Did you know that our Australian dollar is the fourth most traded currency in the world?

More specifically, the AUD-USD pair is the fourth most traded currency pair.

It makes up 6.37% of total global forex volume.

The ‘Aussie’ itself is technically the fifth most traded currency when you consider all trading pairs.

In top place is the US dollar, followed by the euro, Japanese yen, and the British pound.

Then in comes little old us.

It begs the question: Why is the currency of an isolated, island country with only 25 million inhabitants so popular?

And more importantly, why’s it falling so fast right now?

Let’s dig in…

Surprise decline is a warning

The reason the Aussie is traded so much is simple enough.

You see, our dollar is often used by investors as a proxy for global growth.

When the global economy is flying, our commodities are in high demand, so the value of the Aussie dollar generally rises too.

You can see this here:

|

|

| Source: Trading Economics |

During the original mining boom years of 2003–07, we saw the value of the Australian dollar rise from 50 cents to almost US$1.

You can also see how fast the Aussie fell when the GFC hit in 2007.

That fall — near to the level we’re at today — was short-lived as central banks pumped money into the system.

2009 was the birth of large-scale quantitative easing (more colloquially known as money printing) and not uncoincidentally, the birth of Bitcoin too.

You can see the ‘printing’ of more US dollars had a big effect on the relative value of our currency.

And for a brief moment, the value of the Aussie was worth more than the mighty US dollar!

But since that peak in 2011, the Aussie has tumbled lower.

Last week, it started testing lows only seen in recent years at the crisis points of 2007 (GFC) and 2020 (the start of COVID).

It’s unlikely it’ll stay at this level for long.

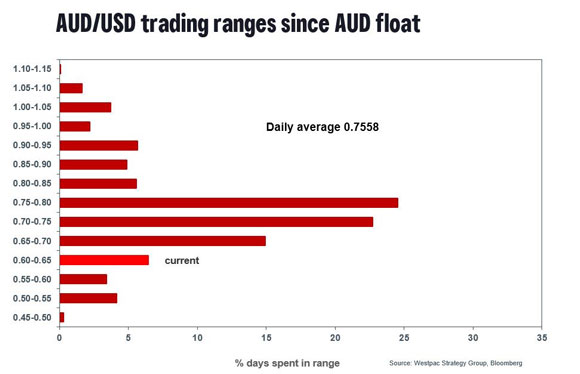

The Aussie dollar has only spent 6.4% of its days in the 60–65 range since 1983, when the currency was first allowed to trade freely:

|

|

| Source: Westpac Strategy Group |

More importantly, if this current downtrend stays in place, it’s a sign that all is not well in the underlying economy.

And it’s clear this weakness in the AUD has caught many off guard.

As the AFR reported on Friday:

‘“The fall in the Aussie has been more rapid than we had expected, but we’re not surprised by its continued downtrend given the deterioration in the global and Chinese economy,” CBA currency strategist Carol Kong told AFR Weekend. “We continue to expect more falls in the Aussie.”’

The National Bank of Australia [ASX:NAB] also said their currency forecasts were now under review too.

Worsening news coming out of China — exemplified by the bankruptcy announcement from huge property developer Evergrande last week — has surprised the investment community.

And investors don’t like surprises.

My gut says the stock market will start off soft this week as traders hit the sidelines and try to work out what it all means.

We’ll see.

But there are a few more worrying signals to pay attention to…

The canary in the coalmine

The US dollar is the world’s go-to safe haven asset.

When investors are worried, they usually dump other assets (euros, gold, stocks, property, whatever) and move it into US dollars.

So a fast-rising US dollar often correlates with sharply declining markets elsewhere.

When interest rates started to rise in early 2022, this is exactly what happened:

|

|

| Source: TradingView |

As you can see, after peaking in October 2022, the US dollar has come off the boil. Not coincidentally, 2023 has been good for markets too so far.

But you’ll need to watch this US dollar index chart closely in coming months. A rise here will tell us that investors are moving funds to safety.

And, in my opinion, we had an early warning signal on a potential change in investor sentiment last week from an unlikely place.

You see, the bitcoin price fell almost 15% on Friday, seemingly for no reason.

Here’s the thing…

Bitcoin is very sensitive to monetary liquidity.

For example, after initially falling 50% when COVID hit in 2020, bitcoin then surged higher as traders realised central bankers were going to go into money printing overdrive.

It went from US$5,000 to almost US$70,000 in just over year.

I think a similar scenario could play out again.

First, an initial sell-off in risk assets because of over-tightening draining liquidity from markets, followed by a broader market panic and, finally, a central bank rescue (money printing).

On the liquidity front, there’s also some interesting dynamics playing out in bond markets right now with a bit of a sell-off underway.

As this tweet points out, this could have a contagion effect on liquidity too:

|

|

| Source: Twitter |

This is important to understand.

As bonds fall in value (due to interest rates rising), collateral across the system falls in price. That collateral underpins liquidity elsewhere.

So, if this bond sell-off continues, we could see a cascade of loans called in. And that could have all sorts of flow-on effects as people have to sell assets to raise funds.

Though, remember, central banks can combat this by reversing course and turning on the liquidity taps again (i.e: QE and interest rate decreases), as long as inflation is under control.

It seems to be a game of chicken right now.

At some point, they will turn back on the monetary taps. It’s just a question of how bad things get before they do.

As this tweet points out, it could get a lot worse before it gets better:

|

|

| Source: Twitter |

As ridiculous as it sounds, investing these days is nothing more than guessing the actions of a group of unelected US bankers.

But it doesn’t need to be…

Time for a Plan B

This is a major reason I invest in Bitcoin [BTC].

It can’t be manipulated by humans, printed at will, or doled out to favoured parties. No wonder central banks hate it!

And although some traders clearly still see bitcoin as a risky asset, I personally see it as the exact opposite.

It’s literally the only asset not tied to the fiat Ponzi in some way. It’s the only asset that can’t be debased by monetary shenanigans.

Once people finally recognise that — which could be sooner than you think — I think the bitcoin price will behave more like a safe-haven asset.

But I recognise we’re not there yet. And plenty people will think I’m crazy to even suggest such a thing.

Time will tell who’s right…

For now, though, bitcoin investors need to be ready for more volatility. But again, that’s nothing new.

Consider this chart:

|

|

| Source: Plan B |

Despite six 30%-plus weekly price falls, the bitcoin price managed to go up 10 times in just over a year back in 2016/17.

Volatility is a two-way street when it comes to bitcoin — up and down!

I remember this particular period well because it was my first serious crypto bull market.

And the payoff for the long two-and-a-half-year ‘winter’ I had to endure ended up being well worth it.

In my experience, when it comes to bitcoin, patience is your biggest edge. After all, bitcoin is the best-performing asset for seven of the past 10 years.

And with the world of fiat money looking shakier by the day, bitcoin’s time to shine is fast approaching.

In my opinion, it’s not a matter of ‘if’ but ‘when’.

Good investing,

|

Ryan Dinse,

Editor, Money Morning

PS: Follow me at @konfidinse on Twitter (X.com) for live updates on this and other investing topics.