WiseTech Global Ltd [ASX:WTC] and Xero Ltd [ASX:XRO] offer software solutions to a vast number of businesses. WiseTech being in logistics, Xero, focusing on accounting.

While both operate in the tech space, their share prices are now operating in very different realities.

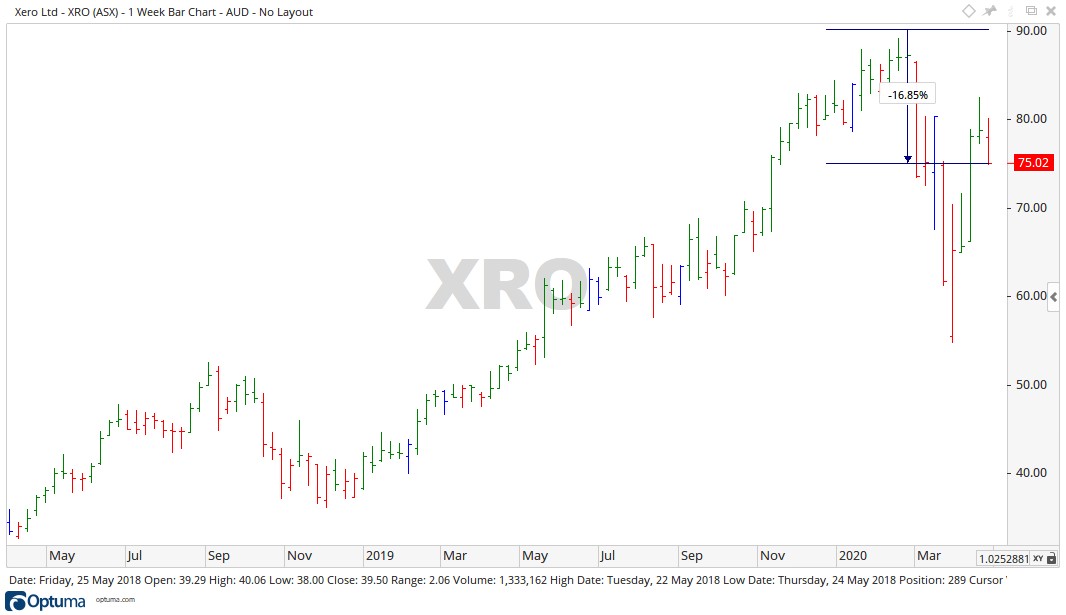

As you can see, the WTC share price was hammered from 19 September, currently down 64.48% to $13.78. The Xero share price faring better, only down 16.85% to $75.02, at the time of writing.

Source: Optuma

Source: Optuma

WiseTech share price in perspective

Back in December 2019 we discussed short seller research on WiseTech, and the September ‘overbought’ reading coupled with reports from J Research Capital, stating that profits may have been overestimated by as much as 178%. Combined with a high P/E ratio, we saw the WiseTech share price start to fall away.

This has only accelerated in 2020 with the onset of COVID-19.

Source: Optuma

From a technical perspective, in recent weeks the share price moved up to $17.85 on decreased volume meaning buyers may not be committed to the move. Currently, with the WTC share price turning down on increased volume, levels of $9.95 and $8.20 may come into play.

Xero share price in perspective

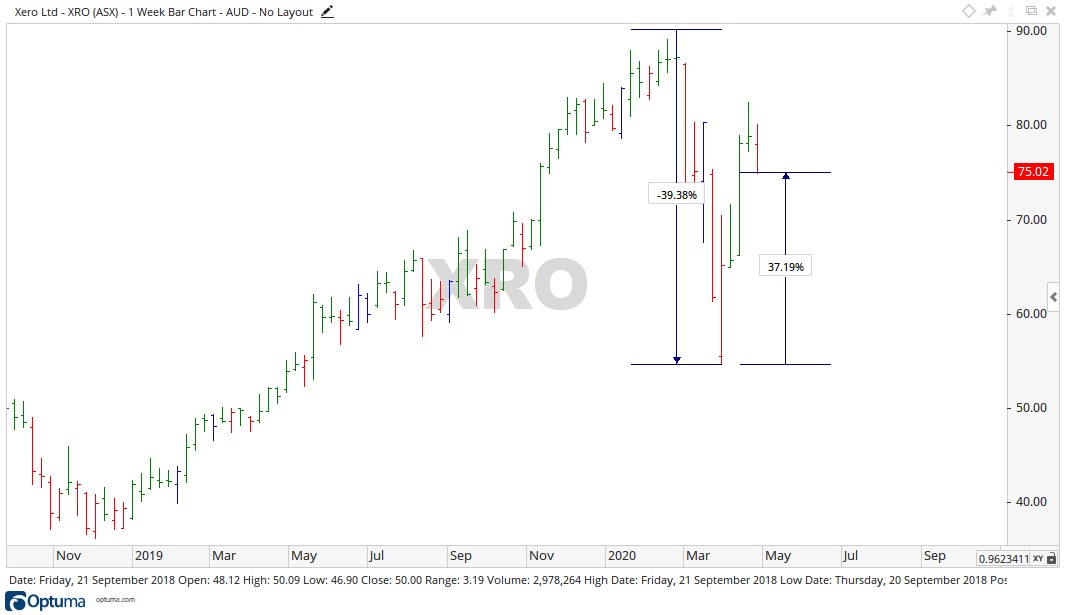

The Xero share price in comparison is faring much better than its other tech counterpart. The top 100 company with a market cap of $10.79 billion saw losses in price like most companies, falling 39.38% from its high in February 2020 to $54.69.

Recovering quickly over the last few weeks, up over 37% to $76.08, at the time of writing.

Advertisement:

REVEALED:

Australia’s 60-Cent

‘Secret Weapon’

It’s a tiny ASX stock that could hand the United States, NATO, and its allies a key advantage in case another major conflict breaks out.

That could make this stock very valuable and potentially profitable for investors over the coming months.

Source: Optuma

The novel COVID-19 virus has put up some challenges for businesses, and in my eyes Xero has reacted quickly to this new environment with updates to their software.

For example, the new tools are designed to enable businesses to calculate eligibility for the Australian Taxation Office’s wage subsidy program, cash flow boosts, and general government payments or reports.

Essentially, the software compares the Government’s criteria against data in Xero’s payroll, suggesting a list of workers and flagging any potential problems with eligibility, such as Australian residency status.

With a strong position in accounting software and the cloud storage space, on paper Xero seems well placed to weather the current storm.

Looking at the technical side, the move up in price has been on lessening volume, reaching the historical resistance level of $85.05 before falling away. Should the price continue to fall, levels of $66.88 and $54.23 may come into play before a potential move back up.

Source: Optuma

All up, whilst Xero holds a strong position in this interesting period of life, WiseTech looks to be facing a much more challenging time.

If you are looking to protect your money during the ‘corona crisis’, check out this free report by our Money Morning analyst, in it he reveals a two-pronged plan to help you deal with the financial implications of COVID-19. Download it here.

Regards,

Carl Wittkopp,

For Money Morning

Advertisement:

Will this no-name stock rule the ‘Aussie Mining Boom 2025’?

It’s showing all the traits, ambition and foresight that Andrew Forrest’s Fortescue Metals had in the early 2000s.

Market cap just $270 million.

And a gameplan that’s addressing many of the same challenges Fortescue Metals Group faced in the 2000s.

This very small company is about to unlock a very big deposit.

The largest of its kind IN THE WORLD.

Its potential has arrived from nowhere, busting into ‘Tier 1’ status and attracting mining behemoths…including Rio Tinto.

This has all the makings of a classic rags to riches story. Click here for the full take.

Comments