Austrian economist Joseph Schumpeter once proclaimed he had three big ambitions.

First, to become the world’s greatest horseman. Then, to become the world’s greatest lover. And thirdly, as an afterthought, he added ‘and perhaps the world’s greatest economist.’

Later he suggested he’d achieved two out of the three, though he wouldn’t specify which ones…

I bring up our big-headed Austrian friend today because his ideas have never been more relevant for you as an investor.

You see, Schumpeter is famous for coining the phrase ‘creative destruction’.

The idea that capitalism existed in a constant state of flux with both winners and losers. As one idea rose, another would fall.

If Adam Smith was the Godfather of free market economics, Schumpeter was the caporegime who knew where the bodies lay buried.

While Smith’s worldview was an eloquent process of finding a natural equilibrium through the magic of the ‘invisible hand’, Schumpeter was under no such illusion.

He knew that the process of change in capitalism was a jarring experience for many.

Free markets were vicious fights to the death…

But combined, their ideas perfectly describe why a system of free markets best allocates capital and resources, and in turn leads to magnificent human progress.

As former US politician Dick Armey once said:

‘The market must clean itself out by taking resources away from the losers, so it creatively destroys the losing companies and reallocates resources to the winning companies. That’s really what’s going on.’

As the grand experiments in socialism over the 20th century showed, alternative ways to allocate resources just created a lot more losers.

Which brings me to the fate of our big banks…

Aussie Big Banks Living on borrowed time

I’ve long argued that a day of reckoning was coming for Australia’s big banks.

In fact, I spent most of last year trying to convince you that they were about to be ‘unbundled’. Torn apart by smaller, nimbler competitors.

I hope you took heed…at least as far as your exposure to the big four banks went.

As is obvious to all now, the big banks are in big trouble.

National Bank of Australia Ltd [ASX:NAB] just announced yesterday that their dividend would be cut to 30 cents, a 64% cut.

At the same time, they said they would be raising $3.5 billion in new money.

A strange case of robbing Peter to pay, well, Peter!

According to the AFR, the move was due to fears of a big increase in loan defaults.

The article stated:

‘The underwritten, $3 billion institutional placement will be accompanied by a share purchase plan to raise a further $500 million, as the bank “seeks to provide a buffer to assist with credit losses” and soaring risk that could result from “a severe and prolonged downturn.”’

Profits were down almost 25% for the half year and that’s before we get any knock-on effects of the bulk of the COVID-19 crisis.

I’d imagine most of the banks are in the same boat.

As was always the case, our banks are sitting on a time bomb of mortgage debt.

And although I don’t doubt the government will to try to bail them out (mainly to prop up the property market), the fact is, if the global economic downturn is prolonged, then there’s not much that can be done.

But even if the lucky country once again manages to somehow dodge a bullet, the big bank unbundling isn’t going to stop.

Here’s why…

Open banking is rising

Open banking is the process by which the customer owns their own banking journey, not the bank.

In Europe it’s a trend that’s gaining traction. It’s only a matter of time before it hits Australia’s shores in a big way too.

You see, banking isn’t about finding a ‘one stop shop’ to do everything anymore. It’s more about the individual cherry-picking the products and services he or she wants.

That’s the essence of open banking. Using technology to make it easy for a customer to utilise multiple products and cross-check the data.

And it’s an idea that’s rising fast.

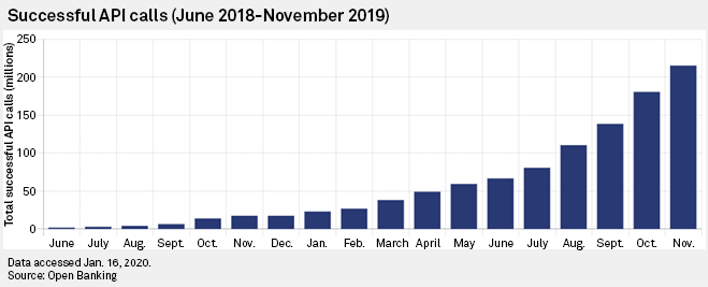

One way to measure its impact is to monitor the number of ‘API calls’.

That’s often third parties requesting consumer data from a bank account using a technology known as an ‘application program interface’ or API.

Check out this chart:

|

|

| Source: Open Banking |

You can see that the number of API calls is growing exponentially, month by month. This suggests both customer uptake and product innovation are growing strongly.

This is the future of banking.

And it’s the creative part of the process that stands in stark contrast to the big banks’ destruction.

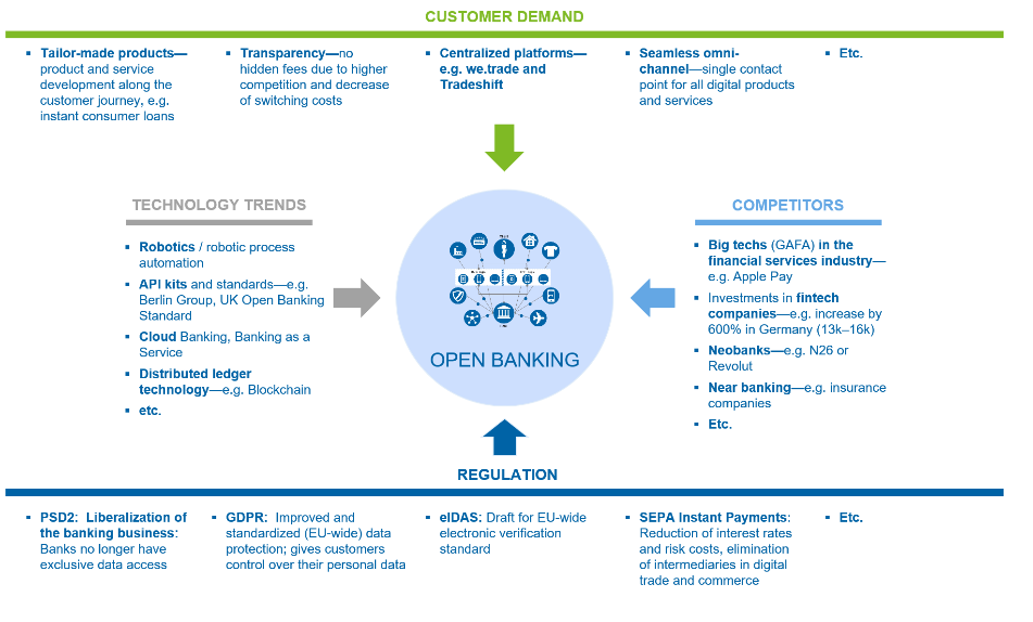

Open banking rewards specialists, not generalists (like our big banks). This image here conceptualises how the future will look:

|

|

| Source: BSFS |

As you can see, this is a trend driven by technology.

Data and digital trends are combining with customer needs to create a unique, specialised, and tailor-made banking experience.

Which means the investment opportunities for you here lie in different tech sectors, none of them explicitly in ‘banking’.

As the big banks are busy putting out fires, this new future is creeping up on them. Whether it’ll be a long slow death march, or a quick kill, I’m still not sure.

But I don’t like their chances of competing in this new world.

I’m sorry but a smiling concierge at the branch door holding an iPad isn’t going to cut it in this new digital world.

But as Schumpeter realised (in between horse riding and wooing the ladies of Venice), this is what progress looks like. And it’s a net win for society.

Just make sure you’re on the right side of it…

Good investing,

Ryan Dinse,

Editor, Money Morning

PS: ‘The Coronavirus Portfolio’ The two-pronged plan to help you deal with the financial implications of COVID-19. Download your free report.

Comments