Have you seen Gold’s recent rally?

| |

| Source: TradingEconomics |

This precious metal is breaking new records again in 2024, gliding past US$2,400.

So, how far can this melt-up last?

Well, my colleague Brian Chu has some clues…

According to Brian, at this point in the investment cycle, investors need to be zeroing in on a specific type of stock.

A segment of the precious metal market that’s underperformed but could do very well as speculators find their way back into the gold market.

For his complete take on what happens next and how to play it, I suggest you read this.

With that, let’s move to the opposite spectrum of the commodity market, a metal rapidly losing favour with investors in 2024… Iron ore.

Australia’s most important export is under pressure, and that’s coming right as new supply is set to hit the market.

The ‘Pilbara Killer’ ready to pounce

As you may already know, Simandou, one of the world’s largest iron ore development regions, is set to challenge the Pilbara’s dominance very soon.

Initially discovered in 1997, this new iron ore frontier is almost ‘open for business.’

According to a report by Rio Tinto, the principal investor in the region, it’s all systems go for Simandou…

Mining conditions have been met, and maidan production is scheduled for next year.

So, what does that mean for Australia’s economic crown jewel… The Pilbara?

On the surface, a wave of new supply from Simandou looms as a considerable threat.

Simandou also hosts superior grades of around 65% ferrous content compared to the Pilbara, which sits closer to 60%.

Higher grades attract a premium in the iron ore market. That can have a significant impact on operating margins.

A few percentage gains may not seem like much, but a higher grade means fewer impurities.

That has important flow-on implications for steel makers.

You see, iron ore impurities like silica and alumina are blasted out in giant furnaces, producing slag, an energy-intensive process.

That makes low-grade ore more expensive to process, which is why some Pilbara ore is sold at a discount in the iron ore market.

Very few DSO (Direct Shipping Ore) projects can export ore with a 65% ferrous content… The benchmark grade for iron ore pricing.

But Simandou is set to change this landscape markedly…

Yet, Australia still holds advantages

Guinea, the West African country hosting Simandou, is approximately 7,700 nautical miles farther from China than Australia.

Iron ore is a bulky commodity, making it expensive to transport.

Proximity to Asian markets remains a major advantage for Australia’s iron ore producers… Particularly amid ongoing disruptions across major shipping routes.

But another angle revolves around geopolitical risk.

You see, Guinea is not the worst place to do business, but it’s far from a tier-one destination.

Human rights abuses, decades of corruption, brutality and dictatorships are just a few of the problems here.

In September 2021, the country’s long-term President, Alpha Condé, was captured by the nation’s armed forces in a coup d’état, the third in just 40 years.

As a major supplier, the military coup caused global bauxite prices to soar on the London Metal Exchange, climbing as high as US$2,782 per tonne.

Events like this will undoubtedly give Rio Tinto and its other Simandou development partners sleepless nights.

And it wouldn’t be the first time…

In 2008, the mining giant lost almost half of its mining concession at Simandou, which was on the back of the Guinea Minister of Mines suddenly relinquishing the company’s rights.

Geopolitical drama can erupt suddenly and without warning in this part of the world, posing an ongoing threat to Rio’s vast capital investment in this emerging iron ore hub.

However, none of these risks exist in Australia.

A market ready to bust?

Undoubtedly, there’s a lot of murkiness in the iron ore market… Rising production from Simandou looms as a key threat.

However, on the demand side, a weakening Chinese real estate market is also diminishing the long-term outlook.

Against the gloom, it’s hard to be bullish on this bulk industrial commodity.

But if you have a contrarian bent, this could be a market worth exploring…

At the big end of the town, Fortescue [ASX:FMG] has pulled back 25% since its February highs.

| |

| Source: TradingEconomics |

While in the mid-tier space, Champion Iron [ASX: CIA] has shed a similar amount.

Both stocks offer highly leveraged exposure to a potential turnaround in the iron ore market.

But where could that come from?

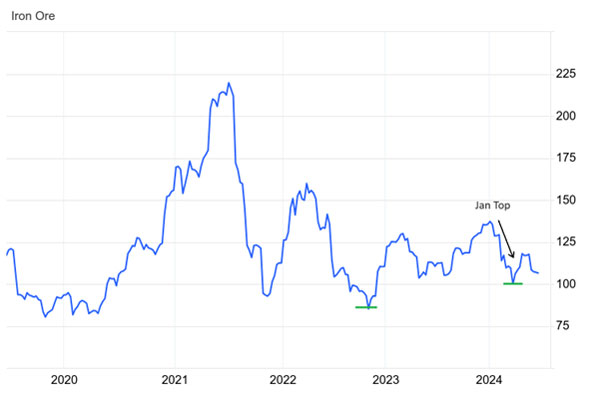

After peaking at around US$130/tonne in early January, the metal (briefly) corrected just below US$100/tonne.

That drove a wave of panic in mainstream media, commentators were fairly bold in their predictions of a crash…take this from a few weeks ago in News.com.au:

| |

Yet, despite the dramatic headlines, iron ore’s ‘free-fall’ in 2024 looks more like a minor blip, small arrow, below:

| |

| Source: TradingEconomics |

In fact, the commodity is consolidating nicely, above US$100/tonne, after posting a sequence of higher lows over the last 18 months.

Given that we’re still early in a possible recovery phase, now could be a great time to start looking at opportunities in this discounted sector.

Particularly as China starts to rev up its butchered real estate market…

Last month, Beijing announced it would reduce the cost of buying a home by cutting mortgage interest rates and the minimum down payment ratio.

This is one of the country’s most targeted stimulus plans since reopening from lockdowns in early 2023.

Measures that are directly aimed at propping up its weakened real estate market.

In addition, China’s latest GDP numbers showed 5.3% growth in Q1 2024, exceeding its 5% target.

This is at odds with what we hear about China’s economy in the West.

But look past the negative banter, and things may not appear as doom and gloom in the iron ore market as most make out.

That’s good news for Australia’s iron ore miners.

Regards,

|

James Cooper,

Editor, Mining: Phase One and Diggers and Drillers

Comments