Auckland International Airport [ASX:AIA] has reset its price setting for the next five years, ending a year-long price freeze that was put into place to help airlines rebuild after the pandemic.

AIA was flat in trade on Thursday after a short discount of 2% earlier in the day had brought the stock to $7.80 a share.

The airport had taken a 5.5% decrease in share value so far in 2023:

Source: TradingView

Auckland International Airport announces price changes and building of a new domestic facility

Early on Thursday morning, many were awaiting the official announcement of price changes for the business, particularly regarding one of the group’s largest shareholders, the Auckland Council, which holds 18.1% of the airport’s shares.

The Auckland Council appears to have been waiting for a big move such as this to drop $2 billion worth of those shares and investors are gearing up to make offers.

AIA said it will be resetting its aeronautical charges for its Price Setting Event Four (PSE4), covering the expanse of a five-year period for the 2023–2027 financial years.

By implementing these new charges, the airport will be able to fund part of the much-needed investments in infrastructure that it has already undertaken.

The new pricing will account for $2.5 billion of commissioned infrastructure and will enable it to focus on highly important airfield, terminal, baggage and transport improvements by the allotted five years.

The increase is also reflective of the growing cost of capital in the current economic environment, particularly in comparison with the previous price-setting event.

The changes will be taking effect from the beginning of July, ending the year-long price freeze that had been adopted by the airport in order to help airlines in their rebuild after the challenging pandemic period.

The group’s Chief Executive, Carrie Hurihanganui, said recovery is well and truly underway and the price changes are a follow-on from consultations with major airlines, an occurrence which ordinarily happens once every five years.

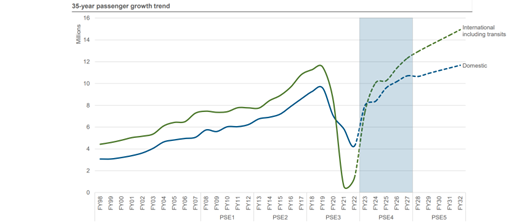

AIA says the forecasted recovery has provided confidence in future demand:

Source: AIA

Ms Hurihanganui commented:

‘Travel is back, and the recovery is taking place more quickly than anyone expected. Now is the time for investment in Auckland Airport if we are to deliver the resilience and customer experience travellers want and the gateway NZ needs for the future.

‘Auckland Airport’s pricing announcement today is the result of 24 months of extensive consultation with major airlines regarding aeronautical investment in Auckland Airport over PSE4 to support their business operations, as well as consultation over the airport’s wider ten-year development roadmap.’

Australia is set for some big change

Australia’s 30 years of abundant, robust trade have broken.

Global supply chains have changed and aren’t the same as what existed years ago.

You may have noticed there’s less on our supermarket shelves and wondered why inflation is so out of control, the banks are closing branches, and packaging is shrinking (while costing more!).

Clues and signs are everywhere, but everyday Australians don’t know what it all means.

Jim Rickards, one of the world’s top financial and geopolitical analysts, does.

He says no one is talking about how the Australian economy as we know it may soon end.

It could happen as soon as within the next 12 months… and it will change the way we all live.

If you want to know how you can prepare for the biggest geoeconomic shift of our lifetime click here for more.

Regards,

Mahlia Stewart

For The Daily Reckoning Australia