In today’s Money Morning…ASX Outlook: Too good or impending doom?…what if crypto becomes a risk-off asset?…and more…

A short anecdote, and then straight into the markets.

Here’s the story…

Both my great-grandfathers were wounded at Gallipoli (thanks a bunch Churchill).

One was shot in the stomach and saved by a belt buckle and the other one got it in the throat.

Both survived though, and I’m grateful to be here.

Guess I’m a lucky person in a lucky country.

And Australia has certainly been spared the brunt of the pandemic — hearing stories from friends, family and colleagues overseas is painful.

But what if Australia’s miracle run comes to an end?

So, on Australia Day, I want you to ponder the risks out there.

Risks to your wealth, risks to your livelihood, risks to the broader economy.

Money Morning usually trumpets the success of small-caps, the advent of new technologies and the most cutting-edge investment ideas and themes we can find.

However, I want to give the bears a bit of airtime here, because if you aren’t listening to multiple outlets and opinions you aren’t really informed.

Valuations are stretched, market ‘sanity’ is limited and our algorithmic products are shifting in and out of cash frequently.

It could mean the chart of the three indices below could be due for a change, or maybe not!

ASX Outlook: Too good or impending doom?

Make hay they say.

There’s a legitimate case out there for the current ASX outlook to be too good to be true.

Or the index is facing impending doom — this is from the bear’s corner.

As we’ve highlighted before, speculative growth is still in vogue.

And value, well, that’s ticking up but not at the same rate.

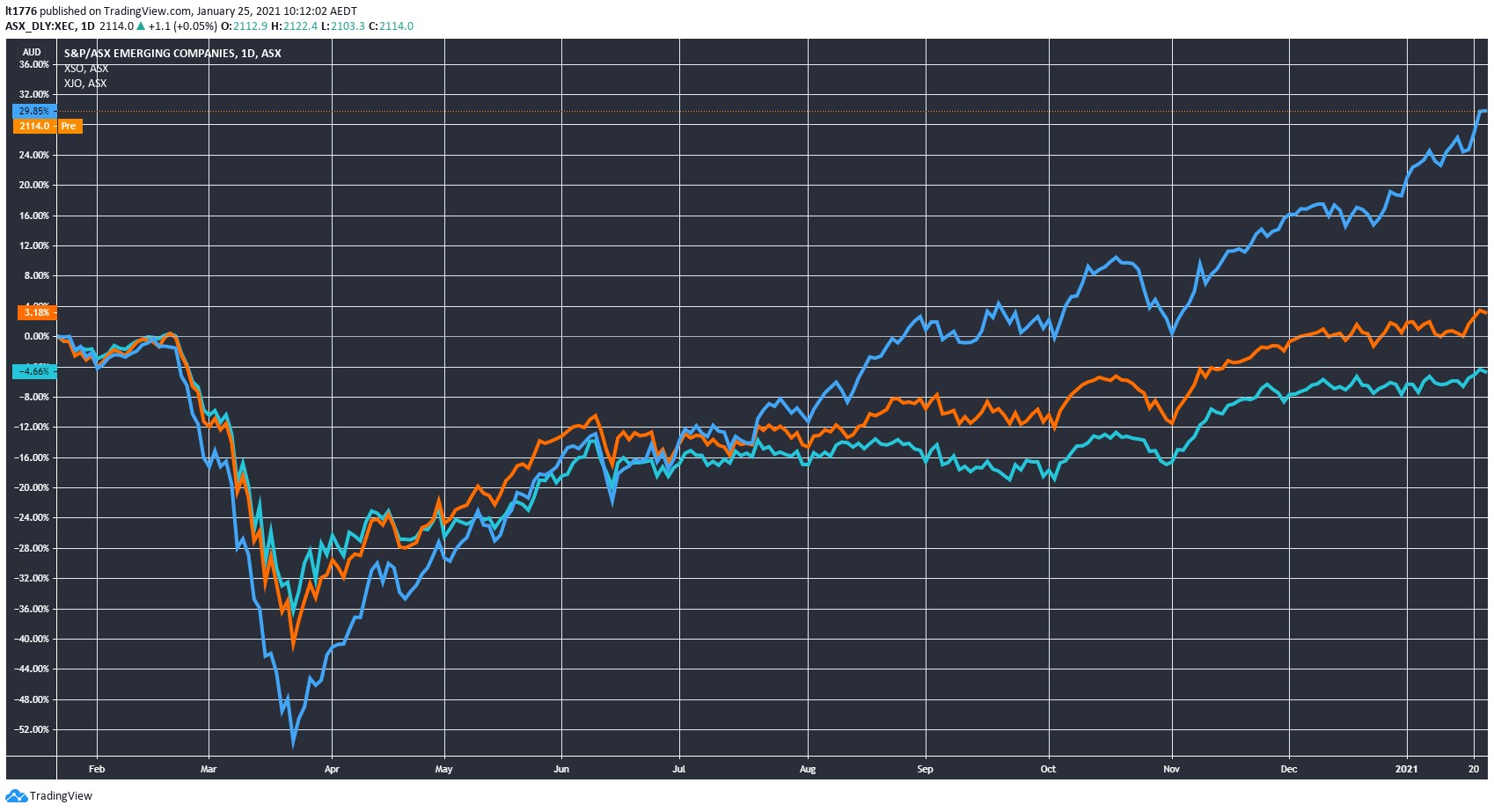

Let’s take a quick look at how the S&P/ASX Emerging Companies [XEC] Index stacks up against [XSO] and [XJO]:

|

|

| Source: tradingview.com |

For context:

‘The S&P/ASX Emerging Companies Index [XEC] is an investable benchmark consisting of 200 Australian microcap companies ranked between 350 to 600 by capitalisation at the time of their index inclusion, that have met reasonable liquidity tests.’

While the S&P/ASX Small Ordinaries [XSO] Index ‘is used as an institutional benchmark for small-cap Australian equity portfolios. The index is designed to measure companies included in the S&P/ASX 300, but not in the S&P/ASX 100.’

Everyone knows [XJO] is lagging in a 12-month window.

And so, is investing in small-caps like shooting fish in a barrel?

Not at all.

Being selective is very important.

That being said, the small-cap renaissance could revert to the mean though — and I have a feeling the retail frenzy is definitely playing a role here.

Advertisement:

REVEALED:

Australia’s 60-Cent

‘Secret Weapon’

It’s a tiny ASX stock that could hand the United States, NATO, and its allies a key advantage in case another major conflict breaks out.

That could make this stock very valuable and potentially profitable for investors over the coming months.

However, some bears out there are calling for the ASX 200 [XJO] to shed 40–70% at some point over the next two years.

In internal editorial conversations in our business, I’m listening attentively to the bear case.

What if the vaccines don’t work? What if global debt burdens start to generate stress? Will countries that have had the pandemic fare better than countries that escaped the worst effects?

That last question is the most intriguing.

Australia’s economy is isolated right now.

The steady flow of immigration that underpinned construction, real estate and let’s be honest, GDP numbers, is now completely cut off.

As a stopgap, we have near-zero rates and RBA QE programs.

It may not last the distance. The small-cap frenzy could just as easily come to an end, so at the very least, consider taking money off the table in a strategic way if this is where you are positioned.

Ponder the following hypothetical scenario though.

What if crypto becomes a risk-off asset?

Maybe you made a killing on speculative growth small-caps.

You’ve sold out and banked the cash.

What next?

Do you just sit in cash for the next two years on the mega-bears’ advice?

Winning by not losing is only a strategy if you’ve already won something genuinely significant.

It’s not investment riddles — it’s simply that demographics and risk appetite are the foundations of financial advice.

One idea could be to look at the big changes in monetary policy and look for trustworthy projects in the crypto-sphere.

I’m not talking just about bitcoin. I’m talking about ethereum and a whole host of crypto projects with genuine potential.

Small-cap wins folded into the future of money (crypto) as a risk-off asset. A plan so crazy it just might work.

If this approach appeals to you, be sure to check out Ryan Dinse’s Crypto Flip Trader service right here.

I think it’s a great resource for this ‘Future of Money’ theme (and potentially lucrative).

It’s possible it all comes crashing down for Australians at some point.

And gratitude for the current safety and stability that this country affords its citizens shouldn’t mean complacency.

But a bear-driven penchant for cash holdings is ultimately regressive.

Advance Australia fair.

Regards,

|

Lachlann Tierney,

For Money Morning

Lachlann is also the Editorial Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.

Advertisement:

Will this no-name stock rule the ‘Aussie Mining Boom 2025’?

It’s showing all the traits, ambition and foresight that Andrew Forrest’s Fortescue Metals had in the early 2000s.

Market cap just $270 million.

And a gameplan that’s addressing many of the same challenges Fortescue Metals Group faced in the 2000s.

This very small company is about to unlock a very big deposit.

The largest of its kind IN THE WORLD.

Its potential has arrived from nowhere, busting into ‘Tier 1’ status and attracting mining behemoths…including Rio Tinto.

This has all the makings of a classic rags to riches story. Click here for the full take.

Comments