ASX lithium stock, AVZ Minerals [ASX:AVZ] will remain in a voluntary suspension a while longer as it continues to work through regulatory issues surrounding its Manono mining licence.

It’s been two months now since AVZ entered voluntary suspension as it seeks a mining licence for its flagship Manono Lithium Project in the Democratic Republic of Congo (DRC).

Yet the suspension is set to continue until at least 29 July as AVZ continues to reach a resolution.

Source: Tradingview.com

AVZ’s mining licence update

AVZ Minerals reappeared with an update pertaining to its voluntary suspension and trading halt, while the company awaits its mining licence for its flagship Manono Project.

The company saw fit to suspend all trade until it had worked through the grant of its mining licence, a process which has been ongoing since the start of May.

The miner said that it has been ‘actively engaged with the highest levels of the Government with respect to the grant of the Mining Licence.’

AVZ expressed its confidence that there will be a positive outcome.

The company said:

‘To provide for sufficient time to allow a decision to be made with respect to the grant of the Mining Licence and an update regarding its exploration rights for the Manono Project, the Company has requested a further extension to the voluntary suspension from the ASX until the commencement of trade on 29 July 2022 or an earlier announcement to the market regarding its mining and exploration rights for the Manono Project.’

Operations recommence

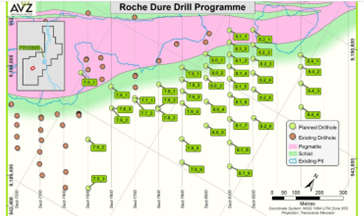

Despite the status of its mining licence, AVZ separately revealed that diamond drilling has started up again at the Manono Project.

The drilling program at Roche Dure has been extended — 15,000 metres of area to cover ore targets 200 metres deep.

The company’s reverse circulation drilling at Manono is soon to commence, a project focusing on tin and tantalum deposits.

AVZ’s Managing Director, Mr Nigel Ferguson, said:

‘I am pleased to confirm that drilling has recommenced at Roche Dure.

‘Drilling at the north-east end of the known orebody, in areas previously inaccessible due to surface water, is aimed at significantly increasing the known lithium-rich ore resources in this area.

‘This will underpin our future plans to extend the stated mine life at Manono, should this drilling campaign prove to be successful.

‘The Company’s confidence in the Manono Project and continuing lithium-ion battery demand, provides a significant opportunity to further increase the known reserves at Roche Dure, which is designed to add long term value for our shareholders and underpin the Project’s credentials as the largest global undeveloped hard rock lithium deposit.’

Source: AVZ

AVZ fights for mining licence

In May, the Australian Financial Review quoted short-focused hedge fund research firm Boatman Capital, who was sceptical about AVZ reaching a favourable resolution to the regulatory mire it finds itself in.

According to Boatman Capital:

‘We believe that AVZ Minerals is in the process of being outmanoeuvred by a group of powerful Chinese battery manufacturers, who are plotting to take control of the Manono lithium project.

‘We think that, at best, AVZ faces months or years of legal fights to block Zijin Mining and to claim shares from [vendor] Dathomir Mining Resources. At worst, AVZ will lose control of Manono and be left with just 36 per cent of the project. We have obtained evidence that makes us think the likely outcome will be negative for AVZ.’

Clearly, AVZ wants to prevent any such outcome — even if it means remaining in voluntary suspension for months.

Investors will be following this story with interest.

Now, while lithium stocks have been hit hard lately, the world where most of us drive EVs is still in the future, and the world will need plenty of battery materials to get us there.

Our small-cap expert Callum Newman recently penned a report on three battery material stocks.

Callum thinks that one of the three battery stocks in his latest report ‘could be one of the most exciting nickel projects in the world’.

To find out more, read Callum’s latest battery materials report, ‘Elon’s Chosen Ones’, here.

Regards,

Kiryll Prakapenka

For Money Morning