A lot of earnings came out this week and it showed a market in disarray. The fintechs and online retailers are pushing ever higher.

At the other end of things are the airlines, banks, and what I call traditional businesses — some are just trying to stay alive right now.

It’s a good snapshot of the change we have all had in our lives since COVID-19 showed up.

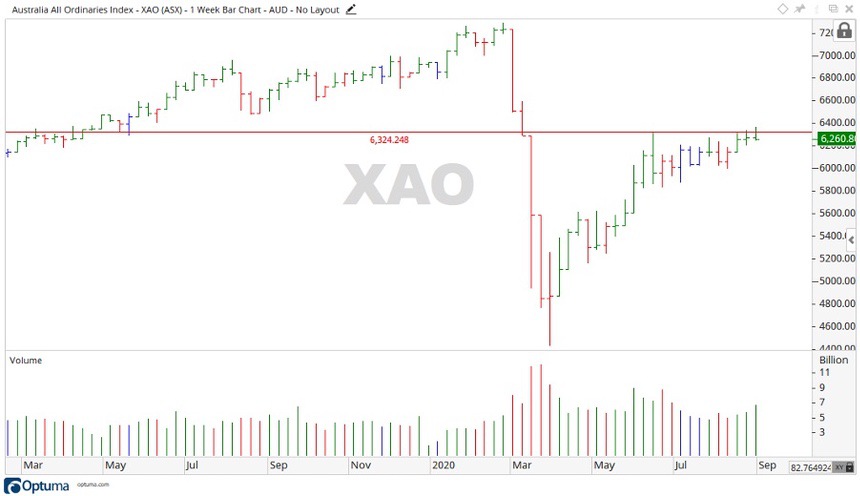

Source: Optuma

The week been saw the ASX All Ordinaries [XAO] crack the 6,324 points level, which was the high set back in June.

The All Ords had been straddling this level for some time and may continue to do so.

There is an old saying in trading that ‘amateurs open the market, and the professionals close it.’

The All Ords closed out the week on a low and marginally below its open, also taking place on increased volume.

Indicating the big players in the market may not be committed to a move up — and it may not be celebration time just yet.

ASX outlook for the week ahead

The coming week may be another flat sideways movement. While companies have reported both good and bad earnings, all things look to be in somewhat of a holding pattern for the time being.

Neither the bears nor the bulls are showing too much commitment.

Right now, is time to play the waiting game.

Without a clear trend in place it’s worth remembering the words of John Maynard Keynes:

‘Markets can remain irrational longer then you can remain solvent.’

A broader outlook for the ASX

With the market still in its sideways funk, the All Ords again gave a mixed bag of results.

Bega Cheese Ltd [ASX:BGA] and Stockland Corporation Ltd [ASX:SGP] moved up 9.11% and 7.73% respectively, while Reliance Worldwide Corporation Ltd [ASX:RWC] gained 27.42%.

There were some declines, with The a2 Milk Company Ltd [ASX:A2M] falling back 4.90%, along with APA Group [ASX:APA] and Newcrest Mining Ltd [ASX:NCM] also declining 7.72% and 4.56% respectively.

Looking into the sectors there were only minor movements up this week, with Financials and Information Technology gaining 0.36% and 3.50% respectively.

While Energy and Utilities fell away 3.42% and 4.78% respectively.

It’s a strange time right now both here in Australia and internationally.

Traditional businesses like banks and airlines are struggling, yet tech businesses are booming.

In the US, Apple Inc [NASDAQ:AAPL] recently hit a $2 trillion market cap, while Tesla Inc [NASDAQ:TSLA] now holds a $420 billion market cap, making Elon Musk the forth richest man alive.

Here at home, Afterpay Ltd [ASX:APT] exploded in value, jumping from a $8.01 stock price in March 2020 to a record price of $88.75 at the time of writing. With a lot of the BNPL sector following suit in gaining enormously throughout the last six months.

But have we seen this all before?

Enter the Wilshire 5000…

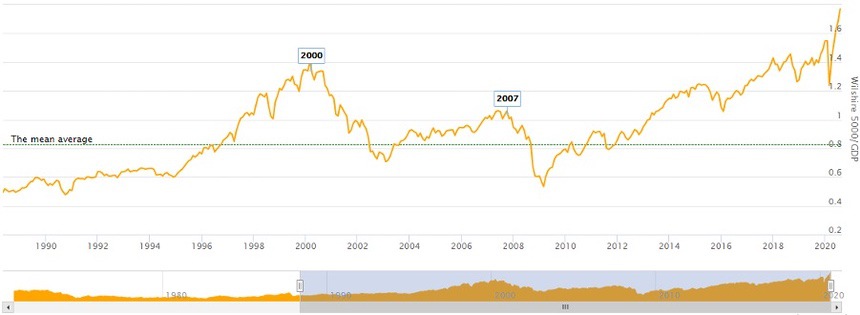

Also known as the Buffett index, being a favourite of Warren Buffett’s, with him stating back in 2001 that this index is:

‘Probably the best single measure of where valuations stand at any given moment.’

This index is a long-term valuation indicator of total market cap to GDP, which at the current point stands at 184.7%, or significantly overvalued.

Source: www.longtermtrends.net

As we can see from the above chart the Wilshire 5000 is the highest it has been since 1990, and the last time it was anywhere close to where it is today was in 2000, the tech bubble, and we all know how that went…

Are we about to see something similar unfold?

Here at home with the uncertainty still glooming over us all, the All Ords may be in for another week of flat movements.

As we spoke about last week, the Australian stock market is lacking conviction to a continued move up and could be looking to move into a ‘wave c’.

The longer we move sideways the less likely I feel it is an upside rally, throw in the weakening global economic picture and the Wilshire 5000 Index, and the more I keep thinking now is a time to be patient and wait for better trading days to come.

Patience can be profitable.

Regards,

Carl Wittkopp,

For Money Morning

PS: Four carefully selected, well-positioned small-cap stocks: These innovative Aussie companies are well-placed to capitalise on post-lockdown megatrends. Download now.

Comments