Editor’s note: In today’s video I discuss the contrasting fortunes on the charts for the two companies in today’s article, I also talk a bit about what they do.

With all the attention on the Tweeting antics of a recovered president, I thought I’d draw your attention to a huge shift on the domestic front.

Without a doubt, we are seeing the first signs of a huge trend in this country towards renewables.

It’s investable too, I might add.

While everyone is likely clicking in a frenzy on ASX futures articles and US stimulus articles, there was this small headline just out of the limelight.

Here it is:

|

|

| Source: Australian Financial Review |

In a nutshell, the Australian Financial Review article in question points to increasing pressure on coal in the immediate future.

Here’s a quick summary of what’s happening with our grid in certain states:

‘Numerous instances of record low demand for grid-based power this spring amid soaring rooftop solar use are causing headaches for the market operator and pushing network owners to trial tariff reforms and technical initiatives to help keep the lights on…

‘Fresh records have been struck within the past month for minimum demand on the grid in Victoria, South Australia, Queensland and Western Australia, according to the Australian Energy Market Operator.

‘In WA, the August record was broken 11 times across two days in September, when rooftop solar was providing half or more of total demand.’

What does this mean?

Stay up to date with the latest investment trends and opportunities. Click here to learn more.

Batteries everywhere!

Well for one it means that solar is becoming so important when it’s sunny, that grid operators don’t know what to do with excess power.

And the fact that solar made up half of total demand in September in WA is huge.

But it has one consequence…

Excess power has to go somewhere when the sun’s out, in preparation for when the clouds come.

This means batteries — really, really big batteries.

We’ve previously mentioned the French-led push to build a battery in SA that’s 10 times bigger than the ‘Tesla Big Battery’ already in the state.

And on Friday, the WA Premier Mark McGowan announced the following battery project:

‘[WA’s] state-owned power provider Synergy has issued a request for information process for the 100 megawatt (200MWh) battery project — the size of 22 tennis courts with the capacity to power 160,000 homes for two hours — which will be built at the decommissioned Kwinana power station…

‘The Morrison government has allocated $15 million towards the building of a 100 megawatt “big battery” in Western Australia.

‘The new money — which forms part of a $28.5 million investment in energy infrastructure in WA announced by federal Energy Minister Angus Taylor on Friday — will help create Australia’s second biggest battery after South Australia’s Hornsdale battery.’

And as batteries spring up around the country, a fossil fuel ‘dodo’ story is unfolding.

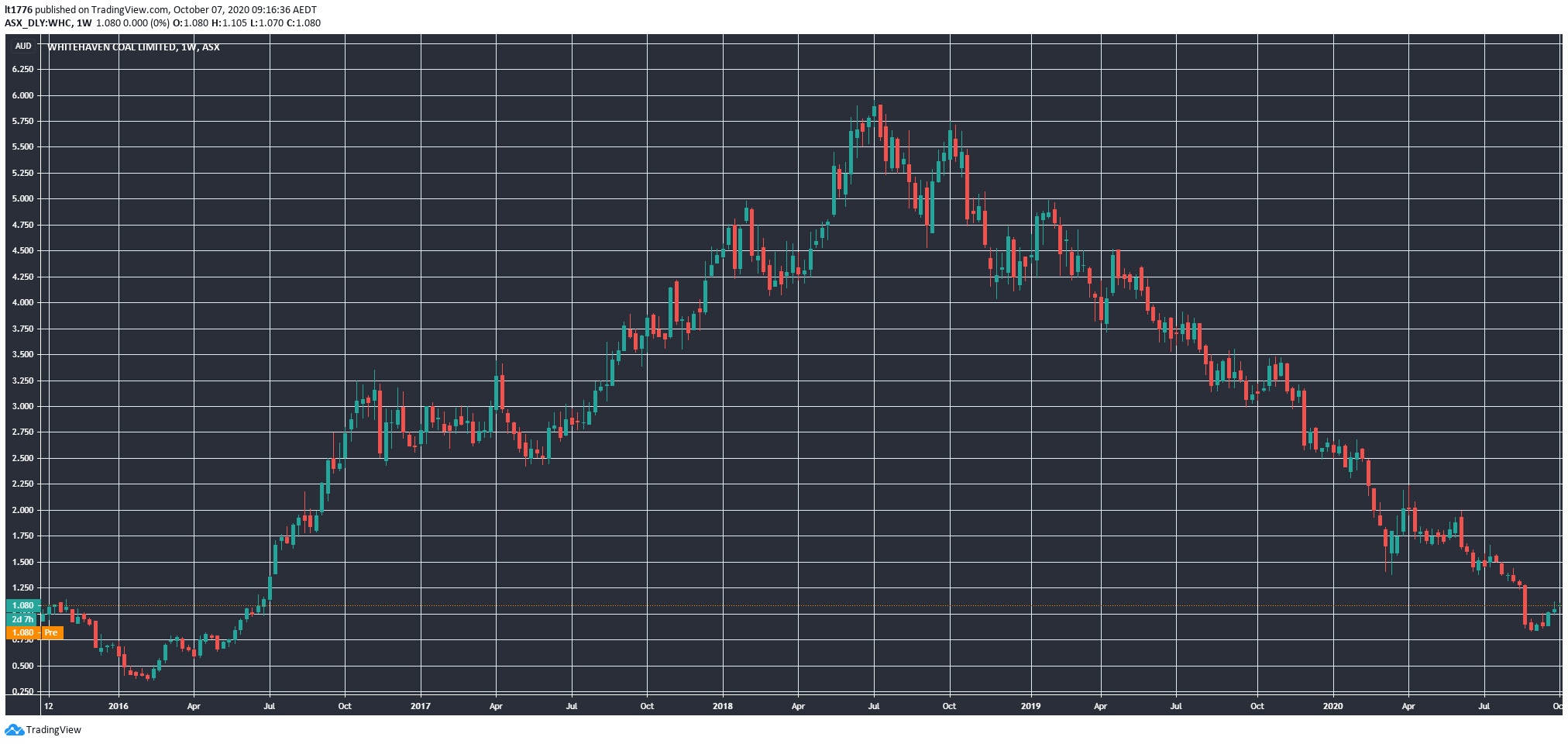

Coal out? A quick look at Whitehaven’s fall from grace

Coal investments are looking increasingly fraught with danger.

And one type of coal may be out according to Dylan McConnell of The University of Melbourne:

‘Black coal is being squeezed by rooftop solar on the demand side (behind the meter) — and lower marginal cost brown coal and utility renewables on the other side.’

It’s unfortunate that brown coal is rising to the fore.

But that doesn’t imply that a brown coal renaissance is on the cards.

If anything, once people wake up to the pressures on black coal, they will double down on renewables even more.

This should add further impetus to the shift to renewables.

Which brings me to a brief discussion of Australia’s largest independent coal producer — Whitehaven Coal Ltd [ASX:WHC].

From a peak in July 2018, the WHC share price went on an immense slide:

|

|

| Source: tradingview.com |

Now, you may think this is a direct result of Australia’s shift away from coal.

But it’s actually more to do with demand from Asia as this is its primary focus.

Whitehaven is currently trading at a P/E of 36.

That’s quite high for such a mature business.

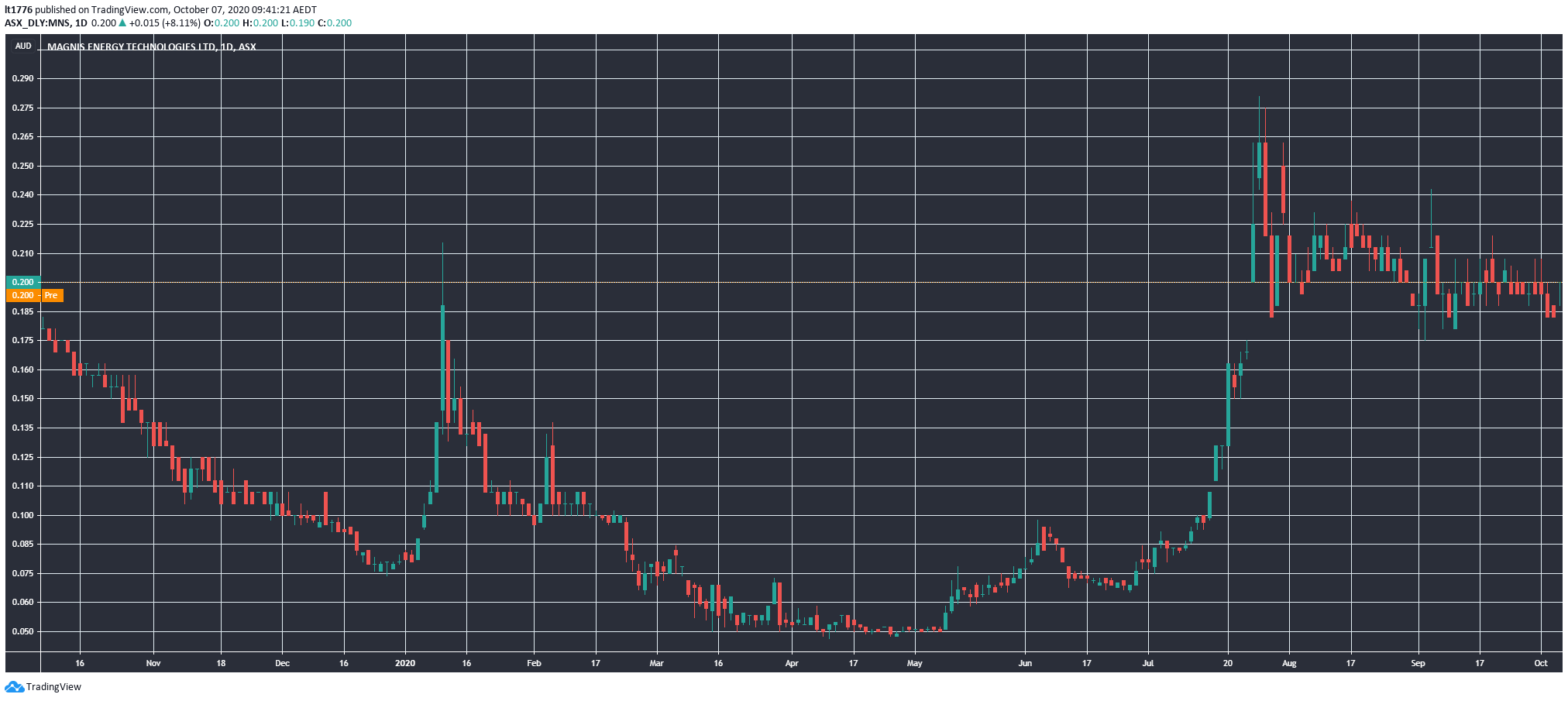

In contrast, on the battery tech front there is Magnis Energy Technologies Ltd [ASX:MNS].

You can see a big spike in the last four months:

|

|

| Source: tradingview.com |

They have a New York Gigafactory and are planning another one in Queensland.

These are the factories that pump out Li-ion batteries.

I believe this shows the contrasting fortunes of coal and renewables at an early stage.

Options for renewables investments will be mostly found in the small-cap space, while the fossil fuel relics slide their way out of the ASX 100/200 over the next decade.

It’s up to you if you want to invest in this changing of the guard.

Regards,

|

Lachlann Tierney,

For Money Morning

PS: Four Well-Positioned Small-Cap Stocks — These innovative Aussie companies are well placed to capitalise on post-lockdown megatrends. Click here to learn more.

Comments