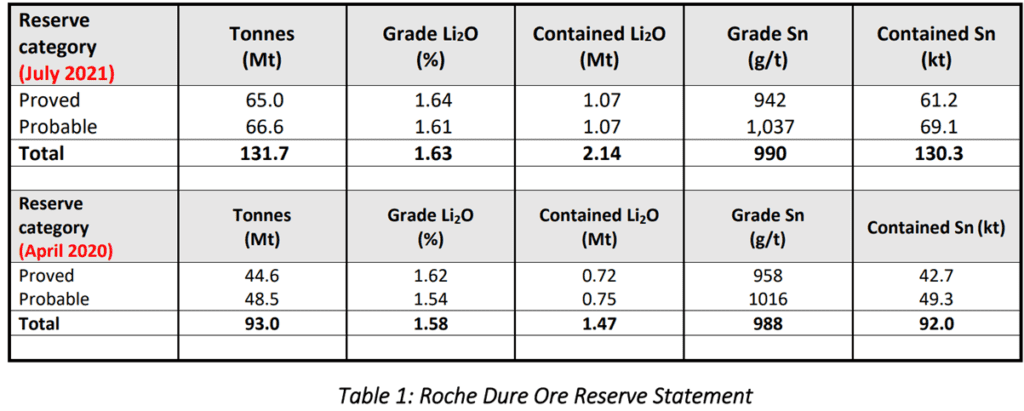

AVZ Minerals also revealed that the average lithium grade increased from 1.58% to 1.63% Li2O.

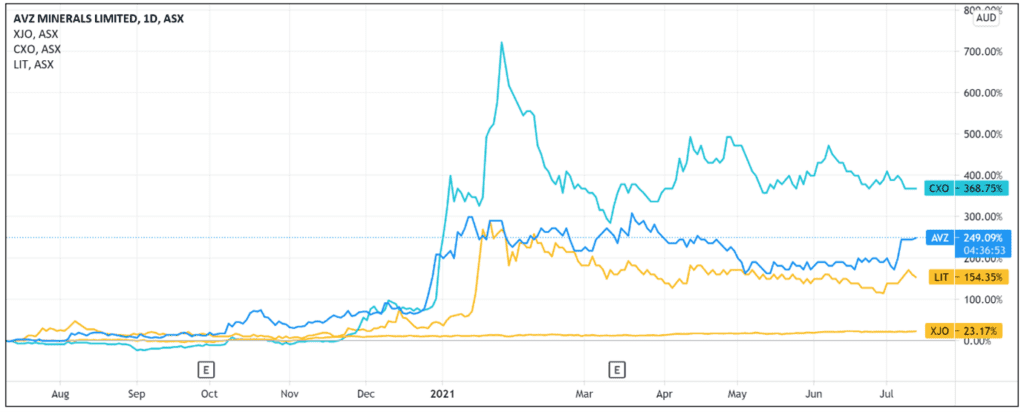

Year to date, the AVZ stock is up 14% but has gained 260% over the past 12 months.

AVZ reserves increase by 41.6%

Today, AVZ announced an upgraded ore reserve estimate for the Manono Lithium and Tin Project, compliant with the JORC Code.

The new estimate coincides with the company transitioning its Manono Project into development.

What does the new estimate show?

A 41.6% increase in mineable reserves with a 3% increase in head grade.

On top of that, the new estimate shows a 47.5% increase in the Life of Mine (LoM).

A feasibility study was originally completed in April 2020 and updated this month by AVZ for a ‘4.5 Mtpa Dense Media Separation (DMS) and lithium sulphate processing facility.’

According to AVZ, the proposed process produces a ‘6% Li2O concentrate as a saleable product, and from that 45 kt/a of Primary Lithium Sulphate (PLS) product’.

This plant size formed the basis of the Ore Reserve estimate.

The feasibility study indicates a mine life of 29.5 years, 21.3 million tonnes of 6% Li2O concentrate produced, 1.7 million tonnes of 80% lithium sulphate concentrate produced, and 77kt of 60% tin concentrate produced.

AVZ share price outlook

AVZ Managing Director Nigel Ferguson pointed to improvements in both CAPEX and OPEX figures as contributing factors to the ore reserve upgrade.

Mr Ferguson told the market that further details from engineering studies would be reported ‘soon’.

AVZ management also noted ‘ongoing studies’ being conducted to ‘fine-tune the quantum of necessary funds required to bring the mine into production.’

The expansion of its ore resources is certainly a positive.

But the modest jump in AVZ’s share price today suggests the market has either largely priced in this possibility or is focused further ahead — on AVZ’s securing project finance, for instance.

As Mr Ferguson himself stated:

‘The upgraded JORC Ore Reserve estimates along with our optimised engineering studies and ongoing funding studies, have delivered a major step forward for the Company as we strategically advance the Manono Project towards a full bankable status in the near future.’

If you’re researching lithium stock investments and want more information or ideas, then I’d recommend reading Money Morning’s free 2021 lithium report.

If you’re keen for more reading, this report on energy disruption is also a great resource. It goes through finding promising energy stocks and discusses why the energy market is ripe for massive disruption.

Regards,

Lachlann Tierney,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here