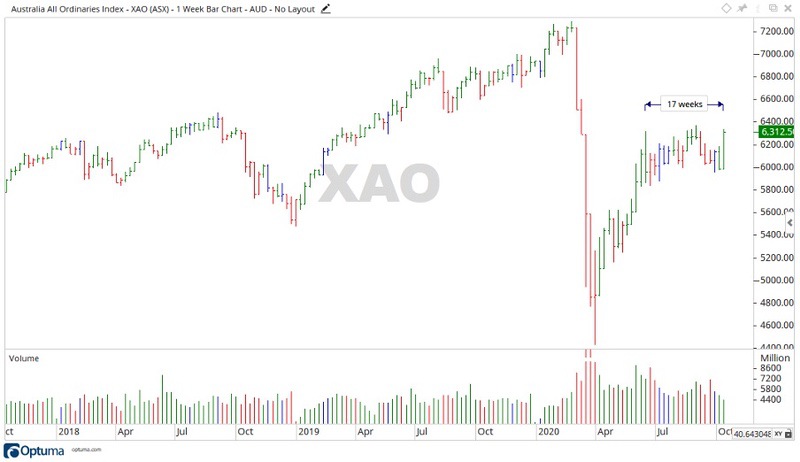

The past week saw a reversal in the price movement of the All Ordinaries [ASX:XAO], closing up 352 points relative to the previous week.

The budget was a major factor, but this is still the 17th week of a sideways movement, as you can see below:

Source: Optuma

ASX outlook for the week ahead

Currently, the All Ords is somewhat directionless. Last week’s move up took place on lower trading volume, indicating the buyers may not yet be committed to a move up.

With the nation in a recession, and the global economy still wrestling with the COVID-19 pandemic, business confidence is naturally at a low point.

A further move up could break the most recent high of 6,369 points, as the All Ords oscillates through this sideways movement.

I wouldn’t take this as a bullish signal for ETFs and being a spectator could work to your advantage if you favour passive investments.

A closer Look at the ASX

With such a jump up in the All Ords this last week, many stocks and all sectors followed the move higher.

Adbri Ltd [ASX:ABC] surged up 12.94%, while Commonwealth Bank of Australia [ASX:CBA] and Computer Share Ltd [ASX:CPU] also put on 6.26% and 5.89% respectively.

With the only notable decline coming from Transurban Group [ASX:TCL] — down 0.91%.

Into the sectors, Financials and Information Technology experienced better weeks with gains of 7.54% and 7.78% respectively.

Consumer Discretionary also popped up 4.83%.

A broader look at the ASX

What a year!

We aren’t yet finished with 2020, but this one year already feels like five.

There are still plenty of macroeconomic headwinds out there too.

Wage growth is sitting at a measly 1.8%, on the decline since 2008 where it peaked at 4.3%.

The nation’s consumer debt-to-GDP ratio is sitting at around 120%.

Add to this the tragic bushfires at the end of 2019, and now the COVID-19 pandemic, and it paints the picture of a nation in trouble.

But there is a silver lining.

Australians are saving more money presently. Meaning opportunities may present themselves to those who have been cautious.

Having a plan is one of the most underestimated aspects of investing.

So, while this year is difficult for us all, if you can hold firm, then the future may look a lot brighter for your investments.

Regards,

Carl Wittkopp,

For Money Morning

PS: Four Well-Positioned Small-Cap Stocks: These innovative Aussie companies are well placed to capitalise on post-lockdown megatrends. Click here to learn more.

Comments