The AVZ Minerals Ltd’s [ASX:AVZ] share price is down 1.3% despite achieving ‘excellent’ drill results from its Manono lithium project.

AVZ shares were up as much as 2.6% in early trade before the stock settled slightly down at time of writing.

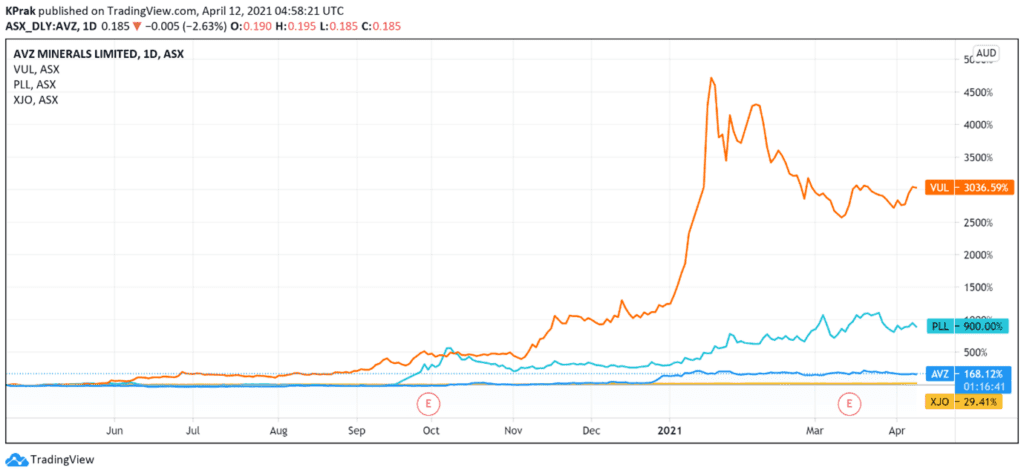

While the AVZ share price is down 5% over the last month, it is still up 8% year-to-date and up 165% over the last 12 months.

AVZ confirms further high-grade lithium and tin mineralisation

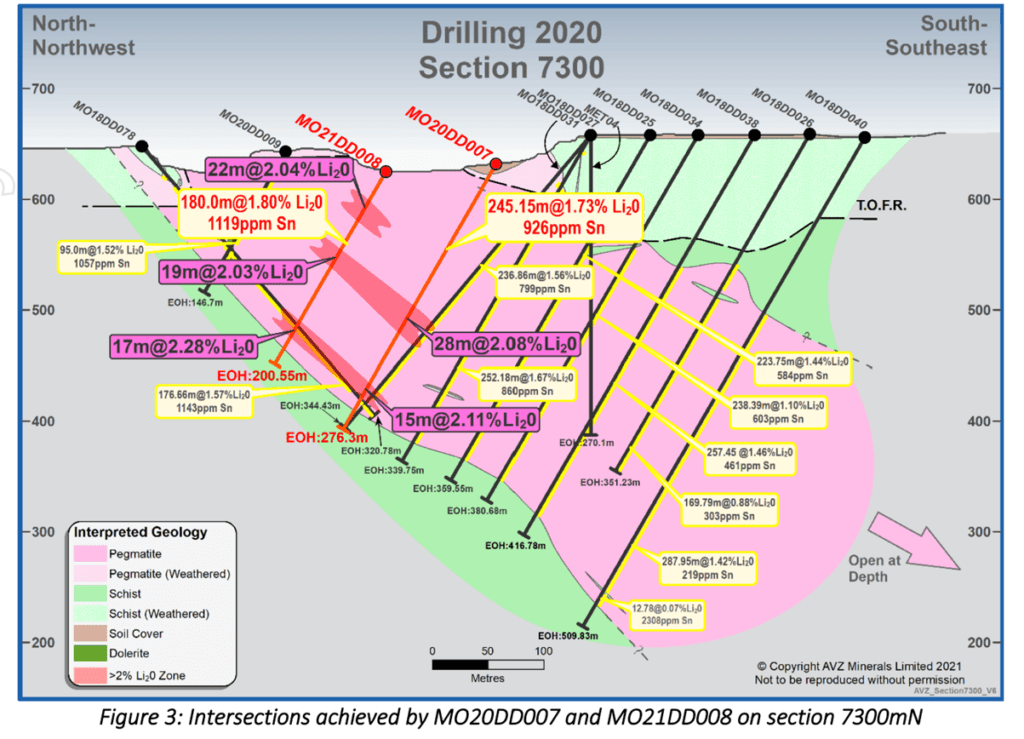

The mineral explorer today announced that resource drilling confirmed further high-grade lithium and tin mineralisation ‘directly beneath the historic pit floor’ of its lithium and tin project in the Democratic Republic of Congo.

AVZ reported that major intersections included:

- 0m at 1.80% Li2O and 1,119ppm Sn

- 15m at 1.73% Li2O and 926ppm Sn

- 60m at 1.69% Li2O and 1,152ppm Sn

The drilling revealed isolated zones where the lithium grade exceeded 2% Li2O.

One such zone was intersected in hole MO21DD001, section 7100mN.

A further zone in hole MO20DD007, section 7300mN, included a reading of 28m at 2.08% Li2O.

AVZ noted that these assay results came from the last three of the nine planned diamond drill holes at Roche Dure in ‘previously undrilled areas beneath the historical pit.’

The explorer’s Managing Director Nigel Ferguson thought the assay results ‘again show strong lithium mineralisation from the pit floor surface.’

AVZ share price outlook

The company announced that it is working on a new resource estimate to update the mineral resources estimate of May 2019.

Mr Ferguson commented that today’s results ‘may present as the start of a much higher-grade core which will need further investigation to determine the possibility of finding more significant tonnages of high-grade feedstock.’

Mr Ferguson stated that the potential increase in tonnage of high-grade feedstock ‘could feed the plant in its early years of operation to shorten the pay-back period.’

The market’s lukewarm reception to today’s update may suggest that the assay results were largely anticipated and already priced in.

Today’s results may not have surprised investors who could have been expecting further developments.

Additionally, investors may have found in AVZ managing director’s qualified language enough uncertainty to refrain from enlarging their positions in the company.

If today’s results ‘may present as the start’ of something, investors are potentially choosing to wait for further announcements in a bid to gather more information.

Despite the potential challenges, lithium stocks have enjoyed positive momentum lately as investors seek to position themselves advantageously for an electric vehicle future.

If you want to learn more about investing in lithium stocks, then you should definitely read our free report.

It outlines three stocks that could surge on the back of renewed demand for lithium in 2021. Click here to get your copy now.

Regards,

Lachlann Tierney,

For Money Morning

Comments