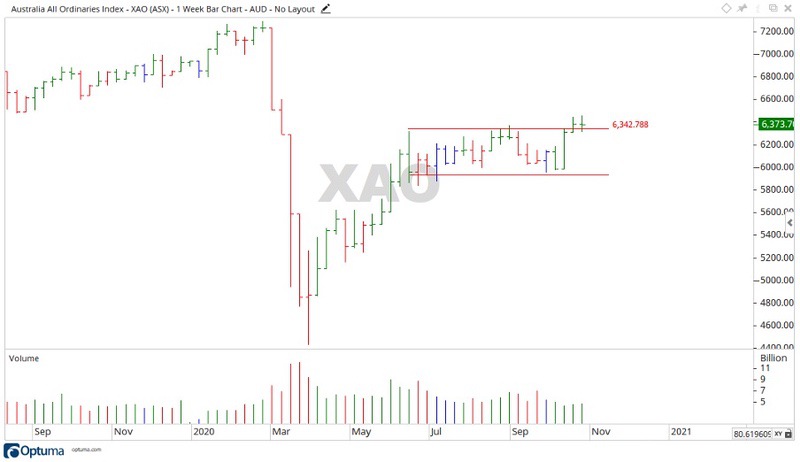

It was a lacklustre week for the All Ordinaries [INDEXASX:XAO], opening at 6,385 and closing out the week at 6,373 points.

Declining 12 points for the week is a good indication that neither buyers nor sellers were willing to take control of a move in either direction.

The All Ords is still moving sideways on an average volume between a band of 5,900 and 6,300 points.

While it’s trading through this range it’s a bit of a waiting game to see where we go next.

Source: Optuma

ASX outlook for the week ahead

The coming week for the All Ords might be much of the same as what we’ve seen over the last 19 weeks.

There are still multiple boarder closures around the country and Victoria is still in a harsh lockdown due to the COVID-19 virus.

Businesses in Victoria are hanging on by their fingernails now, with the situation becoming more dire every day the lockdown continues.

It may be these conditions that are keeping the All Ords in a holding pattern.

Source: Optuma

If we zoom out to the monthly chart, we can see that it’s moving up. Although this move is on very low-trading volume compared to previous months, indicating there may not be a lot of commitment to sustaining the push.

In the coming week I would not be surprised to see the All Ords fall back and continue to trade in the band it has been over the last 19 weeks.

A closer look at the ASX

A bit of a stagnant week unfolded on the All Ords in terms of winners and sectors. There were some minor moves to the upside with Qantas Airways Ltd [ASX:QAN] gaining 8.08%.

While Orora Ltd [ASX:ORA] and Brambles Ltd [ASX:BXB] put on 7.45% and 3.75%.

There were also declines with Wesfarmers Ltd [ASX:WES] falling back 2.68%, along with Telstra Corp Ltd [ASX:TLS] and Super Retail Group Ltd [ASX:SUL] declining 3.87% and 5.30%.

.

Moving on to the sectors, a rather quiet week took place with Financials and Information Technology up 0.66% and 1.80%.

While Utilities and Communication Services fell back 2.13% and 1.54%.

A broader look at the ASX

As a whole, 2020 is proving to be one tough year. The worldwide spread of COVID-19 having its way with the globe, crushing the economy and taking with it a never-ending amount of human lives. Then add on the fact that it’s an election year in the US, which is impacting the S&P 500 in the lead up and it’s been one heck of a year market wise.

In previous commentary, I’ve signalled a bearishness on the ASX generally.

With the timing of where we are now, I would not be surprised if we continue to move sideways before a fall later down the track.

With Christmas a stone’s throw away, people looking to enjoy this period might just inject enough into the economy to hold the market up a bit further.

While this is happening, I still hold the view that the best investment you can make is in education and preparation for when conditions improve.

Learn the ropes and by that, I mean engage with the charts, announcements and financials.

Do this, and you give yourself a major leg up.

Regards,

Carl Wittkopp

For Money Morning

PS: Check out our latest report ‘Four Aussie Innovator Stocks That Could Shoot up after the Lockdown’. These innovative Aussie companies are well placed to capitalise on post-lockdown megatrends. Click here to learn more.

Comments